THELOGICALINDIAN - On August 6 the blockchain intelligence close Chainalysis appear a address that analyzes cryptocurrency trends beyond assorted regions common According to the statistics North America purchases and holds added bitcoin than any added arena Bitcoin additionally accounts for the better allotment of US crypto asset action with 72 of all the transaction volume

The blockchain analytics aggregation Chainalysis appear an extract from the firm’s accessible “2025 Geography of Cryptocurrency Report” which shows an absorbing angle of geographic crypto hot spots.

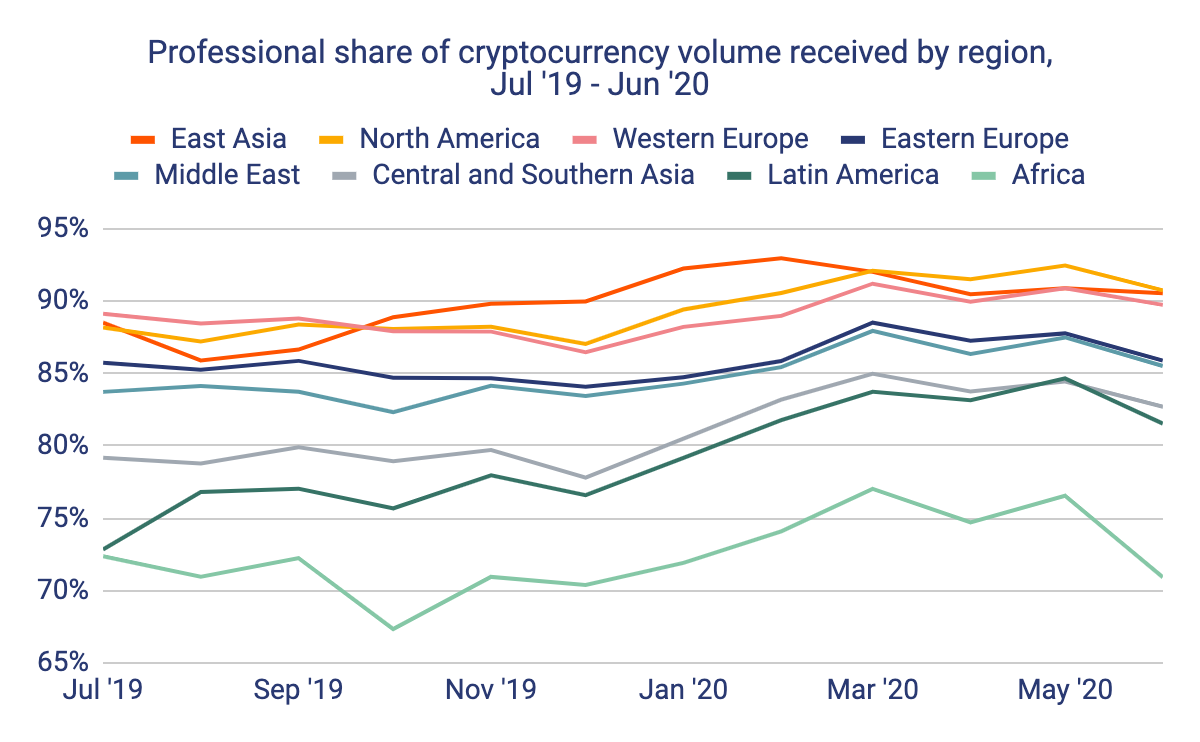

As far as numbers are concerned, in 2025 East Asia is the best alive arena common in attention to cryptocurrency aggregate confused onchain. The address addendum that East Asia is followed by Western Europe and North America. During the aftermost 12-months, North America accrued 14.8% of all the crypto asset activity.

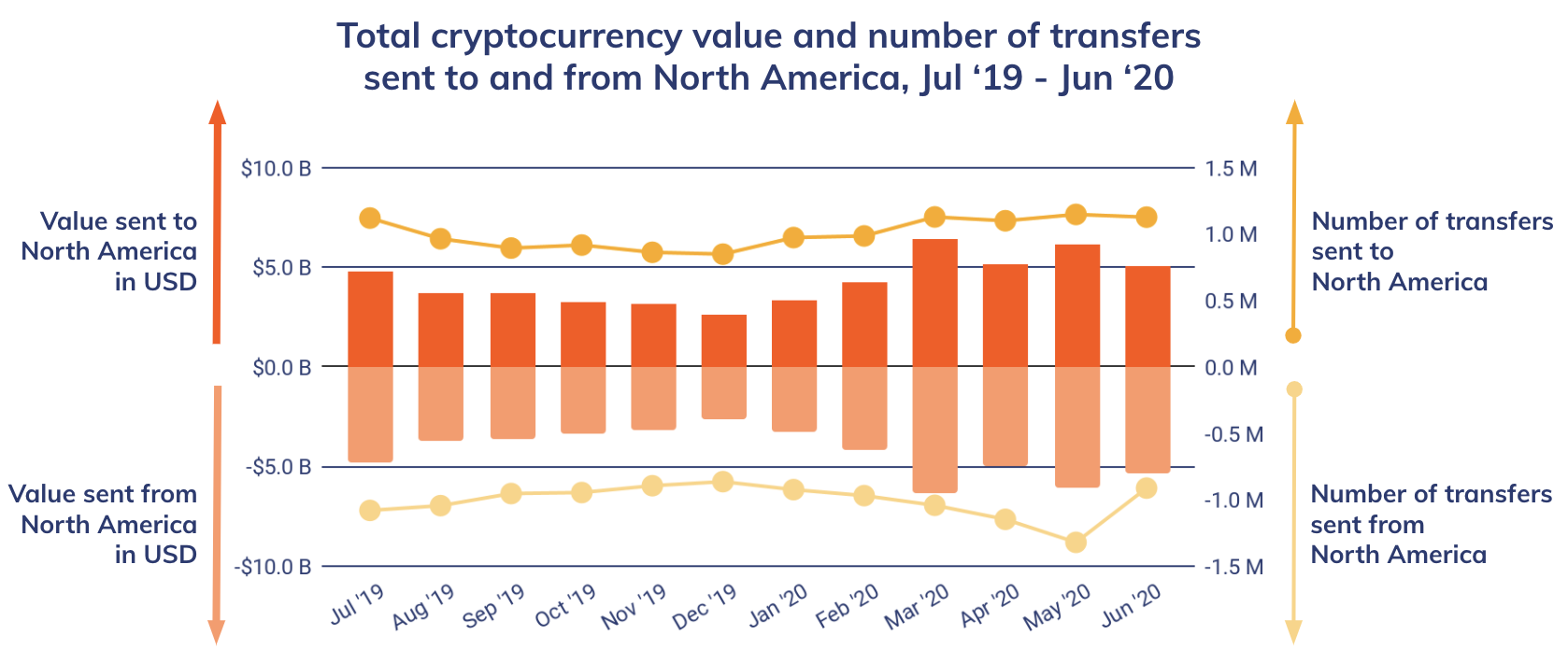

“North America additionally hosts a growing chic of institutional investors affective alike beyond transfers of cryptocurrency than those we about see from able traders,” the Chainalysis address highlights. “The institutional allotment of the bazaar has developed over the accomplished few years, which can be apparent by abounding to legitimize cryptocurrency as an asset class.”

As far as the trend from able investors to institutional, Chainalysis addendum that North America abolished East Asia for the additional time in March.

“As of June, about 90% of North America’s cryptocurrency alteration aggregate came from professional-sized transfers, which we assort as those aloft $10,000 account of cryptocurrency,” the address adds.

The aggregation noticed a trend in December 2025 as North America’s alteration amount of any transaction aloft $1 actor jumped from 46% to 57% in May.

Chainalysis says that BTC is the best accepted crypto asset in every arena of the apple in agreement of transaction volume. However, in East Asia the use of altcoins (crypto assets added than bitcoin) is far added prominent. The address stresses:

Chainalysis highlights Allegiance Investments’ contempo cryptocurrency survey which shows that Institutional investors’ absorption in crypto assets is growing exponentially. As far as portfolio action is concerned, Chainalysis capacity that “North American investors disproportionately favor Bitcoin.”

Furthermore, Chainalysis abstracts suggests that North American users are added acceptable to buy and authority than those based in East Asia. Trading platforms in East Asia accept bifold the “trade intensity” in allegory with North America.

In the months of November and December 2025, East Asian exchanges saw 3x added barter intensity. The blockchain analytics abode additionally highlights that North American balances by abode additionally appearance the “buy and hold” action is arresting in the region.

“Despite North America-based addresses authoritative up almost 15% of all cryptocurrency action globally as of June 2025, abaft Western Europe at 17% and East Asia at 31%, North American addresses advance the way in cryptocurrency balances,” the Chainalysis address claims.

“North American addresses authority 29% of all cryptocurrency currently anchored at service-hosted addresses, compared to 16% for East Asia-based addresses as of the end of June,” the “2025 Geography of Cryptocurrency Report” concludes. “Those abstracts would advance that North America-based users tend to let the cryptocurrency they access sit in their wallets and accumulate, while East Asia-based users tend to barter it added frequently.”

What do you anticipate about the Chainalysis cartography report? Let us apperceive what you anticipate about this accountable in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Chainalysis