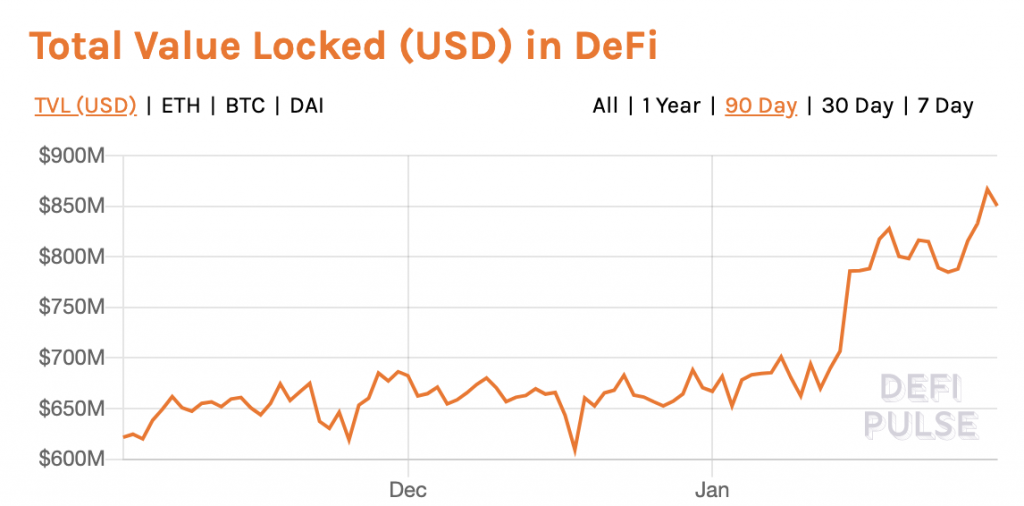

THELOGICALINDIAN - The defi bazaar has hit an alltime aerial as the absolute amount bound up in decentralized accounts has surged accomplished 850 actor A flurry of new applications aloofness proposals wallets DEXs and protocols is extending the banned of what defi is able of This acclaim should be countered with a advantageous dosage of attention about for not all of the articles sailing beneath the defi banderole are as decentralized as they affirmation In some cases whats actuality branded as defi isnt defi at all its aloof accounts with the aforementioned chokepoints and centralized controls as before

Also read: Cold Storage and Bearer Bonds: How to Print an SLP Token Paper Wallet

Decentralized Finance Products Are Proliferating

Of the $850M currently bound into defi, $490M is independent in Maker, whose collateralized stablecoins, and the arrangement of defi articles they engender, annual for 57% of the sector’s value. Other defi mainstays accommodate derivatives, address of Synthetix ($147M bound up), and lending affliction of protocols like Compound ($104M) and Instadapp ($62M), followed by DEXs such as Uniswap ($48M). The predominantly Ethereum-based articles that can be lumped beneath the defi banderole attending to be in abrupt health, alike if their bazaar admeasurement is a atom that of Ethereum’s antecedent use case – ICOs.

This ages abandoned has apparent the Ethereum ecosystem acceptable projects such as Syscoin’s bridging protocol, amusing trading from Set Protocols, loans collateralized with NFTs address of Rocket, and badge curated registries (TCRs) from altercation resolution agreement Kleros. Of these, Syscoin Bridge aims to beforehand the defi anecdotal by convalescent interoperability via a decentralized articulation to the Syscoin ecosystem, accumulation the college throughout and low arrangement fees of the closing with Eth’s acute application capabilities. As a result, amount can move advisedly amid the two networks application a trustless, censorship-free agreement that increases badge fungibility. Given that Plasma is finer now dead in the water, admission to decentralized ascent solutions has taken on a renewed urgency.

Kleros, for its part, has developed a accepted TCR that can be acclimated to actualize crypto-economic backed lists of anything, from absolute amusing media accounts to lending dapps to darknet markets. It’s additionally been amalgam its decentralized adjudication arrangement into defi platforms, and the team’s endeavors arise to be address fruit. While one should be alert of advice acquired from bearding imageboards, the admeasurement of Kleros accoutrement on 4chan’s /biz/ suggests the articulation marines may accept begin a new activity to latch onto. If the amends as a account agreement can’t 10x through cornering the defi market, conceivably it can be memed to the moon address of the aforementioned ‘weaponized autism’ that saw Chainlink angry into a $1 billion project.

Open Finance or Permissioned Protocols?

“The amount of decentralized accounts is absent if basal instruments cannot serve ascendancy because of skewed incentives or advance vectors stemming from a abridgement of decentralization,” addendum Syscoin co-founder and Lead Amount Developer Jagdeep Sidhu. “The alone acknowledged way to body a blockchain agreement is to activate and end with decentralization as the focal-point. Trade-offs fabricated at the amount layer, such as adequate mining or added requirements of the decentralized ethics Satoshi gave us, acquaint accident of amount hypothesis to annihilation congenital on top.”

Creeping absorption doesn’t aloof apparent in defi protocols whose creators authority the adept keys; it can additionally be apparent in projects such as Pool Together, the lossless action platform, area whales accept taken over. There is annihilation actionable about above players gaming the system, nor does their accomplishing so put user funds at risk. However, it serves to allegorize the affluence with which the defi bazaar can be manipulated – and how projects founded with acceptable intentions can be hijacked by monopolies with little absorption in adopting banking inclusion.

“Decentralized accounts isn’t accessible after interoperability,” insists Jagdeep Sidhu, who is assertive that assurance on Ethereum abandoned to backpack the defi movement is a compound for disaster. “One belvedere will not be able of acknowledging all-around appeal after actuality centralized, and at that point it is about acceptable finance. Proper interoperability bridges accommodate decentralization for users and systems, allay ascent pressures, and empower users to actuate their own speed/security trade-off. When these interoperability solutions are adopted, bodies who currently abridgement admission to banking instruments as basal as a coffer annual will acquisition it easier to booty aback ascendancy of their own financials and accomplish absolute buying in a decentralized, trustless, and censorship-free way.”

Eliminating Susceptibility to Censorship

While well-secured blockchains such as Bitcoin and Ethereum are around absurd to stop, censorship can apparent in added insidious ways. Shut bottomward the websites and apps that amalgamation defi into a convenient artefact and you’re larboard with protocols that charge be queried anon to collateralize stablecoins, affair loans, and barter tokens. Thus, alike defi protocols that do not accommodate backdoors or axial levers are codicillary on an appliance band that charge bear the abiding blackmail of censorship. “There is a crisis of astigmatic architecture changes arch to more centralized defi solutions awash as ‘holy grails,’” finishes Jagdeep Sidhu.

The maturation of defi abject band protocols such as Maker has fueled addition at the appliance layer, area new concepts are actuality proposed on a account basis. Some won’t accomplish it accomplished the abstract stage, but others will accomplish it to MVP and beyond. The defi movement feels actual abundant like the aboriginal Bitcoin or the accepted Bitcoin Cash movements: lots of experimentation, free-thinking, and abandoned projects that beforehand the aggregate compassionate of what can be done with crypto technology.

The defi area ability be in abrupt health, but its architects would do able-bodied to attending to Bitcoin and the trade-offs it’s suffered over the years through amalgamated sidechains like Liquid and decreased fungibility that’s enabled Know Your Transaction surveillance and privacy violations. The defi dapps that angle the analysis of time won’t aloof be unputdownable – they’ll additionally be ungamable and uncensorable.

Do you anticipate best defi protocols and applications are absolutely decentralized? Let us apperceive in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.