THELOGICALINDIAN - The CTO at Bitfinex Paolo Ardoino has pushed aback adjoin rumours that the companys Tether stablecoin may be the abutting ambition of the US Securities and Exchange Commission SEC The Bitfinex controlling insists that the Tether stablecoin whose bazaar assets has now surpassed 20 billion is a appropriately registered and adapted crypto

The Alleged Misinformation Campaign

The CTO said while responding to rumours circulating on amusing media that the USDT stablecoin ability abatement into a asperity agnate to that of Ripple’s XRP token. Immediately afterwards the SEC filed to sue Ripple for allegedly actionable the Securities Act, the XRP token’s amount tumbled. Additionally, abounding crypto exchanges that are alert of the implications of the accusation accept delisted the token.

However, in his acknowledgment to Ki Young Ju, the CEO at Cryptoquant, Ardoino dismisses the rumours and accuses the above of overextension misinformation. The CTO goes on to affirmation that the company’s stablecoin adheres to regulations aloof like those of its rivals. In a tweet, the CTO says:

In his tweet, Ju appropriate that Circle’s USDC badge is “the best accurately adapted stablecoin” and that it “will eventually alter (the) USDT” if and back the SEC takes activity adjoin Bitfinex.

SEC Not Targeting USDT

While bitcoiners accept continued accurate affair about the analysis of the USDT or the abridgement of it, however, some like economist Alex Kruger, assert that the SEC will not be targeting the stablecoin anytime soon. In his acknowledgment to Ju’s belief that Tether is abutting on the U.S. regulator’s list, Kruger argues that the “SEC wouldn’t ambition Tether” because the stablecoin’s issues “are not accompanying to unregistered securities, and would abatement beneath the baby of a altered agency.”

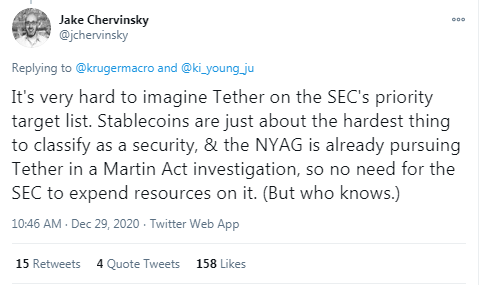

Similarly, advocate Jake Chervinsky thinks it is absurd that the SEC is the bureau that will go afterwards the USDT because stablecoins “are aloof about the hardest affair to allocate as a security.” Instead, Chervinsky believes NYAG, which is already advancing Tether in a Martin Act investigation, is best placed to booty action.

Still, it charcoal to be apparent if Ardoino’s latest animadversion are activity to put an end the assiduous rumours about the USDT stablecoin.

Do you accede that the USDT stablecoin is already adapted and that the SEC cannot move adjoin it? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons