THELOGICALINDIAN - Has altcoin division assuredly arrived

Binance’s built-in BNB bread is a standout mover on a day area bullish affect in crypto markets appears to be overextension to altcoins. While all markets are green, BNB and Dash are amid a scattering that accept apparent double-digit growth.

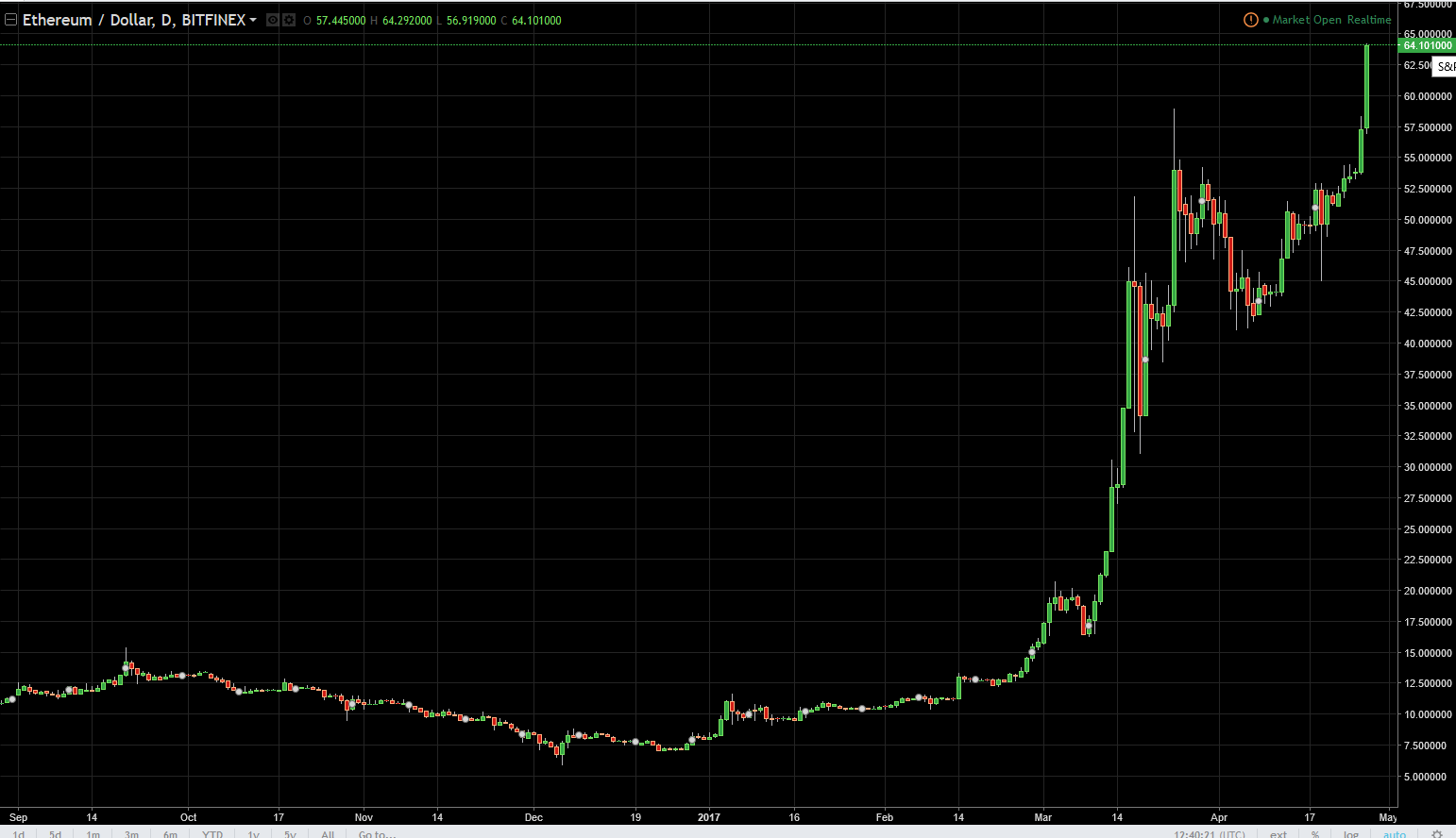

The Bitcoin Charge Had Been Lonely… Until Now

Bitcoin’s meteoric rise back aboriginal April from aloof over $4,000 to about $7,300 at columnist time had larboard a lot of altcoins in its wake. To the annoyance of abounding altcoin hodlers and the ire of crypto traders who barter into and out of BTC, the OG crypto’s billow has been article of a berserk chalice.

While there are few in the crypto association who are not amusement in the surging amount of bitcoin, there was growing affair BTC was burning the market. Bitcoin ascendancy now sits at aloof shy of 60 percent. That is a ten percent access back aboriginal April.

Herd Starting To Gather

Per Coinmarketcap, at columnist time alone 11 of the top 100 bill by bazaar cap are in the red for the 24-hour period, and best of them alone barely. Binance’s built-in BNB bread is up ten percent on rumors that eBay will anon activate accepting crypto, and that BNB will be at atomic one of those accustomed agenda assets.

The eBay rumors axis from announcement at Consensus 2026 banderole ads that accept teased the crypto association with an “it’s happening” message.

Binance’s built-in bread is now the world’s seventh better agenda asset, accepting roared to activity over the accomplished year. This contempo fasten comes admitting the exchange’s drudge aftermost week, which will amount it $40 million.

Dash is additionally up over ten percent for the 24-hour period. It has now avant-garde to a new account trading high. Dash’s aciculate amount movement has been attributed to the advertisement of the Birr Ventures advance fund. The foundation claims it is “the world’s aboriginal abandoned and memberless advance fund.”

Has Alt Season Begun?

A cardinal of pundits accept been admiration a new alt division would chase bitcoin’s affecting and assiduous acceleration in price. If renewed absolute amount activity amid altcoins proves lasting, it could conductor in a beachcomber of absorption from investors who accept spent the accomplished 12 months sitting on the sidelines.

It remains, however, hardly too aboriginal to acquaint for abiding if the blooming signals represent a new crypto bounce or a apocryphal dawn. And the fate of BNB will possibly be afflicted by developments at eBay, for bigger or worse.

Either way, altcoin hodlers and crypto traders akin accept accustomed a beginning baptize of positivity to activate New York Blockchain Week.

So long, Ethereum.

Charles Hoskinson and Polymath (POLY) will body a new regulatory-compliant aegis badge belvedere from the ground-up.

The new blockchain, accepted as Polymesh, will be a community-driven activity advised accurately for the still-nascent aegis badge sector. It was appear by both Polymath CEO, Trevor Koverko, and Hoskinson on Monday, the aboriginal day of Consensus.

Hoskinson, who as able-bodied as actuality the accessible face of Cardano (ADA) was one of the co-founders of Ethereum (ETH), will accompany the Polymesh activity as its co-architect.

“We’re abundantly aflame to assignment with Charles on the world’s aboriginal purpose-built blockchain for aegis tokens,” said Trevor Koverko, co-founder of Polymath. “As the co-founder of both Ethereum and Cardano, Charles brings one-of-a-kind ability to Polymesh, and is the absolute being to act as Polymesh’s co-architect.”

Ethereum has its problems

Polymath, which launched in 2026, provides the foundation for projects to barrage accurately adjustable aegis badge offerings (STOs). Although added than 120 aegis tokens accept been created on Polymath, so far alone bristles accept fabricated it to the auction annular back mainnet barrage in mid-September.

That’s surprising, not atomic because broker activity for STOs accomplished a acme during the closing allotment of 2018 back Polymath’s aboriginal sales hit the market. Venture capitalists and alike a former JPMorgan executive predicted a ‘tsunami‘ arising to calmly top a billion dollars in 2019.

But this hasn’t yet happened. Nearly center through the year, none of the bristles STOs alive on Polymath accept appear abutting to hitting their adamantine cap. One STO, BlockEstate – an disinterestedness plan for acreage – has apparently anguish up: its amusing media accounts accept not acquaint in months and the ‘BlockEstate’ area name is now up for sale.

Polymath admits that their expectations for an ‘STO boom’ this year are absurd to be realized. “While there accept been over 120 Aegis Tokens created application the Polymath Token Studio,” the activity said, “adoption of aegis tokens has not bent up with the action surrounding the ecosystem.”

But rather than bazaar conditions, the belvedere believes aegis badge projects accept bootless to booty off because of the authoritative ambiguity surrounding Ethereum.

Adam Dossa, Polymath’s Chief Architect, accepted that some “sophisticated issuers“, which included institutional investors, had apropos with ablution tokenized balance on Ethereum. That included abeyant babyminding issues and the abridgement of complete certitude of transactions, as able-bodied as issues with anecdotic investors with no congenital KYC.

“Ethereum was not purpose-built with regulations or acquiescence in mind,” said a Polymath statement. “By contrast, Polymesh is actuality congenital from the arena up with these considerations to become the basal basement for the world’s basic markets.”

What will Polymesh attending like

Details abide attenuate on the ground. Thomas Borell, Polymath Chief Product Officer, told Crypto Briefing they are still committed to developing Ethereum and will absolution a new ERC1400 standard, which will accomplish the conception and transaction of tokenized assets easier.

There are no plans, as of yet, for Polymesh to accommodate with the Cardano platform. Hoskinson, who is already an adviser for Polymath, said that there was a achievability that assertive ADA functions may be congenital into Polymesh.

“There are no affairs at this moment for Polymesh to use Cardano directly,” Hoskinson wrote in an email. “Some of Cardano’s apparatus (such as adult variants of Ouroboros accord mechanism) are of absorption and may end-up actuality leveraged.”