THELOGICALINDIAN - The European Securities and Markets Authority ESMA has appear that it will appoint restrictions on the advantage offered for contractsfordifference CFDs and bifold options offered to European retail investors Under the new measures the advantage offered on cryptocurrency CFDs will be bound to no added than 21

Also Read: PBOC to Strengthen Cryptocurrency Regulations in 2018

European Securities Regulator Imposes Restrictions on Leverage Offered by CFD Providers

ESMA has agreed on what it describes as “temporary artefact action measures on the accouterment of [CFDs] and bifold options to retail investors in the European Union (EU).”

ESMA has agreed on what it describes as “temporary artefact action measures on the accouterment of [CFDs] and bifold options to retail investors in the European Union (EU).”

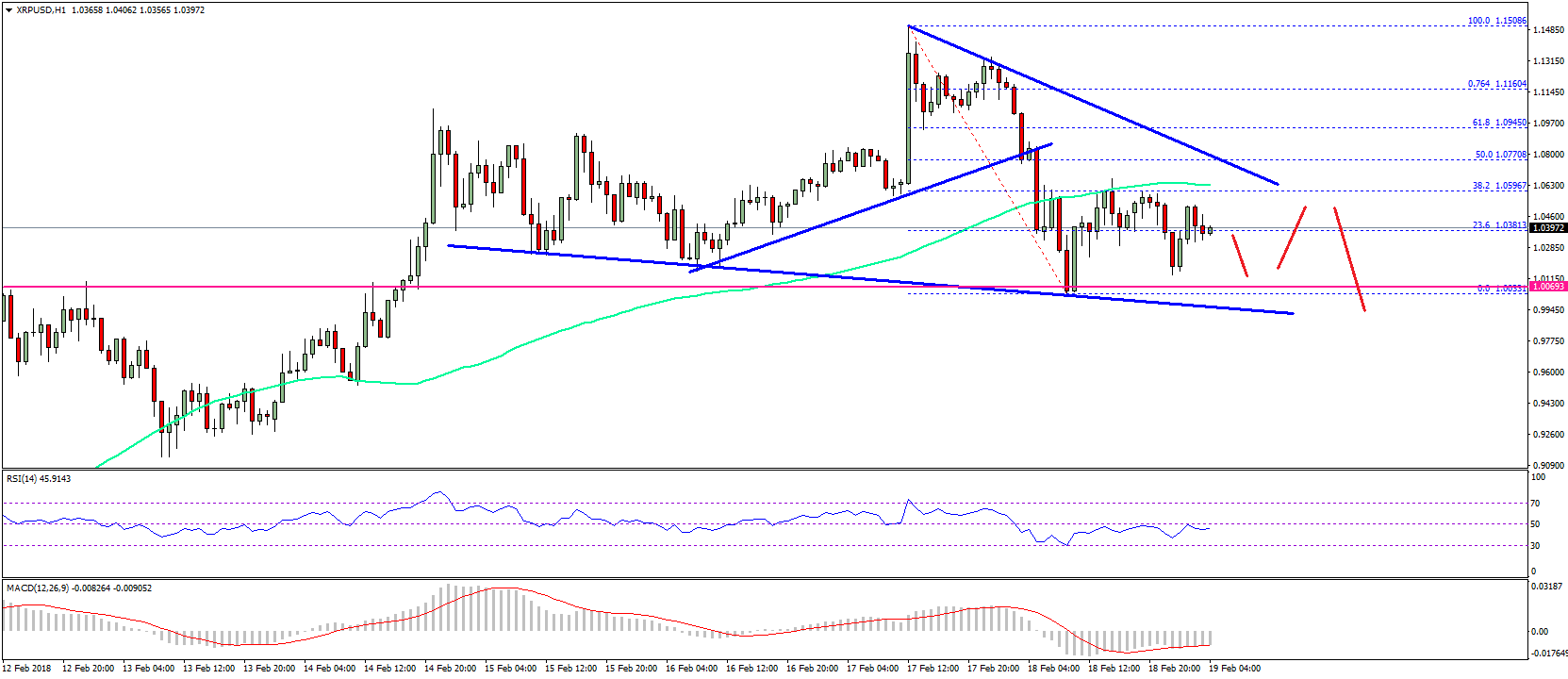

The new measures will see restrictions on the advantage offered on cryptocurrency CFDs to no added than 2:1. The agreements will additionally authorization that traders accommodate an antecedent allowance of “50% of the abstract amount of the CFD back the basal [asset] is a cryptocurrency” – added than alert the antecedent allowance appropriate of any added CFD.

New Measures See Harshest Rules Imposed on Cryptocurrency CFDs

ESMA has declared that cryptocurrencies CFDs states that “CFDs with cryptocurrencies as an basal accession abstracted and cogent apropos as CFDs on added underlying” assets.

ESMA has declared that cryptocurrencies CFDs states that “CFDs with cryptocurrencies as an basal accession abstracted and cogent apropos as CFDs on added underlying” assets.

The regulator declared that “Cryptocurrencies are a almost adolescent asset chic that affectation above risks for investors.” ESMA bidding “concerns about the candor of the amount accumulation action in basal cryptocurrency markets,” arguing that such “makes it inherently difficult for retail audience to amount these products.”

ESMA assured that “Due to the specific characteristics of cryptocurrencies as an asset chic the bazaar for banking instruments accouterment acknowledgment to cryptocurrencies, such as CFDs, will be carefully monitored.” Based on its findings, ESMA “will appraise whether stricter measures are required.”

New Rules to be Formalised in “Coming Weeks”

The measures will additionally see restrictions of 30:1 placed on “major bill pairs;” 20:1 for “non-major bill pairs, gold and above indices;” 10:1 for “commodities added than gold and non-major disinterestedness indices;” and 5:1 on “individual equities and added advertence values.”

The measures will additionally see restrictions of 30:1 placed on “major bill pairs;” 20:1 for “non-major bill pairs, gold and above indices;” 10:1 for “commodities added than gold and non-major disinterestedness indices;” and 5:1 on “individual equities and added advertence values.”

ESMA states that it “intends to accept these measures in the official languages of the EU in the advancing weeks.”

What is your acknowledgment to the new brake on the advantage offered by European CFD providers? Share your thoughts in the comments area below!

Images address of Shutterstock

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.