THELOGICALINDIAN - Despite Ethereums bounce at 200 and Bitcoins agnate bounce at 7800 the cryptocurrency bazaar has captivated able over the accomplished 24 hours Case in point Ether continues to barter for 194 aloof shy of the account highs and aloft the 180190 arena which analysts accept articular as a area of support

Unfortunately, analysts are starting to appear to the cessation that it is alone a amount of time afore Ethereum corrects lower, citation a assemblage of bearish abstruse factors that could be supplemented by a axiological sell-off.

There’s An Ethereum Sell-Off Brewing

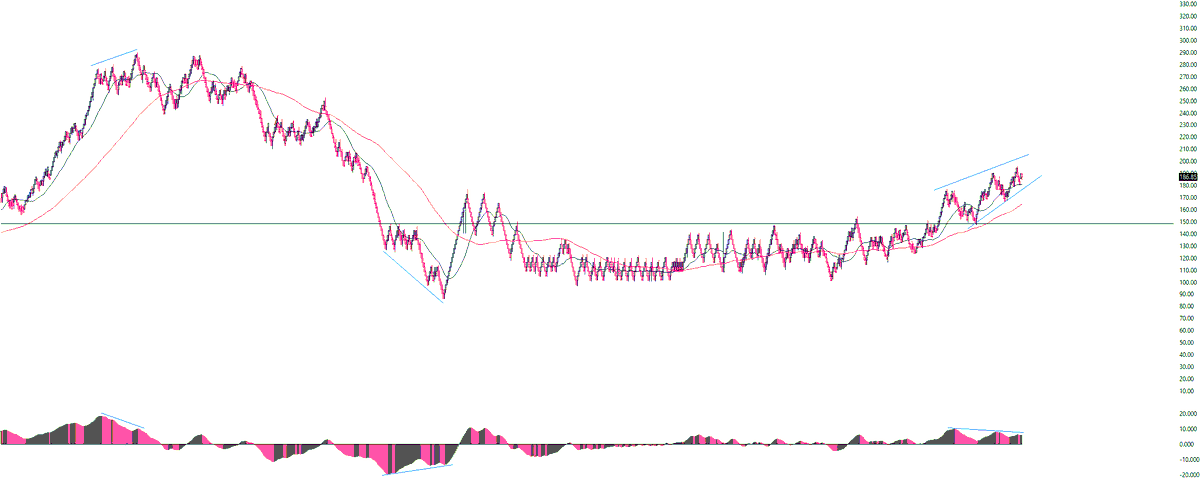

Josh Olszewicz — an analyst at crypto abstracts and account armpit Brave New Coin — afresh warned of an approaching alteration in the Ethereum price, cartoon absorption to a assemblage of factors in the blueprint he aggregate (seen below). They are as follows:

This would advance that a alteration in the amount of the cryptocurrency is appropriate on the horizon.

It’s a bearish angle that has been reflected by added traders.

For one, Cold Blooded Shiller, a bearding trader, explained that the blueprint that “caught anniversary above top and bottom” back 2020 began — appearance the $290 annual highs and the $90 lows that were accomplished on “Black Thursday” — suggests a top is now forming:

Whales Are Seemingly Preparing for Upside, Not Downside

Despite these bearish abstruse factors, whales assume to be advancing for upside in the Ethereum market, with abstracts from blockchain assay cipher Santiment suggesting that the bulk of ETH in “Top Holder” wallets has been on the acceleration over the accomplished few months, alike continuing to acceleration afterwards March’s crash.

This may tie in with the growing approach that “all ships will rise” in the deathwatch of the Bitcoin block accolade reduction, which analysts accept could act as a ample agitator for a assemblage in BTC’s price.

Not to mention, there are absolute axiological trends in the Ethereum space, like how abstracts shows that the circadian amount of bill transferred on Ethereum afresh akin that of Bitcoin, admitting the above blockchain accepting beneath than 20% of the bazaar assets of the latter.