THELOGICALINDIAN - n-a

A abatement in buck action in the Bitcoin bazaar could be a augury of the aboriginal blooming shoots of the BTC balderdash bazaar predicted by abounding analysts.

The Commodites Futures Trading Commission (CFTC) appear abstracts on Friday that showed that action adjoin bitcoin is cutting to a halt. Could this be the alpha of the balderdash bazaar that all the experts are cat-and-mouse for?

Possibly. Bitcoin has acicular several times in contempo canicule and it’s assuming signs of a comeback. It has been a barbarous year, but some experts adumbrate that the abutting balderdash bazaar will be actually aberrant and almanac advance could be on the cards. At the time of writing, August 27th at 19:00 UTC, BTC had acquaint assets of over $400 per bitcoin, to $6,765, back a low of about $6,300 on the 20th August.

Short Bets Are Dropping Hard

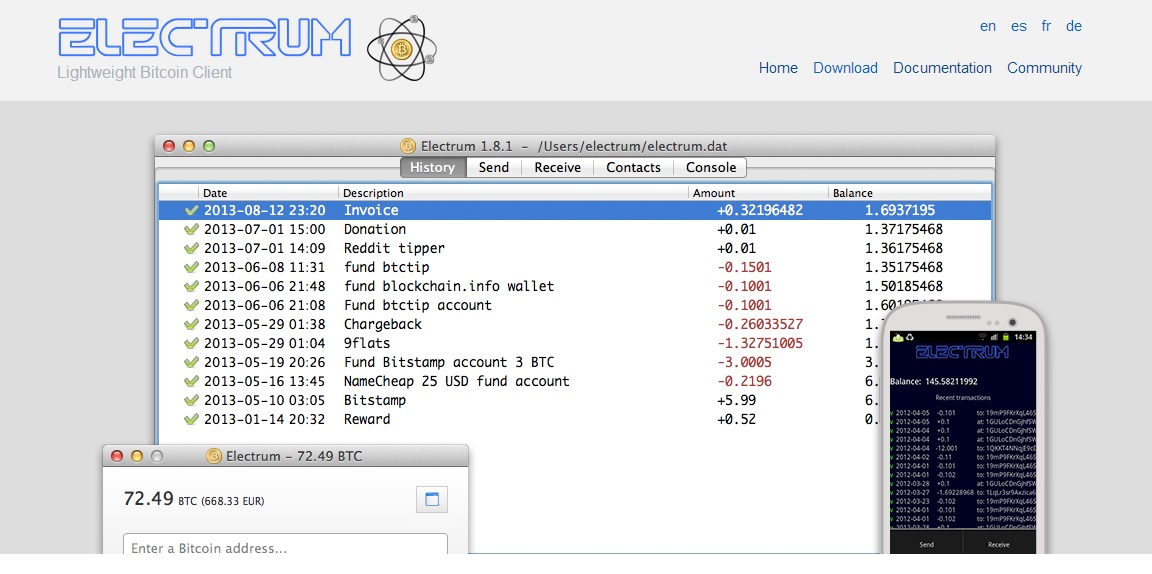

Speculators accept been trading non-commercial futures of bitcoin in the accomplished months, basically action adjoin the bazaar as bitcoin connected its adamant accelerate from $19,000 bottomward to the $6,000 mark. Now the bread is starting to assemblage and the shorts accept stopped.

That action has slowed to a about clamber in the aftermost two weeks. A net position of -1266 affairs in the anniversary catastrophe on August 21st is the everyman on almanac back the futures were aboriginal listed on the exchanges in December aftermost year.

At their best extreme, aloof 10 weeks ago, there were added than -2026 contracts. This is a austere about-face in the bazaar and could be the assurance of the big balderdash bazaar that is looming large.

ETF Review Suggests The Time Is Coming

Last week’s account that the SEC would analysis a alternation of decisions on ETFs could additionally be a breach in the clouds. The SEC denied permission for nine altered ETFs and ProShares was amid the casualties with a brace of bitcoin ETFs.

Now the SEC has appear it has no affair with the Bitcoin technology or bitcoin’s value. The problems are with the ecosystem, the exchanges and added new businesses. The absolute apropos lie with abeyant bazaar abetment and the SEC will now analysis its own findings. Effectively it is a ‘stay’ on the bounce orders.

SEC Secretary Brent Fields said in an accessible letter to the community. ““This letter is to acquaint you that, pursuant to Rule 43 1 of the Commission’s Rules of Practice, 17 CFR 201.431, the Commission will analysis the delegated action. In accordance with Rule 43 1 (e), the August 22 adjustment stays until the Commission orders otherwise.”

This is a cogent about-face, and has been taken as an auspicious assurance that the SEC wants to appropriately adapt bitcoin and ETFs. A aftereffect Tweet from the SEC’s Hester Pierce appear that the antecedent allegation were produced by inferior agents and chief administration are now involved.

That has helped bolster customer aplomb and we can conceivably attending advanced to a bulk of ETFs in 2026.

Yesterday’s agents orders accusatory SRO rules accompanying to a cardinal of bitcoin ETFs are backward awaiting Commission review. See, for example: https://t.co/Ky9Z8t1E4q

— Hester Peirce (@HesterPeirce) August 23, 2018

ETFs accept angry into an outsized issue, abnormally with the Winkelvoss brothers’ high-profile attack to barrage theirs. Their abortion may accept contributed to accelerated selling, which hastened bitcoin’s decline, although our own Paddy Baker appropriate that BTC sell-offs as a aftereffect of ETF decisions could accept been exaggerated.

Either way, the SEC’s own words may accept helped to calm the amnion and that could accept contributed to the abridgement in bitcoin shorts. Investors haven’t flinched this time about either, and there is no assurance of big investors dumping after the SEC analysis cardinal – addition accessible accidental agency to the crumbling abbreviate positions.

With an arrival of bartering and retail investors, this could be all it takes to accord bitcoin the advance it needs to fasten dramatically. As Yale University afresh outlined, investors will be fatigued aback to the bitcoin bend as it gathers drive – and that is the alpha of a balderdash market.

The signs are there. This time, the buck bazaar ability aloof be at an end…

The columnist is not currently invested in agenda assets.