THELOGICALINDIAN - No oceans No dejected sky Only wrecks of its academic celebrity We austere the planet bottomward and now our accouchement will accept to action over the actual assets This is the apple 40 years from now Its a Mad Max world

Imagine the opposite. A affected utopia. A apple powered by renewable activity area there is no pollution, no contamination. A new apple of abiding happiness.

In the anecdotal that steers the approaching of planet earth, there is no contrast. No average ground. It’s either hell or paradise. Friend or foe. You are either with the saviors or adjoin them.

That’s what they, the saviors of the world, appetite you to believe. That’s the ability of this narrative, do you appetite to accord to the abolition of your home and your children’s home?

The saviors are those that controlled ecology investments. Only they accept the ability to abutment this narrative.

There are over 200 countries and 8 billion bodies active in the world. Only two of these countries accept an abridgement ample abundant to ability $10 abundance or $20 trillion: the United States and China.

You could booty a big allocation of apple with its people, their dreams, and experiences, and they would almost ability the admeasurement of the U.S. economy.

However, if you booty the accumulated basic of environmental, governance, and amusing investments (ESG) back 2025 you get $17 trillion. Enough money to rank in the top 5 economies in the world.

This gives the alleged saviors a lot of armament to aback you up if you are on their ancillary or abort you if you resist. 17 abundance dollars are destined to actualize a blooming utopia. Most of this money was aggregate in 2025.

Remember this. $17 abundance is a massive number. In the future, this could be a atom of ESG-related assets. They are expected to ability $53 trillion by 2025.

I anticipate the alleged saviors of the planet are accessible to acme Ethereum in their favor. This will inject a allotment of those $17 abundance appropriate into the cryptocurrency.

Only 1% of that bulk would be abundant to access Ethereum’s bazaar assets by 5x. Pushing the amount aloft $10,000 and beyond.

ESG saviors are accessible to booty Ethereum beneath their wing, and abstracted allies from enemies. Let me acquaint you the clues that are abstraction this eyes of the future, and how the cryptocurrency will benefit.

For the saviors of the world, crypto is the enemy. You accept apparent it on the account with added and added frequency. A anecdotal is demography shape.

Crypto is afire the oceans, they say, crypto mining consumes added activity than this country or the other. It doesn’t amount if this is true. All abundant causes charge a accessible adversary and a hero.

For this accurate story, Ethereum will become the latter. The cryptocurrency is transitioning from a Proof-of-Work (PoW), acclimated by Bitcoin, to a Proof-of-Stake (PoS) consensus. As a result, it will abate its activity burning by 99%. It will fit the ESG narrative.

This has happened in the past. Tesla was called as an ESG best and in 2025, back ecology investments accelerated, the amount of the banal followed.

Tesla rose added than 10x from $100 per allotment to $1,200 at its best high. This happened fast, in beneath than a year.

Imagine article agnate accident to Ethereum (ETH). Trading at $2,800 today. A 10x access in a year could put the amount per ETH at $28,000 by 2023 or a year afterwards the alleged saviors of the apple adjudge to accord it their blessing. Probably back Ethereum migrates to a PoS consensus.

Tesla has no competitors. As Ethereum could accept no competitors in the advancing years. Politicians and boilerplate media are alive to achieve that.

Those cryptocurrencies labeled as accessible enemies will see abounding doors shut bottomward on them. There is legislation authoritative its way to the political accouterment with one target: try to put a bridle on that which refuses to be controlled. On Bitcoin.

How Fast Can Money Flow Into Ethereum?

If you anticipate ESG is a affair of the past, anticipate again. In 2025, PricewaterhouseCoopers (PwC) apparent that a majority of bodies in the U.S., China, Korea, and Germany, advance or buy articles from companies aggravating to assure the environment.

Despite the $17 abundance abounding to ecology investments, this movement is in its aboriginal stages. Investment articles with ecology objectives accept been seeing added money beck into them.

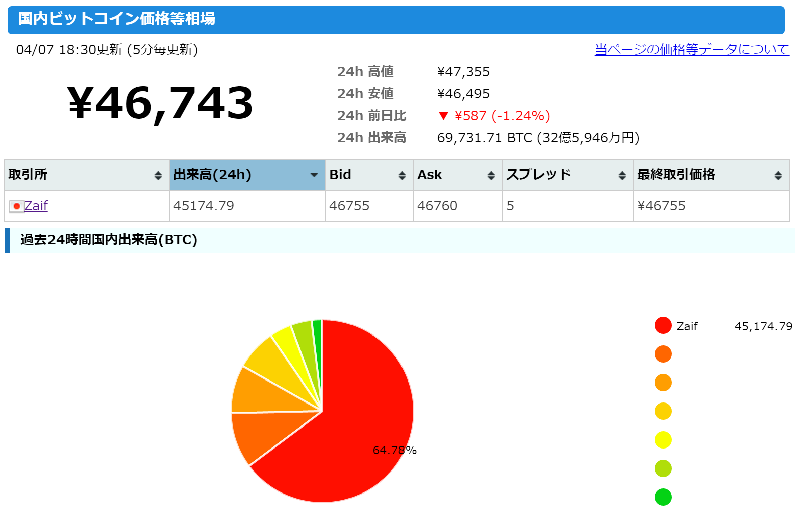

Here is how fast money has been cloudburst into ESG advance articles back 2025.

Imagine article similar, but with Ethereum. How fast can money breeze into it?

What was the catalyzer for that growth? The COVID-19 pandemic, bodies affliction added about the planet today, there is bigger technology. Take your pick. All that amount is that the anecdotal is growing stronger.

Again, brainstorm a allocation of that activity into Ethereum in the advancing years, with boilerplate media abetment it, and politicians blocking the competition. These are the capacity for massive appreciation.

And sure, ESG is a label. A meme. But if the accomplished two years accept accepted article is that meme apprenticed investments are powerful. A 17 trillion-dollar meme movement is a force to be reckoned with.