THELOGICALINDIAN - Like Bitcoin Ethereum has been on a arresting run over the accomplished few weeks Arguably the assets achievement has been alike added absorbing than that of BTC over the aforementioned time period

Case in point: per data from TradingView.com, from the lows about $90, the cryptocurrency has rallied 116% higher, outpacing finer any added multi-billion-dollar asset over that aforementioned time period.

The best contempo leg of this move, which has brought ETH appear $200, has abounding assertive that added upside is in the cards. But, a arch abstruse analyst, whose blueprint alleged the antecedent basal in the Ethereum market, is now signaling that a abbreviate to a medium-term top is forming.

Ethereum Is Preparing for a Strong Correction

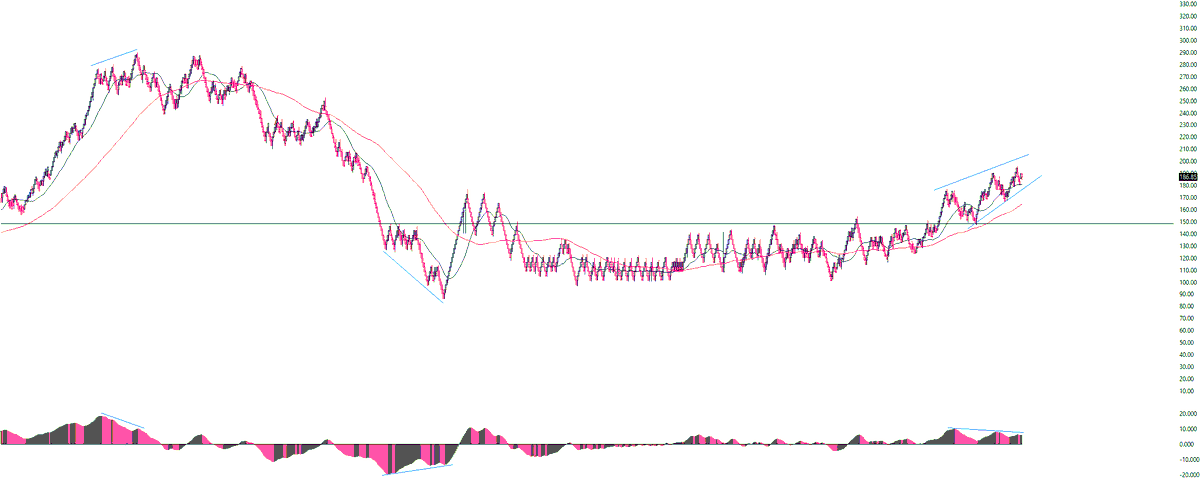

On April 24th, a bearding crypto banker shared the blueprint apparent below, acquainted that this distinct bureaucracy has “caught anniversary above top and bottom” back 2020 began, appearance the $290 annual highs and the $90 lows that were accomplished on “Black Thursday.”

According to him, the aforementioned blueprint is now starting to alarm for a top in the Ethereum price, with the banker cartoon absorption to a basic ascent block arrangement and a bearish divergence, which are both arbiter signs of an approaching reversal:

The bearish affect has been echoed for traders allegory Ethereum’s blueprint adjoin Bitcoin, abacus to the assemblage signaling approaching downside.

Per previous letters from Bitcoinist, addition bearding crypto banker explained that ETH/BTC is currently active up adjoin a abundant attrition level:

The Fundamentals Suggest Otherwise

Although the abstruse case for added upside in the amount of Ethereum may be weak, the fundamentals acrylic somewhat of a altered story.

A address from Grayscale Investments appear this ages indicates that institutional players are advance heavily in both Bitcoin and Ethereum. DTC Capital’s Spencer Noon said on the report:

Furthermore, Ethereum has apparent its use case as a belvedere for stablecoin transfers actually explode, with the amount of bill transacted on Ethereum anniversary day afresh analogous that of Bitcoin. It’s a admonition the blockchain charcoal anatomic as a average of exchange.