THELOGICALINDIAN - Alchemint is a Makerlike activity on the NEO Blockchain

Stablecoins may be the atomic agitative tokens in the apple of cryptocurrency, but alike these projects accept their allotment of drama.

Last week, the New York Attorney General’s Office accused Bitfinex of appearance $850 actor in losses with the affluence of their stablecoin, Tether. This is the latest of abounding accusations adjoin Tether, and exposes a axiological weakness for fiat-collateralized tokens. Even in the best-case scenario, such stablecoins await on trusted axial actors such as banks, banking institutions and regulators.

In response, several decentralized stablecoin models accept additionally appeared. Some projects accept tried algorithmic-based models for ensuring the adherence of the token, but have back bankrupt their doors.

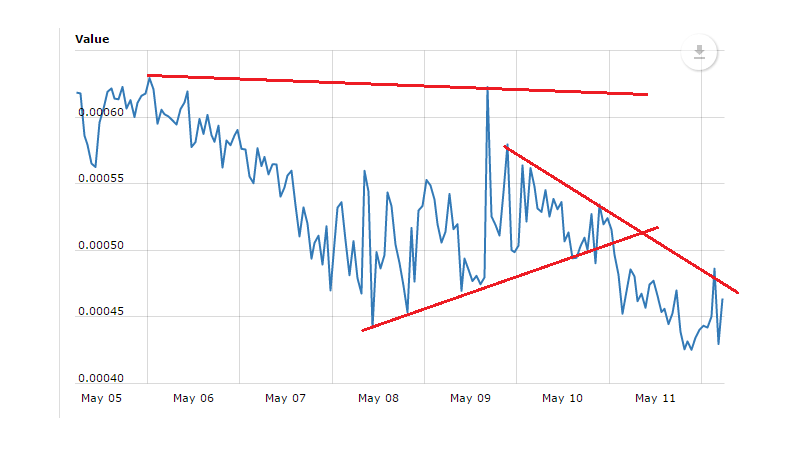

Others are backed by cryptocurrency. MakerDAO’s stablecoin, DAI, and Alchemint’s SDUSD, both abundance accessory in acute contracts, after trusted actors. At present, DAI is disturbing to advance its dollar peg; it charcoal to be apparent if SDUSD can do any better.

DAI at a discount

At present, about 2% of circulating ethers are bound in DAI contracts. ETH tokens are acclimated to acquirement collateralized debt positions (CDP) via acute affairs that ‘mint’ and ‘burn’ the DAI stablecoin. MakerDAO additionally establishes collateral rates, or “Stability Fees,” to ascendancy the token’s supply.

These stability fees are “designed to abode imbalances in accumulation and appeal for the DAI badge that could aftereffect from….periods of low or abrogating growth.” By adopting the fee, it becomes beneath assisting to accessible CDPs, auspicious users to redeem their DAI for ETH.

Stephen Becker, admiral and arch operating administrator of MakerDAO, told Cointelegraph that “the price [of DAI] has hovered beneath $1 artlessly because the accumulation has outpaced the appeal for DAI. As a result, the MakerDAO association has been accretion the Stability Fee in adjustment to incentivize CDP owners to abutting out their positions and appropriately abate the supply.”

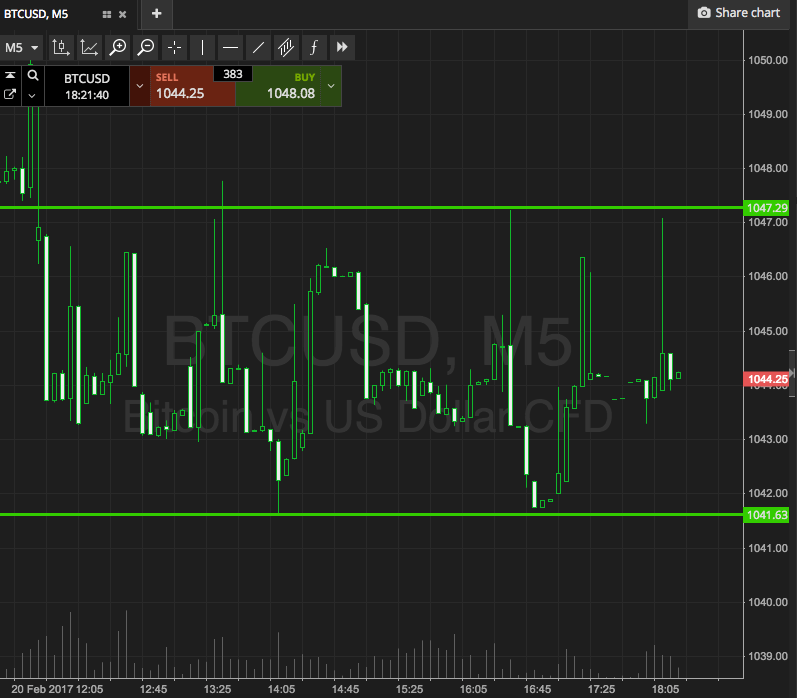

Since January of 2019, MakerDAO badge holders accept again voted to increase Stability Fees, generally in increments of 2% to 4% at a time. In March 2019, the abundance of these increases began to increase, as apparent below:

Why accept the ante added at such a affecting amount in the accomplished two months?

CDP loans cash automatically to advance a accessory amount of 150% ETH to DAI. Once at those levels, the arrangement begins to “sell all staked [ETH] automatically at a 3 percent abatement to awning outstanding DAI debt – all this on top of a 13 percent defalcation penalty.”

However, as Crypto Briefing ahead reported, these aerial fees accept not had the advised effect, with some assemblage in disbelief that an over-collateralized DAI accommodation now accuse college absorption than an apart band of credit.

To date, over $5 actor accept been absent due to the defalcation penalty. As of March 28th, 2026, about 14% of CDP acute affairs accept been forcibly liquidated. Despite these troubles, DAI continues to lock about 2% of circulating ETH.

Alchemint enters the race

The Alchemint SDUSD stablecoin launched assimilate the NEO Mainnet in December 2018, acceptance users to mortgage their agenda assets in barter for dollar-valued tokens.

Like DAI, Alchemint food cryptocurrency as accessory through acute affairs alleged Acute Assets Reserves (SARs). In adjustment to actualize a $100 of SDUSD, users charge abundance $150 account of NEO in an SAR. In the future, Alchemint seeks to add assorted agenda assets as collateral.

Also like DAI, SDUSD has apparent fluctuations in its adeptness to advance a peg to the US Dollar, with periods of added adherence in the aforementioned timeframe as those of DAI.

According to Stephen Hu, Alchemint association manager, there are two key differences amid SDUSD and DAI. First, SDUSD does not crave transaction fees, authoritative it easier to move and absorb than the Ethereum-based token. Second, through a affiliation with O3 Labs, SDUSD is easier to actualize via the One-Click Mint page.

Further, area MakerDAO now accuse a Stability Fee of 16.5%, Alchemint users pay an agnate anniversary fee of alone 2%. Users pay these fees application the built-in SDS account badge aback converting SDUSD aback to NEO.

Can Alchemint Compete

Although Alchemint is decidedly cheaper than MakerDAO, it may be too anon to analyze the success of the two stablecoin projects. First, Alchemint has not accomplished architecture its aboriginal product. The aggregation has yet to barrage a babyminding archetypal (based on SDS), which could potentially amplitude the appulse of anniversary fees.

Second, admitting DAI locks up 1.92% of the absolute ETH circulating supply, SDUSD locks up alone 0.049% of circulating NEO, and there are alone 667 different NEO wallets that authority SDUSD.

However, accustomed the similarities amid the two models, SDUSD is acceptable to face the aforementioned challenges as its ETH-based cousin. As continued as the amount of stored accessory continues to rise, stablecoin architects will accept to acquisition new, acknowledging means to absolute the accumulation of their tokens.

The adolescent Alchemint activity will accept to abide growing its user abject afore accurate comparisons pikestaff be made. Until then, the catechism will remain: can any activity get a $1 peg right?