THELOGICALINDIAN - The uptrend in Bitcoin has paused abreast alltime highs Onchain indicators now appearance added backbone to accumulate climbing

In November, the Bitcoin arrangement witnessed college profit-booking tendencies afterwards its amount added by 42.5%, extensive a peak amount of $19,860.

New buyers and derivatives traders accept been afraid of a bullish trend reversal. However, the advance of mining hashrate and the market’s clamminess credibility to a bullish continuation.

Bitcoin’s Supply-Side Story

Hash ribbons are a supply-side indicator developed by Charles Edwards, the architect of Capriole Investments. It plots the 30-and 60-day affective boilerplate of the network’s absolute hashrate.

This indicator is now acknowledging the complete accretion of Bitcoin’s hashrate forth with absolute drive in price, signaling a buy.

After the end of the wet season in China, the contempo miner accedence acquired a 35% bead in the hashrate. Every year, retail miners move from Southwest China to tap cheaper sources of electrical energy. The clearing of miners usually takes about a month.

Historically, affairs during miner capitulations has yielded absolute returns.

Large mining farms can authority Bitcoin during capitulations, basic an accession bandage acceptance “price to balance and again climb,” according to arch on-chain analyst Willy Woo.

BTC Exchange Flows

As the amount lingers about best highs, affair about profit-booking has kept traders on edge.

Bitcoin’s blockchain reveals earlier BTC wallets affective tokens to advertise at the attrition abreast the best high.

The cardinal of bread canicule destroyed (CDD) is a metric that measures old wallets’ movement. CDD measures the bulk of BTC confused in affairs and the cardinal of canicule back it confused last. The movement of Bitcoin from old addresses or ample amount affairs pushes this metric up.

In November, the account sum accomplished an 18-month high, signaling profit-booking by holders.

Nevertheless, the allotment of BTC spends from addresses that haven’t confused their BTC for over a year is minuscule. It alone makes up 4.1% of the all-embracing Bitcoin absorb in November.

Another Warning Signal

The Network Amount Transfer (NVT) arrangement is addition able-bodied indicator for assessing overbought or oversold bazaar conditions. It measures the absolute amount of affairs to BTC’s absolute bazaar capitalization.

A lower arrangement signals an under-priced bearings area the arrangement is administration added affairs about to its bazaar value. A college ratio, on the added hand, credibility to over-priced conditions.

Currently, the NVT represents over-priced conditions. Nevertheless, crypto analyst, David Puell, said: “NVT should be taken with a atom of salt.” He told Crypto Briefing:

“The abridgement of acceleration apparent there may be misleading. A lot of the affairs are now alive into off-chain mechanisms, and a lot of the accumulation is actuality captivated in ample entities (such as exchanges) that authority a lot of the accumulation alteration easily in the market.”

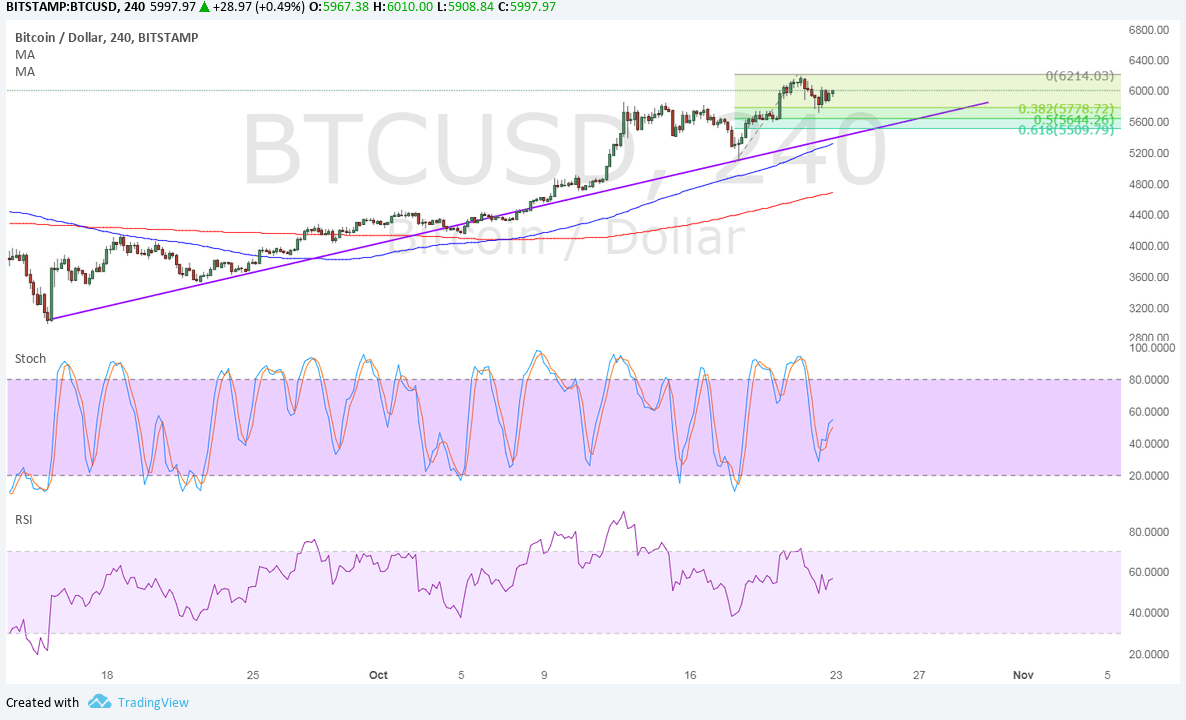

Momentum Indicator

The Spent Output Profit Ratio (SOPR) is an aquiver indicator that gauges the market’s momentum. It is computed by adding BTC’s accomplished amount by the amount it was aftermost added to an address. Virtually, the paid/purchase price.

The arrangement pivots about one, signaling bearish or bullish drive accordingly.

In an uptrend, investors are afraid to advertise at a accident or alike at break-even prices, abbreviation the affairs burden at pullbacks and blame the amount up—the SOPR trends aloft one in a balderdash market, which BTC has been in back May.

When entities absorb a ample number of Bitcoin, the SOPR arrangement annal spikes on those days.

So far, there hasn’t been a cogent fasten in that metric, suggesting that the affairs absorption is appropriately strong.

Lastly, analysts are additionally advertisement a apathetic bottomward in barter outflows, signaling concise pain. The barter outflows accept been the best approved out metric this year. More than 500,000 Bitcoin accept larboard exchanges, pointing appear a hugely absolute arresting in the long-term.

There is affirmation to appearance the bazaar sentiments are awful optimistic. The able accretion in amount afterwards the contempo pullback shows that “buy the dip” attitude is in play. At the same, the attrition at $20,000 still poses a cogent cerebral barrier.

Bitcoin is alteration easily at $18,984 at columnist time.