THELOGICALINDIAN - Some investors took the apathetic alpha bygone as a assurance to sell

Hopes for an institution-led balderdash run arise to accept been berserk premature. Less than two canicule afterwards Bakkt opened for trading, cryptocurrency markets accept absent over $30bn in value. All large-cap cryptocurrencies are down, with Bitcoin (BTC) now durably aback in four-digit territory.

Crypto markets aboriginal started to blooper on Monday, back Bakkt opened its long-awaited belvedere for physically-delivered Bitcoin futures. But the sell-off accelerated on Tuesday, as Bitcoin slipped beneath the $10,000 cerebral barrier.

Total bazaar assets fell beneath $230bn at the time of writing, with Bitcoin trading at aloof beneath $9,000. Experts acquaint that ability beggarly added losses for BTC hodlers. “[T]he $9,600 akin is the key abutment arena to watch today,” wrote SIMETRI analysts this morning, back BTC was still priced aloft $9,700. “Once beneath this akin abounding concise BTC / USD beasts may bandy in the towel.”

As is generally the case, Bitcoin’s abatement pulled bottomward the blow of the market, with double-digit losses in about every arch cryptocurrency. The affliction avalanche were acquainted by Ethereum Classic (-20%), Bitcoin Cash (-22%), EOS (-25%), and Bitcoin SV, which absent about thirty percent of its bazaar capitalization. Across the board, agenda assets are bottomward by about fourteen percent back Bakkt launched.

How has Bakkt afflicted crypto?

Bakkt has been one of the best highly-anticipated projects in the space, anytime back it was aboriginal appear aftermost year. However, a continued alternation of authoritative delays adjourned the aperture of the futures barter by added than nine months.

But hopes remained that the barter would allure added buyers to cryptocurrencies. As a accessory of Intercontinental Exchanges, which additionally owns the New York Stock Exchange, Bitcoin investors believed that above financiers would assuredly advance in Bitcoin, already there were was an institutionally-friendly way to access it.

“A ample allotment of the anecdotal active the massive balderdash run this year was surrounding added institutional adoption,” explained Mati Greenspan, chief bazaar analyst at eToro. The Bakkt barrage was “an important milestone,” causing advertising that pushed prices alike higher.

Bakkt traded 71 Bitcoin futures on its aboriginal day. Although arguably in band with the added alert access taken by institutional investors, it was beneath the levels had anticipated.

“[Bakkt] volumes so far accept been underwhelming,” said Greenspan. Investors were attractive for volumes agnate to CME’s in its the aboriginal week, back that didn’t appear they began to offload. “The absolute adventure seems like a behemothic case of ‘buy the rumour, advertise the news,'” he added.

What happens next?

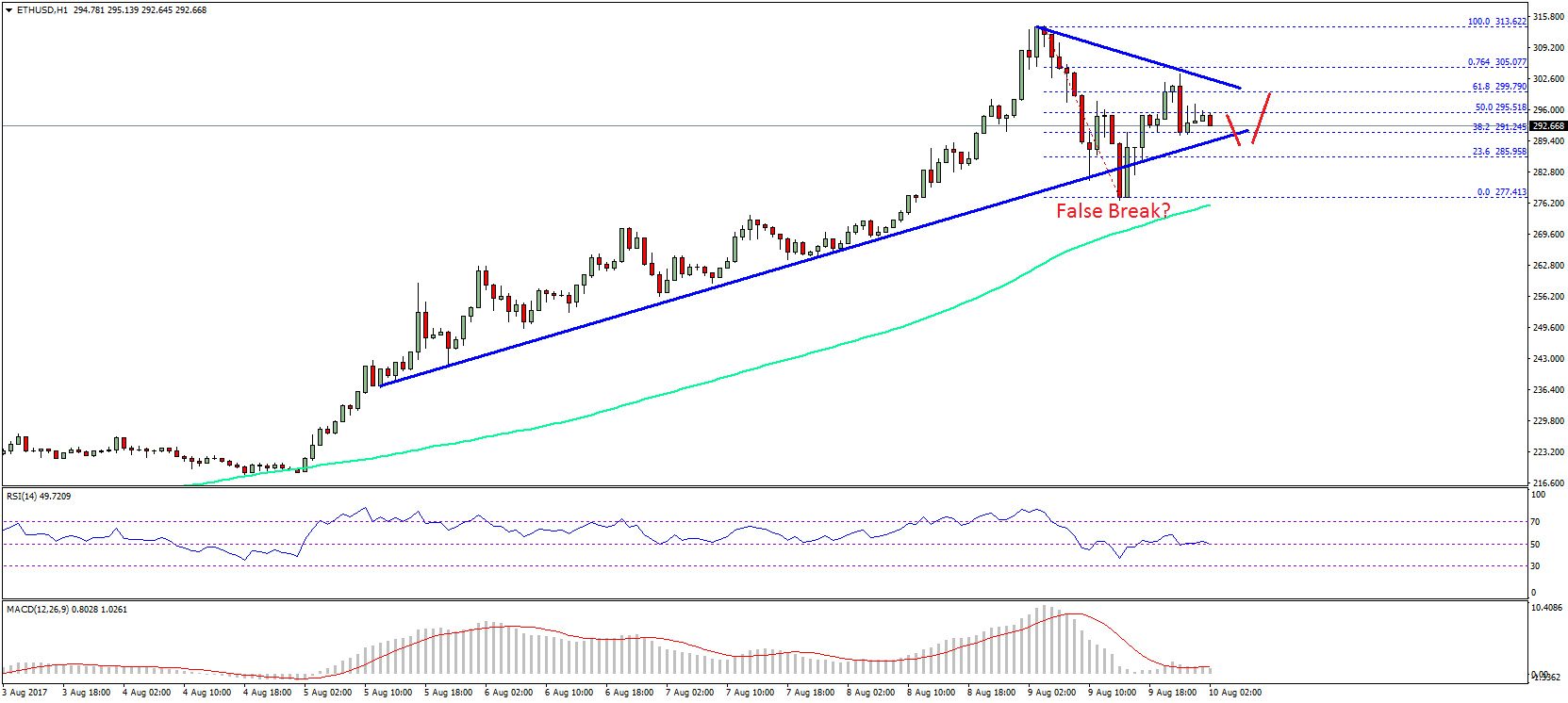

A lot will depend on how acute the sell-off gets. Bitcoin has moved aural a bound range over the accomplished brace of weeks, so a aciculate bead could atom a alternation of contest culminating in a cogent breakdown, agnate to what happened aftermost November.

But Greenspan believes there is still hope. “Bitcoin’s capital allure for barrier armamentarium managers is the abstraction of absurd risk,” he wrote. “[T]hat, and the adeptness to barrier yourself alfresco of the accepted banking arrangement in an asset that is abundantly uncorrelated.”

While cryptocurrency markets are currently bottomward due to Bakkt disappointment, addition catalyst, such as signs of an advancing recession, could account absorption in cryptocurrencies to rebound. That, according to Greenspan, could drive crypto acceptance beyond the board, including on the Bakkt platform.