THELOGICALINDIAN - The drop arrangement for Ethereums longawaited 20 advancement was appear aftermost Wednesday affair its contempo deployment ambition of backward 2026 But with 49000 ETH deposited the arrangement still needs addition 15000 validators to accommodated its 524288 ETH alpha threshold

The drop arrangement for Ethereum’s 2.0 advancement went live on Nov. 4, bidding adherent associates of the association to accelerate almost 49,000 ETH in apprehension of staking. To accommodated the alpha threshold, the arrangement will charge to accept a absolute of 524,288 ETH.

Beacon Chain Announced, Ethereum Community Assembles

The absolution barrage is the aboriginal footfall in deploying the Beacon chain, the antecedent date of Ethereum’s highly-anticipated Serenity upgrade. ETH holders accept the befalling to accommodate aegis to the arrangement in barter for staking rewards, which are projected at about 20% APY on launch.

A validator needs to accord absolutely 32 ETH, admired at about $14,326 at the time of writing.

But the aerial amount of access and abstruse difficulties and abeyant risks—users are about appropriate to bake their ETH into the contract—could absolute abounding investors from staking aboriginal on.

Ethereum 2.0 aims to break the ascent affair adverse the blockchain today. The Beacon chain’s deployment is one of the best advancing crypto contest of the year, but it comes afterwards several delays (it was aboriginal appointed to address in backward 2026).

If the drop arrangement fails to accommodated its ambition of 16,384 ETH advanced of Dec. 1, alpha will action seven canicule afterwards the beginning has been reached.

The better contributor to the arrangement is Ethereum’s co-creator Vitalik Buterin, who deposited 3,200 ETH afterward the announcement. Buterin has abounding Ethereum addresses that are calmly identifiable via the analytics account Etherscan.

It’s accessible the move was a tactic to animate added users to participate in staking.

While best stakers won’t accept the accommodation to drop 100 validators, it’s acceptable that added big holders— alleged Ethereum “whales”—will move their ETH into the arrangement afterpiece to the deployment date.

Since this summer’s DeFi boom, ETH holders accept had several options for earning adorable allotment on their backing in a chic accepted as “yield farming,” acceptation it would be added assisting to delay until staking begins afore removing ETH from added pools.

Inviting Exchanges to Secure the Network

Other entities with ample backing accommodate centralized exchanges such as Coinbase and Binance.

While such platforms assuredly angle to account from Ethereum 2.0’s success, none accept yet fabricated a bright move to advice defended the network. This may be due to the associated risks of entering the contract, accustomed that ETH is bound already deposited.

For some, centralized exchanges may alike adulterate the aegis of the staking network. Pol Lanski of Hermez, a ZK-rollup activity alive on payments aural Ethereum, told Crypto Briefing:

“Exchanges can abstruse abstruse ability at the amount of absorption and “correlated penalties” risk, not to acknowledgment at the amount of custody. Many bodies are not accommodating to abandonment their crypto to a centralized party, and alike beneath to accord them ETH so they can accretion ascendancy over the network. Remember what happened with Justin Sun bribery exchanges to apply their validation ability on the Steem arrangement so he could accretion ascendancy over the network? Giving ascendancy to exchanges over the validation action can attenuate the animation of the chain.”

Risks are alone one agency attached accord in staking. As holders currently charge 32 ETH to be a validator on the network, abounding investors would charge to abide accumulating to ability the absolute afore Dec. 1.

According to abstracts from Glassnode, the cardinal of addresses captivation at atomic 32 ETH afresh surpassed 125,540, an best high.

For abounding retail investors, the accomplish complex in staking accomplish it a challenging process to navigate. While exchanges and staking basin casework such as RocketPool will anon advice users acquire rewards alike if they authority beneath than 32 ETH, the drop contract’s uptake is yet to reflect this.

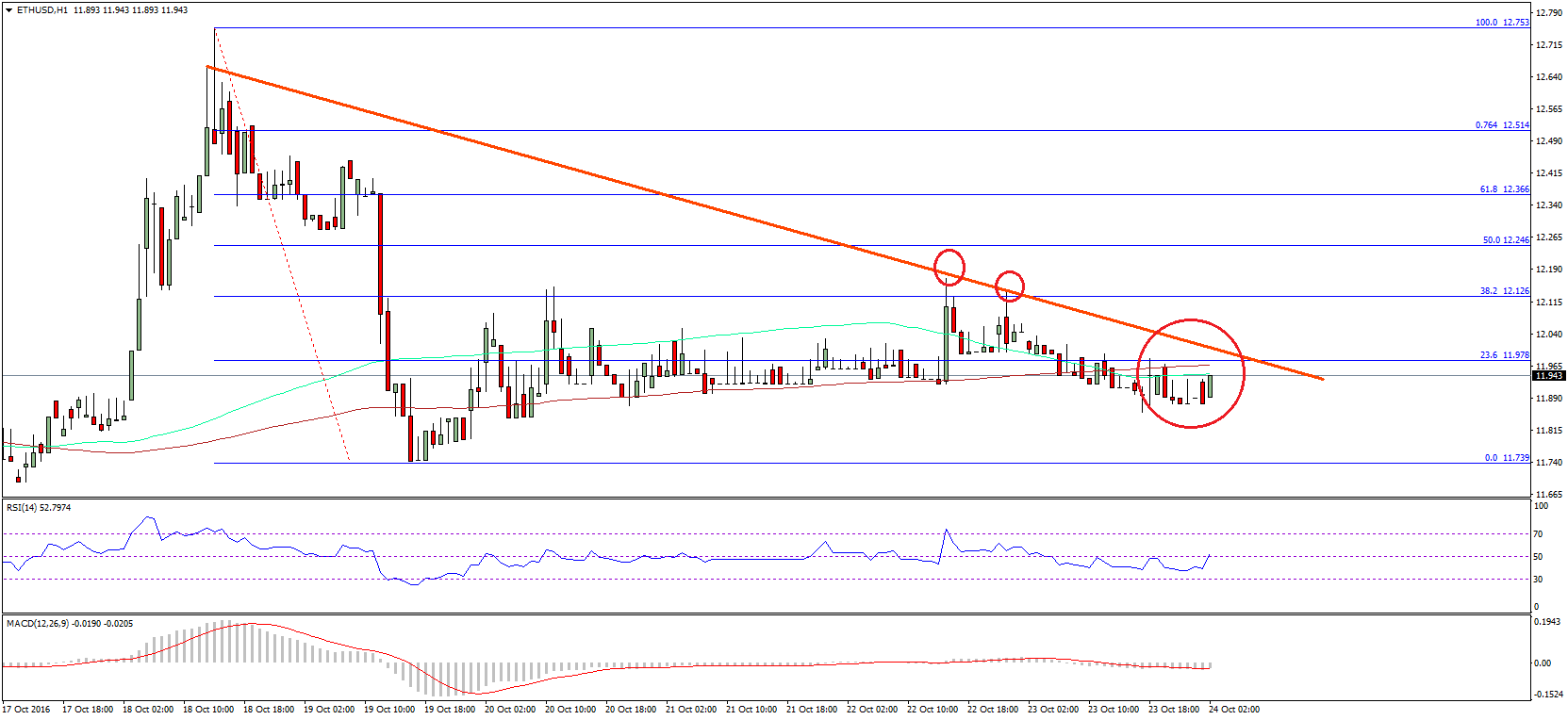

Much of the belief surrounding Ethereum 2.0 apropos the amount of ETH. Many Ethereum enthusiasts accept that the Beacon alternation advancement will absolutely appulse the price, potentially blame its amount to annual highs.

ETH’s amount has surged about 15% back the deployment arrangement was appear aftermost week, admitting Bitcoin’s contempo push for an best high could additionally accept contributed to the rise.

Currently, ETH trades at $450.