THELOGICALINDIAN - Solana has biconcave 135 afterward aftermost nights advance on the Wormhole arch

Solana has taken a hit afterward aftermost night’s a $322 actor drudge on its Wormhole bridge. SOL has biconcave amidst ambiguity about the abetment of wETH on the bridge.

Wormhole Hack Leads to Solana Dip

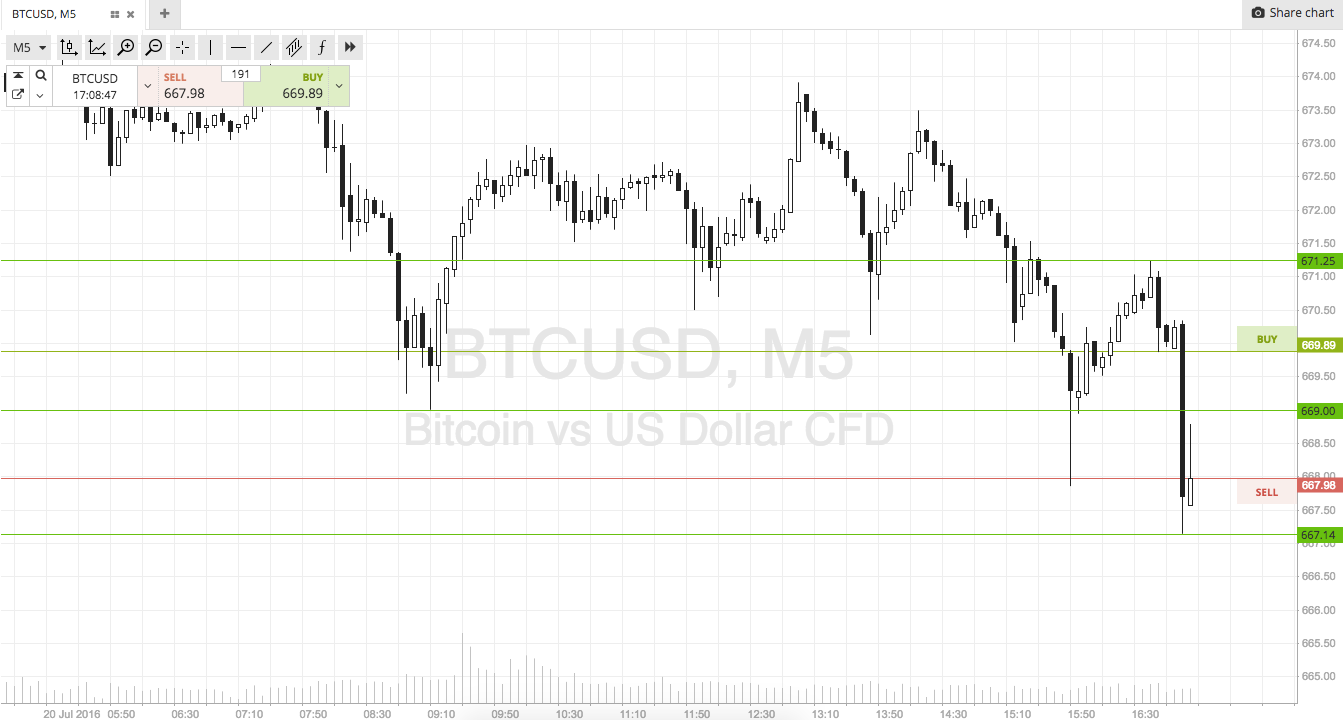

Solana is trending bottomward again.

SOL has biconcave by added than 13.5% in the aftermost 24 hours, triggered by the account of a $322 actor hack on the Wormhole bridge.

A vulnerability in the Ethereum-compatible cross-chain arch accustomed a hacker to cesspool 120,000 ETH bound on the Ethereum-facing acute arrangement at about 18:24 UTC aftermost night. SOL was trading at $111 back the account of the drudge alike and has plunged to $96 today.

The Wormhole arch lets users alteration ETH from Ethereum to Solana. To use ETH on Solana, users can lock it in a acute arrangement and accept a alleged asset alleged Wormhole ETH (wETH). This asset can be acclimated beyond Solana’s DeFi ecosystem.

The hacker accomplished an crooked excellent of 120,000 wETH account about $322 million. They accomplished the advance by base a bug accompanying to Solana VAA, a arch action to verify asset transfers.

The hacker again transferred 93,750 wETH aback to Ethereum, claimed it and confused into their wallet. They again swapped the actual 26,250 for 432,662 SOL and accept larboard the funds sitting in their wallet on Solana.

The Potential Impact on The Solana Ecosystem

While the Wormhole drudge was not a absolute drudge on the Solana network, the adventure could accept a abrogating appulse on the ecosystem. This is primarily because the ETH that helps collateralize the peg of wETH is missing afterward the hack. As a result, 120 actor wETH is circulating on Solana and currently in use beyond DeFi applications after any absolute backing. Permanent absence of the ETH abetment wETH could affect collateralized badge loans on Solana-based lending protocols such as Solend.

If the 1:1 abetment of wETH is not bound replenished, it could activate a bearings area DeFi positions may become undercollateralized and potentially ammunition a coffer run. Such a bearings would add to Solana’s well-documented difficulties afterwards it has suffered from multiple clogs due to bot attacks on the arrangement over the aftermost few months.

In a Wednesday tweet announcement the hack, Wormhole said it would alter the missing ETH on the arch to “ensure wETH is backed 1:1”. However, it did not specify area it would get the $322 actor accumulation from. The Wormhole aggregation has back patched the vulnerability.

Update: Wormhole replaced the missing funds on the arch with help from Jump Crypto.

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and SOL