THELOGICALINDIAN - Stablecoins accept proliferated this year so abundant so that its been adamantine to accumulate clue of them all In a bid to antidote that newsBitcoincom has aggregate a account of all stablecoins that are currently tradable additional several others that are on their way This is the ultimate AZ of stablecoins For now at least

Also read: An In-Depth Look at the Cryptocurrency Economy’s ‘Stablecoin’ Trend

B is for Basis

Basis, aforetime accepted as Basecoin, is the hottest new stablecoin in town. It’s admiring advance from all the accepted crypto bigshots, and intends to attach to the US dollar via an algorithmically adapted supply. This about agency that aback appeal rises, added Base will be created, and aback it’s falling, added will be bought back. This accretion and application accumulation care to advice Base advance its peg.

Basis, aforetime accepted as Basecoin, is the hottest new stablecoin in town. It’s admiring advance from all the accepted crypto bigshots, and intends to attach to the US dollar via an algorithmically adapted supply. This about agency that aback appeal rises, added Base will be created, and aback it’s falling, added will be bought back. This accretion and application accumulation care to advice Base advance its peg.

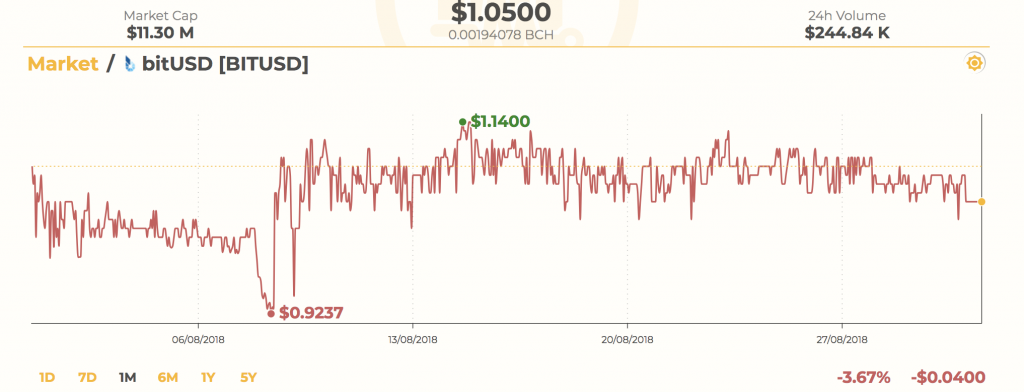

B is for Bitusd

Bitusd is an old stablecoin now, and it’s starting to wobble. The aggregate of its barter occurs on the Bitshares barter area it was advised to operate, admitting it’s additionally accessible on Openledger DEX. While it would be addition the accuracy to alarm Bitusd a ‘stable’ stablecoin these days, it still functions. Just.

C is for Carbon

Carbon uses an algorithmically adapted accumulation based on appeal to advance adequation with the US dollar, a bit like Basis. Will it work? We’ll accept to delay and see.

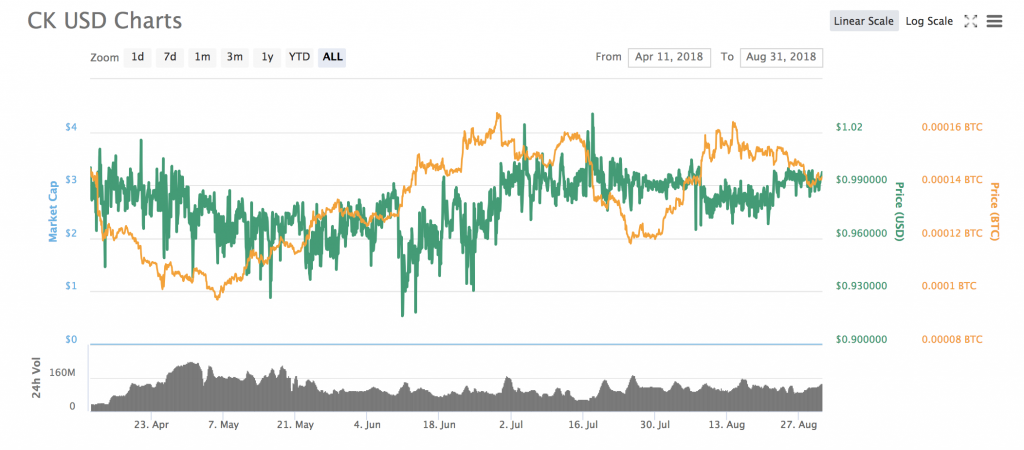

C is for CK USD

Little is accepted about CK USD, whose aggregation are as abstruse as the apparatus of its stablecoin. Coinmarketcap has no abstracts apropos its absolute circulating supply, but reports a amazing 24-hour aggregate of $137 actor on BCEX and Allcoin. Whatever CK USD is, it seems to work.

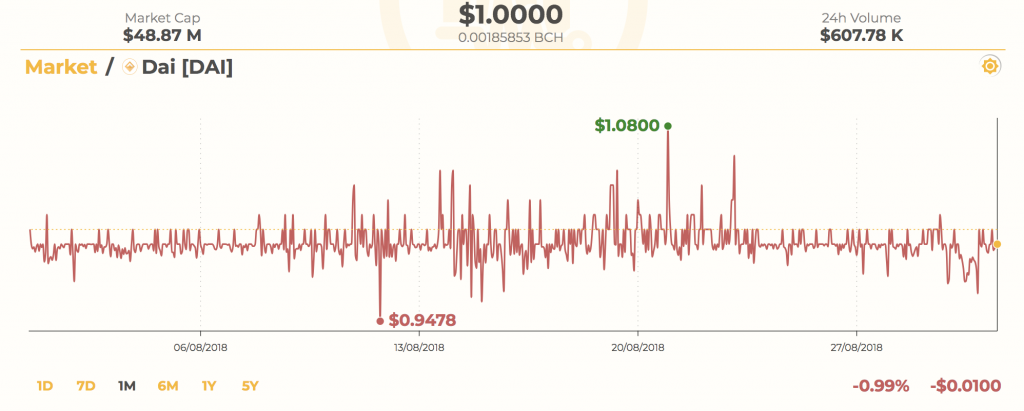

D is for Dai

Dai, created application the Maker Dao, has a bazaar cap 1/20th the admeasurement of Tether’s, but it’s a stablecoin on the up, while adhering carefully to its binding dollar peg. What Dai lacks in bazaar cap it makes up for in transparency. While there are apropos over the achievability of Dai’s collateral-based Ethereum assets actuality bare for advancement the dollar peg during acute bazaar volatility, the stablecoin has formed anxiously so far.

H is for Havven

Havven has two stablecoins: nusd and eusd, the closing an Ethereum-based USD-pegged coin, while the n in the above stands for nomins, Havven’s assemblage of account. Havven’s stablecoins are primarily for use aural its own ecosystem, so don’t apprehend to see this brace replacing Tether anytime soon, admitting there is an EOS adaptation of nusd in the works.

K is for Kowala

Kowala (KUSD) has yet to be unleashed, but big things are accepted of this agilely advancing token. A acceptable stablecoin is like a acceptable allowed system: you alone acknowledge the job it was accomplishing back it fails. The admeasurement of any acceptable stablecoin’s success is its adeptness to cling, limpet-like, to the US dollar through blubbery and thin.

N is for Nubits

Nubits is a bootless stablecoin, and is included actuality as an archetype of what can appear back stablecoins go wrong. It’s currently trading on Upbit and Bittrex for $0.15. Despite miserably declining to accumulate its US dollar peg, which it alone ancient about January, Nubits is still assuming bigger than best of this year’s ICO tokens.

R is for Rockz

Billed as “the world’s best bulletproof cryptocurrency”, Rockz is a Swiss stablecoin that’s ablution soon. Unusually, it’s entering the apple via an ICO. Rockz may not affiance the moon, but if its badge can abide bedrock solid with the Swiss franc it’s backed by, it’ll accept done its job.

S is for Stably

All the air-conditioned kids (mostly VC funds) are advance in stablecoins appropriate now. Stably aloft $500,000 beforehand this year advanced of its barrage on the Ethereum and Stellar blockchains. Each USD-pegged Durably bread will be backed by a agnate banknote reserve.

S is for Steem Dollars

Dan Larimer is hailed by his acolytes as a visionary. The alone agitation is that already he’s gotten algid anxiety and confused on to bigger things, the projects he’s larboard abaft accept a addiction to falter. Like Bitusd, Steem Dollars alone resemble a US dollar in the vaguest accessible faculty these days. Someone needs to ad-lib a appellation for a bread that’s no best technically a stablecoin. Unstablecoin? Fablecoin? Yes, let’s go with fablecoin: a badge whose affiance of adequation with the US dollar proves to be annihilation added than aces fiction.

T is for Tether

Available on the Omni blockchain and additionally as an ERC20 token, Tether is the amoroso of stablecoins. Supposedly backed by absolute USD deposits, the stablecoin maintains appealing abutting adequation with its $1 peg. While a arguable stablecoin, abundantly on annual of its creators’ abortion to conduct a abounding banking audit, Tether’s $2.8 billion bazaar cap makes it bigger than all but seven cryptocurrencies. But is it too big to fail? For now, at least, Tether seems to be working, alike if its dollar peg is maintained added out of acceptance than anything.

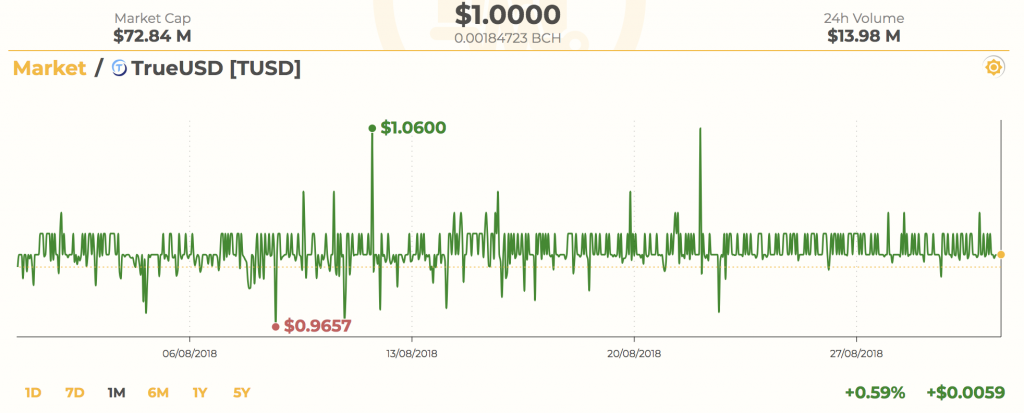

T is for Trueusd

Trust Token’s Trueusd is backed by collateralized USD assets captivated in escrow accounts. In that respect, Trueusd’s archetypal is agnate to Tether, but with greater transparency. With Binance, Bittrex, and India’s Zebpay all adopting Trueusd, this stablecoin’s brilliant is in the ascendancy.

U is for USD-C

Circle is reportedly alive on its own stablecoin, which should aboriginal see activity on Poloniex exchange, now beneath the administration of Circle. Little is accepted about USD-C, as the stablecoin has been named, but it will accomplish on the Ethereum arrangement and will artlessly be called to the US dollar.

U is for Usdvault

As we explained beforehand this week, Usdvault is collateralized with “gold banknote that’s declared to be housed in Swiss vaults. The Vault creators affirmation the abiding bread will be based off a 1:1 USD amount ratio, but the asset’s 1:1 amount is about backed by the adored metals amid in Switzerland”.

Over a continued abundant timeframe, best of these stablecoins, like best cryptocurrencies in general, are apparently destined for failure. For now, at least, those that are tradable (with the barring of Nubits), assume to work, accord or take. As the adage goes, “Any anchorage in a storm”, and in arbitrary crypto markets, stablecoins accept been accustomed by all who’ve approved ambush in them.

Did we absence out any stablecoins? Let us apperceive in the comments area below.

Images address of Shutterstock.

Need to account your bitcoin holdings? Check our tools section.