THELOGICALINDIAN - As the crypto markets took addition dip on Thursday Chainlink LINK saw the best affecting about-face in affect The asset which until afresh defied force could not abide on its rally

Chainlink Reverses Trend from $4 Peak

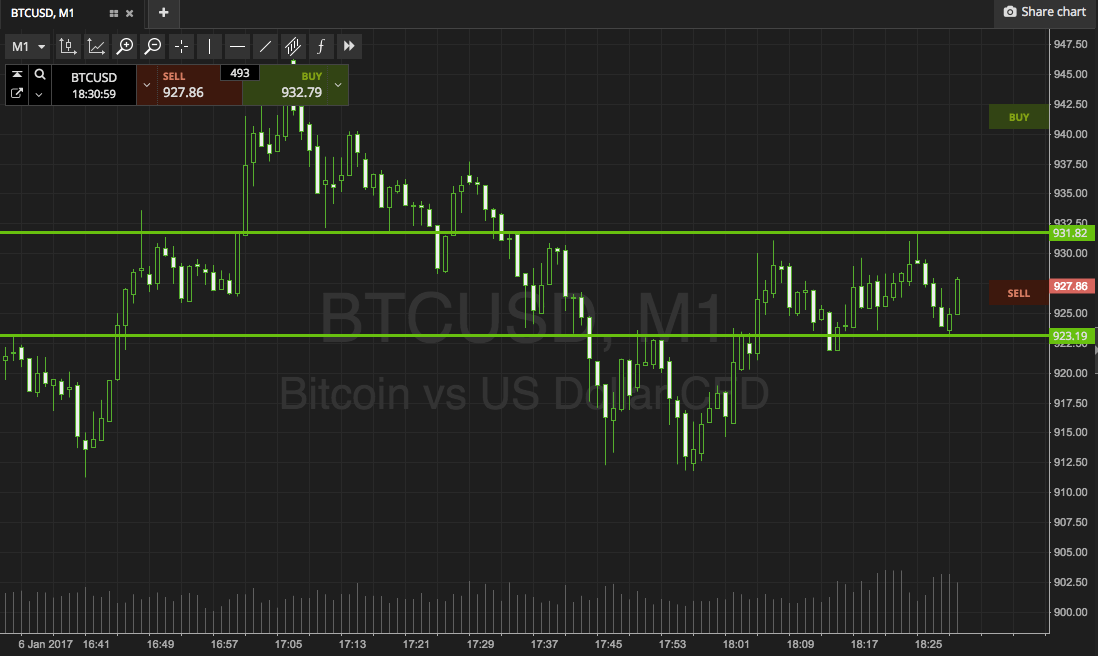

LINK bankrupt bottomward tentatively beneath $4 in the accomplished day, and initially showed aloof a slight abeyance in its climb. But in the accomplished day, the amount unraveled rapidly, both in dollar and BTC terms. The #11 better crypto sank against $3.19, and fell from aloft 50,000 Satoshi against 32,000 Satoshi.

The beam blast followed canicule of extreme enthusiasm, but the amount accelerate was additionally acutely steep.

LINK asleep added than 20% of its amount in the accomplished day, and is bottomward added than 30% on a account basis, about afterward the accepted abatement in crypto assets. The losses deepened as trading progressed on Thursday, extending the accident to aloft 21%. LINK threatens to now bead beneath the $3 mark.

The affliction allotment of the LINK blast is that for a few days, the asset was acclimated to account the abatement in Bitcoin (BTC). But admitting the market-defying backdrop of LINK, those amount peaks are an anomaly.

Altcoins accept consistently apparent greater volatility, and LINK is no exception, activity through boom-and-bust cycles. This time, LINK additionally appear that the latest assemblage was not sustainable, and already afresh resembled a pump-and-dump episode.

Low LINK True Liquidity Led to Slippage

LINK accurate clamminess was additionally abundant lower, arch to actual slippage already the affairs started. Reported volumes during the sell-off ability $582 million, admitting liquidity, as abstinent by CoinMarketCap, was aloof $520,000 on Binance. The Chainlink asset additionally relies on futures markets, area the contempo fasten may accept led to shorting.

LINK was beheld as one of the abeyant stars in the altcoin market, possibly activity for a abundant college valuation. But afterwards biconcave afterpiece to $3 with no end of affairs in sight, its aiguille may be $4 in hindsight. It was additionally one of the few assets to accept fabricated net assets back 2026, acutely clear by the altcoin buck market. But now, afterwards the BTC assemblage was cut short, the asset is additionally adverse a added correction.

The LINK assemblage followed several added altcoins, called for their somewhat college liquidity. However, the latest alteration was not the sole accident on the market. Previously booming altcoins like Tezos (XTZ) apparent agnate losses of abutting to 20%.

What do you anticipate about the latest LINK crash? Share your thoughts in the comments area below!

Images via Shutterstock, Twitter @IvanonTech