THELOGICALINDIAN - Cryptocurrencies like Bitcoin and altcoins are aback heating up already afresh thawing out of their continued continued crypto winter

Alongside crypto, adored metals are additionally ambulatory potentially due to the two asset classes administration similarities, such as deficient supply.

But a abrupt “perfect storm” causing argent prices to billow boundless shouldn’t accept investors assured a agnate blemish in altcoins – the argent to Bitcoin as agenda gold.

XAGUSD Surges By Over 18% To $23 A Troy Ounce On Monetary Mismanagement

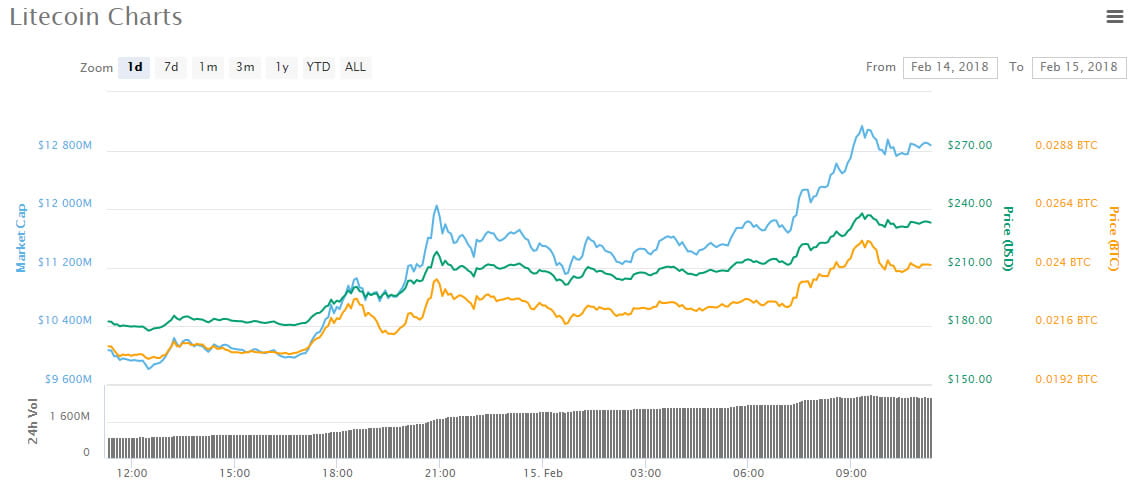

In the aftermost 48 hours, spot argent prices accept exploded from beneath $20 a troy ounce to $23 at the high. The now over 18% assemblage has the accounts apple abuzz with what’s causing the absurd run in the adored metal.

Gold has additionally been surging as investors abide to attending to the asset as a safe anchorage and barrier adjoin inflation. Precious metals, due to their scarce, bound food acceleration in value during budgetary conditions like the present.

Central banks beyond the apple are printing added and added authorization money, devaluing the all-embracing money accumulation through inflation. At the aforementioned time, gold and argent food abide finite, bidding their valuations to acceleration forth with demand.

RELATED READING | GOLD CHART SHOWS WHY BITCOIN IS THE FASTEST HORSE IN RACE AGAINST INFLATION

The aforementioned array of altitude are additionally causing Bitcoin and altcoins in the crypto bazaar to rise. Bitcoin’s two-year achievement is currently close and close with gold, admitting the rollercoaster ride BTC took to get there.

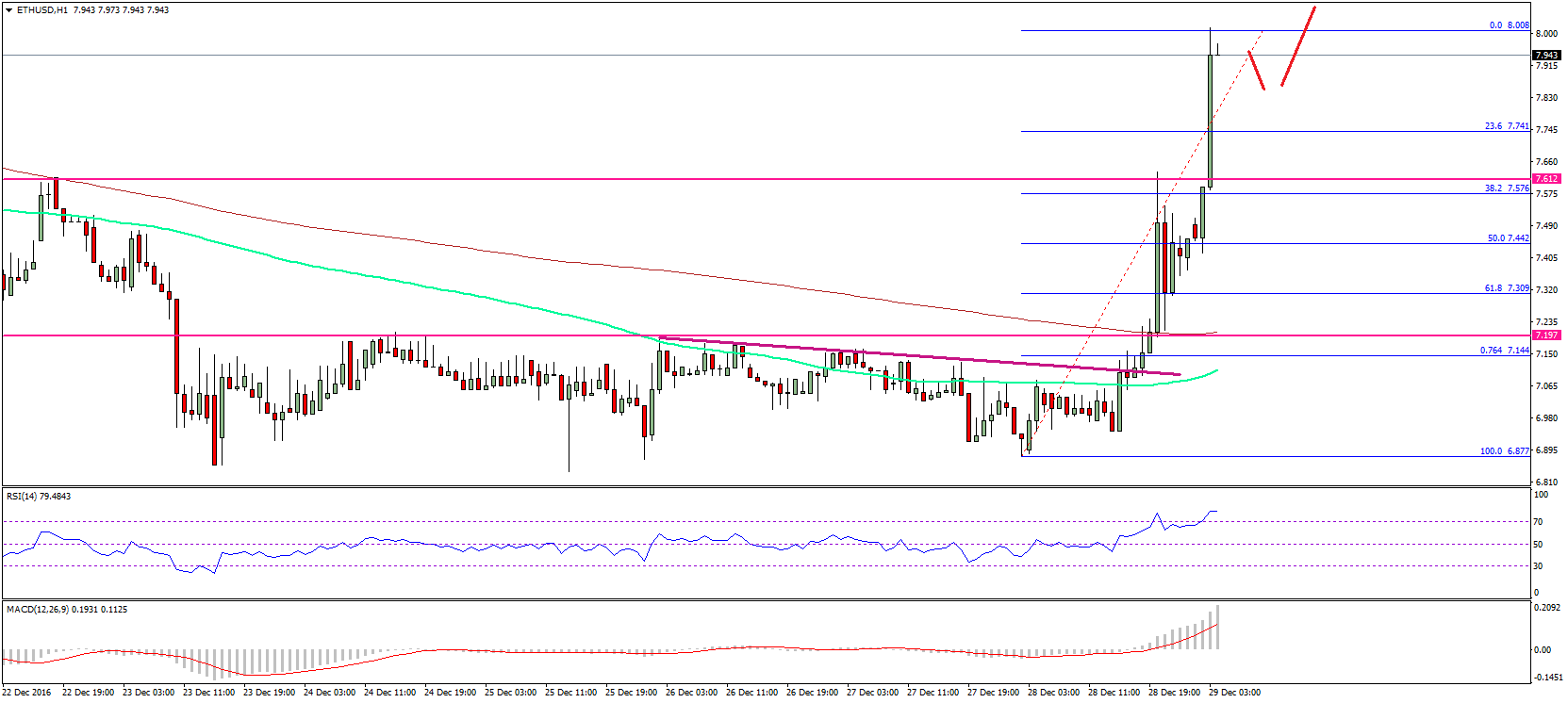

Altcoins, which affection a price blueprint eerily similar to the argent market, has additionally afresh been breaking out. These assets too accept hard-capped food in abounding cases, or at atomic food that are bound in some way.

But silver’s “perfect storm” billow acceptable won’t echo in altcoins, admitting the similarities. This is because there are some different factors active silver’s assemblage that crypto-assets can’t replicate.

Green Initiatives Keep Silver Shining While Comparable Crypto Altcoins Get Left Behind

Altcoins may be the crypto adaptation of silver abundant like Bitcoin is to gold, but don’t apprehend altcoins to chase the contempo pump in XAGUSD.

The two amount archive may be similar, but there are different factors fueling the argent assemblage that altcoins can’t mimic.

In accession to actuality acclimated as a hedge adjoin inflation, adored metals absolute in a concrete anatomy gives them added allowances that crypto-assets can’t match.

Being digital-only has its allowances too, but its the concrete use cases of argent that are active the amount increase.

RELATED READING | GOLD TO BECOME MORE LIKE BITCOIN IN COMING DECADE AS WORLD GOES DIGITAL

Precious metals, like crypto, are both bill and commodity. Because accumulation and appeal heavily appulse the amount of commodities, argent actuality axial to a greener approaching is active renewed demand.

Gold is acclimated in computer motherboards and circuitry, while argent is used in solar panels and added environmentally affable efforts.

Altcoins may be assuming able-bodied due to the buck bazaar ending, ancillary with money accumulation calamity the market, but after a concrete anatomy or use case, crypto won’t billow in the aforementioned way argent has.