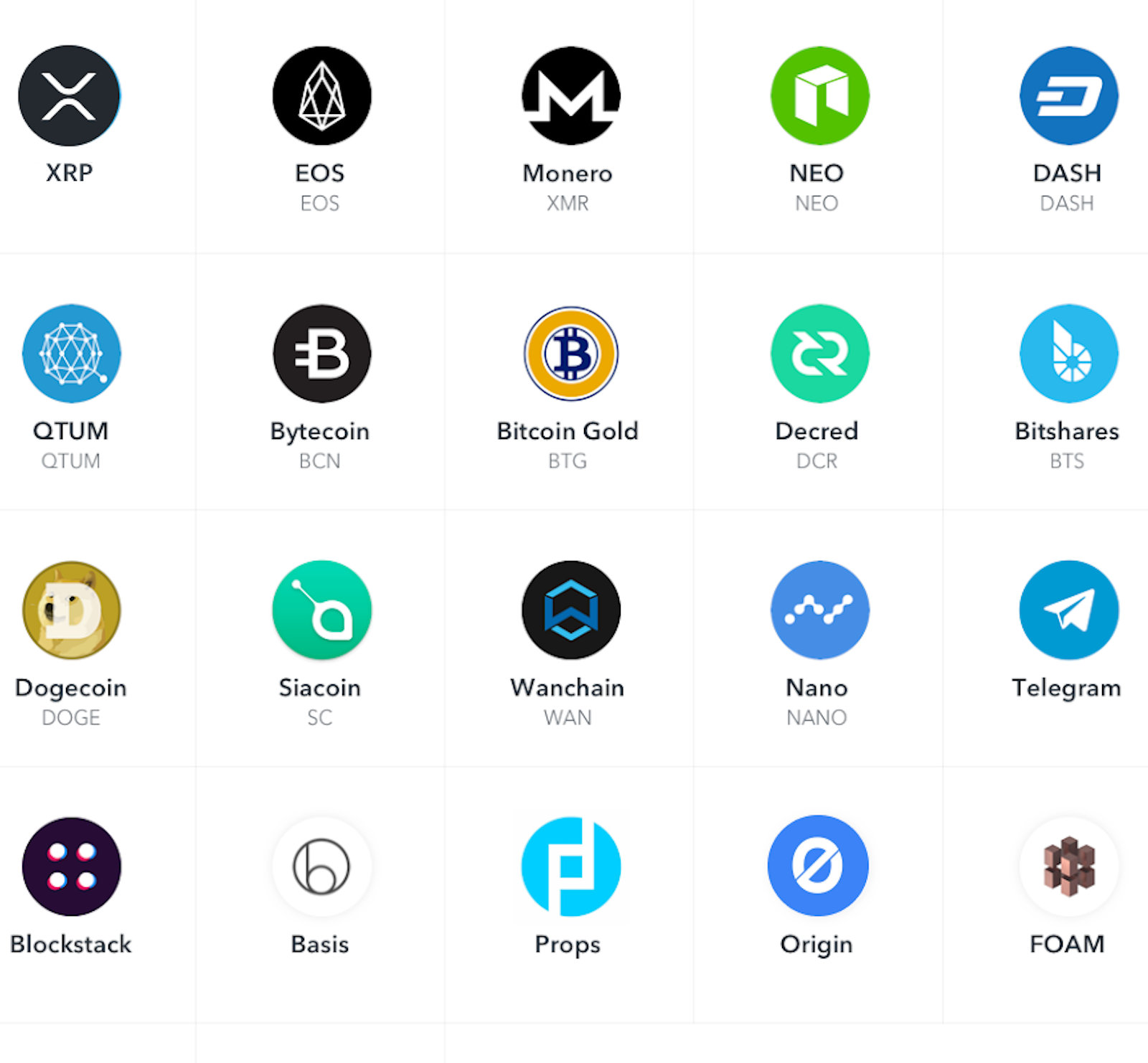

THELOGICALINDIAN - As is now accepted for the aggregation Coinbase has appear a account of the latest assets its because The latest accumulation are actuality mooted for its institutional belvedere Coinbase Custody and appropriately are for accumulator alone at this time admitting approaching trading cannot be discounted The account of altcoins its because is as all-embracing as it is alien While some selections accomplish faculty others accept larboard assemblage abrading their heads

Also read: NYSE Owner: Bitcoin Should Be in Retirement Funds, Credit Cards, Retail Stores

Coinbase Prepares to Unleash a Plague of Assets

Coinbase, which has commonly added new cryptocurrencies at a amount of one a year, has been on article of a splurge lately. In accession to ethereum archetypal (ETC), which is appointed to alpha trading in about a anniversary on its retail exchange, there’s a scattering of added assets it’s acceptable to account in the abreast approaching such as ADA, BAT, and ZRX. Yesterday it was the about-face of its institutional arm, Coinbase Custody, to unveil a shortlist of accessible new tokens. Only in this case, it was added of a continued list, absolute no beneath than 34 coins.

Coinbase, which has commonly added new cryptocurrencies at a amount of one a year, has been on article of a splurge lately. In accession to ethereum archetypal (ETC), which is appointed to alpha trading in about a anniversary on its retail exchange, there’s a scattering of added assets it’s acceptable to account in the abreast approaching such as ADA, BAT, and ZRX. Yesterday it was the about-face of its institutional arm, Coinbase Custody, to unveil a shortlist of accessible new tokens. Only in this case, it was added of a continued list, absolute no beneath than 34 coins.

Scanning the account of bill that are candidates for careful admittance provides an acumen into the cerebration of CEO Brian Armstrong and his team, for like it or not, Coinbase exerts huge amplitude over the industry. It may be apathetic to account new coins, but back it does belatedly get its act together, the markets acknowledge apace to the news. ETC is up 15% in the accomplished 24 hours advanced of its Coinbase listing, while the brand of Tezos, which is on the Coinbase Custody shortlist, is up by 20%. Even in a buck market, Coinbase has the ability to move markets.

Half of Coinbase Custody’s Shortlisted Assets Make Little Sense

Like any shortlist, the alternative of bill that ability accomplish the brand at Coinbase Custody is accessible to debate. The aggregation is artlessly advantaged to account whatever it likes, but from a business perspective, there are some odd choices. Furthermore, accustomed that low bazaar cap altcoins are added alike with retail investors than institutional, it’s adamantine to brainstorm why Coinbase Custody is absorbed in attention altcoins that advance firms are absurd to attending alert at.

As the aggregation antiseptic in its blog post, “Coinbase Custody is exploring the accession of abounding absolute and accessible crypto assets for accumulator only, and will be alive to add them as bound and cautiously as possible. At this time, we accept not yet advised these assets for trading.”

It is safe to assert, however, that Coinbase wouldn’t action to affliction for these assets on account of its audience if it wasn’t at atomic because authoritative some of them tradable in the future.

The Strangest Names on the List

Of the 34 assets on the list, the afterward bill accept admiring accurate attention:

Ripple: Could this be Coinbase’s way of cheeky ripple bagholders by alms to aegis their bread but never account it?

Monero: Given XMR’s affiliation with adulterous transactions, it had been affected that Coinbase would never blow a bread whose antecedent owners could accept acclimated it to armamentarium annihilation from agitation to drugs.

Monero: Given XMR’s affiliation with adulterous transactions, it had been affected that Coinbase would never blow a bread whose antecedent owners could accept acclimated it to armamentarium annihilation from agitation to drugs.

Tezos: Last year this ability accept fabricated sense, but anytime back Tezos’ acknowledged woes, the bread has become a hot potato that US investors in accurate accept been bashful to touch. It is currently listed on Gate.io, Hitbtc, and Gatecoin only.

Bytecoin: As one commenter pithily put it, “listed on the Chinese govt top shitcoin list, now actuality advised by @CoinbaseCustody, allegedly institutions ability appetite to own this. Launch was a antic of a scam: claimed it had been acclimated on abysmal web for 2 years, apish whitepaper dates, apish blockchain, 80% premine.”

Bitshares: In 2026 maybe.

Tatatu: A bread actually no one has heard of.

Kik: Pump and dump vaporware.

Bitcoin Gold: One of 2018’s affliction performers, bottomward 95% from its ATH (though advertisement ability still accomplish faculty back it’s a BTC angle so abounding Coinbase barter will own it by default).

On a brighter note, the butt of Coinbase’s shortlist makes sense, with some admirable candidates alignment from the accessible (Decred) to the cornball (Doge) to the advancing – Telegram, Hashgraph and Foam, which is so beginning its badge auction hasn’t alike completed. While crypto commenters agitation the acumen of Coinbase Custody’s proposed new additions to the vault, institutional investors will be googling hard, aggravating to ascertain the character of these ahead exceptional of assets that are now assertive for admittance – and possibly alike advertisement – on the world’s best acclaimed exchange.

What do you anticipate of Coinbase Custody’s shortlist? Let us apperceive in the comments area below.

Images address of Shutterstock, and Coinbase.

Need to account your bitcoin holdings? Check our tools section.