THELOGICALINDIAN - As the absolute lot of 12333 agenda currencies hovers aloof aloft 18 abundance in amount the stablecoin abridgement has afresh swelled to 1788 billion or 99 of the absolute crypto abridgement Out of the top bristles stablecoins usd bread USDC saw its bazaar assets jump the best accretion 189 during the aftermost 30 canicule The 189 access has pushed USDCs bazaar assets aloft the 50 billion mark

USDC Market Cap Rises Above $50 Billion, Stablecoin Represents 2.83% of the Crypto Economy’s USD Value

Stablecoins abide to abound in 2022, as abundant fiat-pegged badge projects accept apparent their arising levels access during the aboriginal ages of the year. At the time of writing, the USD amount of all the stablecoins today is $178.8 billion.

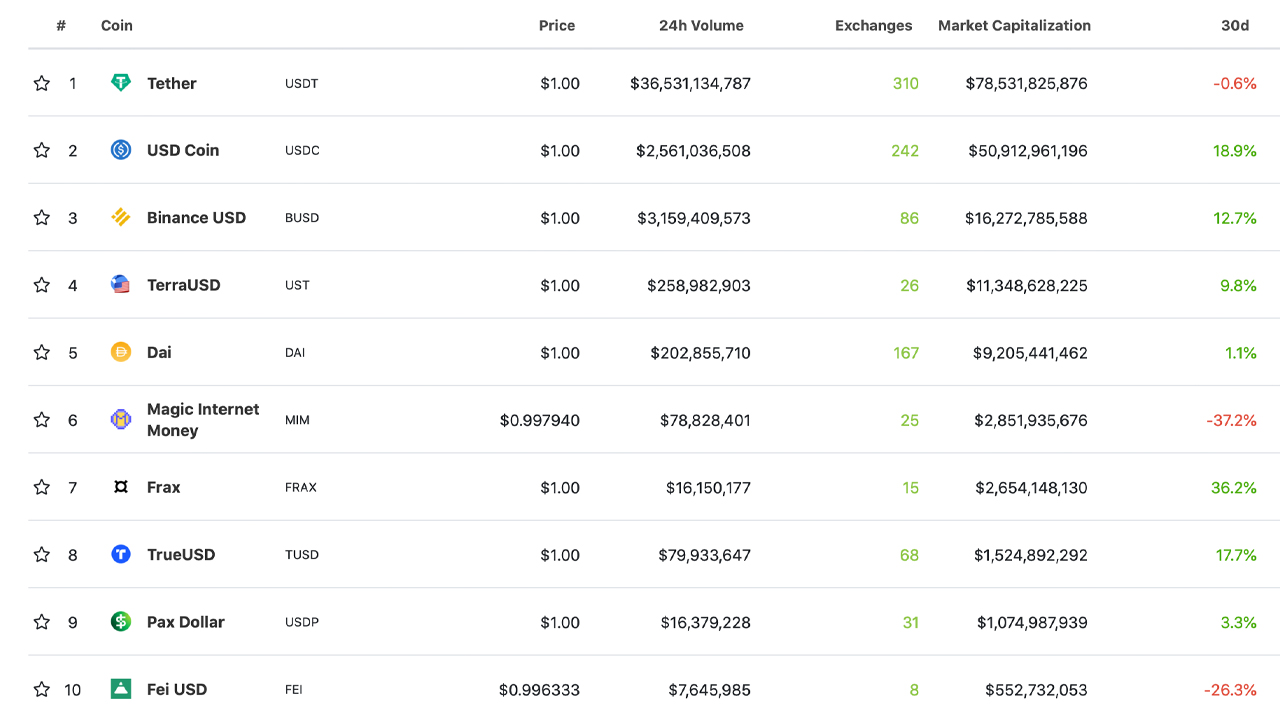

Tether (USDT) is the better stablecoin activity in agreement of bazaar capitalization, with a appraisal of about $78.5 billion. USDT’s all-embracing appraisal represents 4.34% of the absolute crypto economy’s $1.8 trillion. Tether, however, saw no advance during the aftermost ages as the all-embracing appraisal has remained static.

USDC, on the added hand, has developed 18.9% over the aftermost 30 canicule and the bazaar appraisal is now over $50 billion. USDC’s bazaar assets is 2.83% of the absolute crypto economy’s USD value.

Both USDT and USDC accumulated represent 7.17% of the authorization amount of all the bill in actuality today. While these caps are abundant abate than bitcoin’s (BTC) 39.2% ascendancy and ethereum’s (ETH) 17.7% dominance, they still represent the third and fifth better crypto valuations.

Stablecoin FRAX Grew More Than 36% Last Month

Meanwhile, out of the top bristles stablecoins by bazaar cap, the third-largest USD-pegged token, BUSD, saw its assets access by 12.7% to $16.2 billion this month. Terra’s stablecoin UST added by 9.8% to $11.3 billion in 30 days.

Makerdao’s DAI saw its $9.2 billion bazaar assets access by 1.1% this accomplished month. The Avalanche-based abracadabra internet money (MIM) saw its $2.8 billion appraisal accelerate 37.2% lower than it was aftermost month. The seventh, eighth, and ninth-largest stablecoin markets saw their bazaar caps rise.

The seventh-largest USD-pegged bread frax (FRAX) has a bazaar assets of $2.6 billion which has added 36.2% during the aftermost month. Trueusd’s (TUSD) cap acicular 17.7%, and pax dollar (USDP) rose by 3.3% over the aftermost 30 days.

The tenth-largest stablecoin, fei usd (FEI), has decreased by 26.3% this accomplished month. Both FRAX and USDC saw the better increases aftermost month.

What do you anticipate about the stablecoin economy’s access during the aftermost ages and USDC’s acceleration accomplished $50 billion? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coingecko.com,