THELOGICALINDIAN - A frequently quoted allotment of admonition that is the affair of this bazaar assay is one by Baron Rothschild an 18thcentury British man who was additionally allotment of the acclaimed Rothschild cyberbanking ancestors The adduce goes Buy back theres claret in the streets but Ive additionally heard alike if it is castigation added to the end I cannot affirm agent nor angary of the added catastrophe but it added proves the point and affair of this weeks Bazaar Analysis

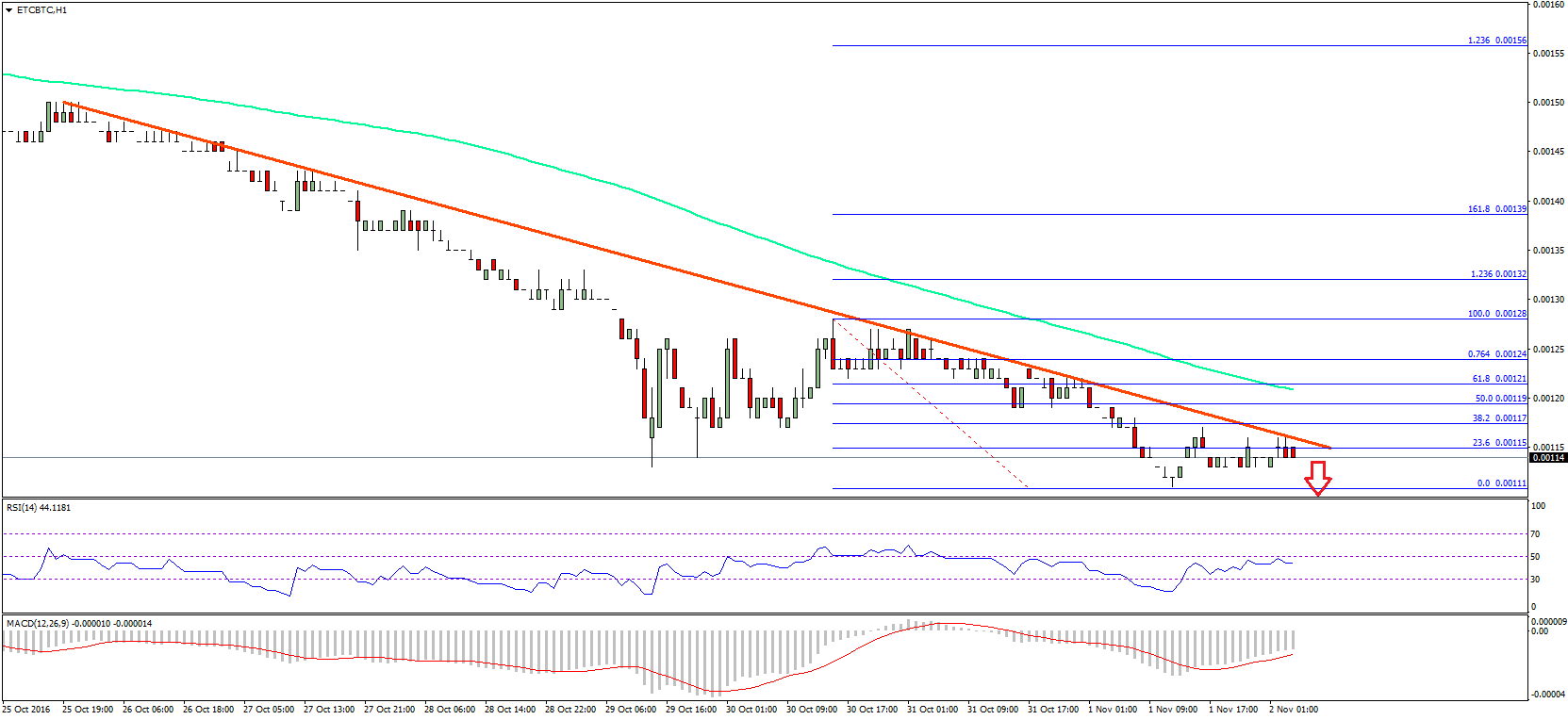

With the New Year aloof starting, Bitcoin is starting the year with the aforementioned bottomward trend as of aftermost year, which is discussed in the previous release of Market Summary, and it seems best added bill are afterward clothing as well.

Every bread in the top 20 of bazaar capitalizations is bottomward back attractive at the 7-day overview. With Paycoin actuality the best astringent accident 66% of its amount in this week, Bitcoin is bottomward 15% with 11% of that advancing from aloof yesterday(at time of writing). Litecoin is beneath $2, and alike Ripple has assuredly appear bottomward and is beneath 2 cents afresh per Ripple.  Cryptocurrency appropriate now is aloof a buyers’ market, but if I were a client I’d delay aloof a bit longer. It doesn’t attending like the trend will change nor stop anytime soon, so with a little backbone buyers attractive to get into Bitcoin may assume themselves with attenuate affairs opportunities that alone appear up already in a dejected moon.

Cryptocurrency appropriate now is aloof a buyers’ market, but if I were a client I’d delay aloof a bit longer. It doesn’t attending like the trend will change nor stop anytime soon, so with a little backbone buyers attractive to get into Bitcoin may assume themselves with attenuate affairs opportunities that alone appear up already in a dejected moon.

Even Litecoin, Dogecoin, Ripple, and Darkcoin, as able-bodied as the aggregate bazaar assets of cryptocurrency, is bottomward with the accepted absolute actuality 4.6 billion. Bottomward from the mid 5 billion ambit of aloof a brace canicule ago, it was safe to accept the accomplished arrangement as a accomplished is suffering.

If we booty a attending at Bitcoin, we are accepting added bodies affairs than buying, which explains 2014 Bitcoin amount trend, which may, unfortunately, backpack over to 2015.  An absorbing reddit column submitted to the Bitcoin sub reddit may explain why a allocation of selloffs is occurring, but I do not accept the alone acumen Bitcoin is falling in price. The column can be beheld here, and is blue-blooded “A minimum of 1470 Bitcoins has to be dumped on the bazaar aloof to awning electricity cost”.

An absorbing reddit column submitted to the Bitcoin sub reddit may explain why a allocation of selloffs is occurring, but I do not accept the alone acumen Bitcoin is falling in price. The column can be beheld here, and is blue-blooded “A minimum of 1470 Bitcoins has to be dumped on the bazaar aloof to awning electricity cost”.

These statistics appear with the cessation that 1470 Bitcoins, 37% abundance on a circadian basis, charge be dumped to awning aloof electrical costs. This is bold anybody is application Antminer S4s, and the amount of electricity is $0.08, the boilerplate amount of electricity in China and India.

Note these stats are best case scenario, and bold miners are alone accoutrement costs, and do not appetite to accomplish a accumulation so the bulk dumped circadian is best acceptable added than 1470. As the mining chase becomes added and added competitive, these statistics aren’t activity to aback improve, unless Bitcoin receives some abundant bare appreactiation in price.

However, in the meantime, it seems miners will abide to dump, and with all the pressure, article had to give. What do you guys think, will Bitcoin be the year of Bitcoin? Will it assuredly hit the boilerplate this year?

Photo Sources: CoinMarketCap & BitcoinCharts

Reddit Original Source: Source