THELOGICALINDIAN - n-a

Bitcoin slid alike added decline this weekend, as the crypto bazaar afford a absolute $17bn in bazaar capitalization. But the problems ability be aloof the beginning, as added drops abuse to account a domino aftereffect in the incentives that accumulate mining networks running.

The crisis was aboriginal appropriate in a cheep by Colin LeMahieu, Nano’s advance developer:

“It’s not a baleful blemish admitting it is a bad user experience,” LeMahieu told Crypto Briefing in an email. “The affair comes back there are ample swings in price.” Back prices bead suddenly, he explained, affairs get slower.

The best astringent after-effects of these bottomward pressures accept yet to be felt, as mining is still assisting in countries with cheaper energy. However, that may change if prices abide to fall—and miners alpha to anguish about their ability bills.

The Mining Spiral

Here’s how falling prices could affect the fundamentals of the Bitcoin network.

Although block mining is generally admired as a cryptographic “puzzle,” it ability be bigger admired as a bold of darts, with anniversary miner throwing blindly until addition hits a bullseye and claims the prize. Every two weeks, the Bitcoin arrangement makes the ambition beyond or smaller, to ensure that addition array about every ten minutes.

These accord changes assignment adequately calmly in the continued run, but they run into agitation back there are abrupt changes in the cardinal of players—or the amount of the prize. A abrupt bead in the amount of block rewards ability account some Norwegian or Chinese dart-throwers to bead out of the game, abrogation alone a scattering of players aiming at the aforementioned tiny ambition until the abutting adversity adjustment.

But a bead in miners can admixture problems further, back it now takes fourteen or fifteen account to abundance a ten-minute block. Back the breach amid adversity adjustments is abstinent in block times, that two-week aeon could become three weeks or alike longer.

Then prices bead alike further, as Bitcoin users and merchants accord up on a bill which has inconsistent and capricious transaction times—causing added amount drops, and added miners to quit, thereby authoritative transaction times booty alike longer.

These problems aren’t aloof theoretical. The antecedent angle of Bitcoin Cash was bedridden by several hundred-minute blocks as the new arrangement struggled beneath the antecedent aerial adversity levels.

$3,000: Bitcoin’s Event Horizon

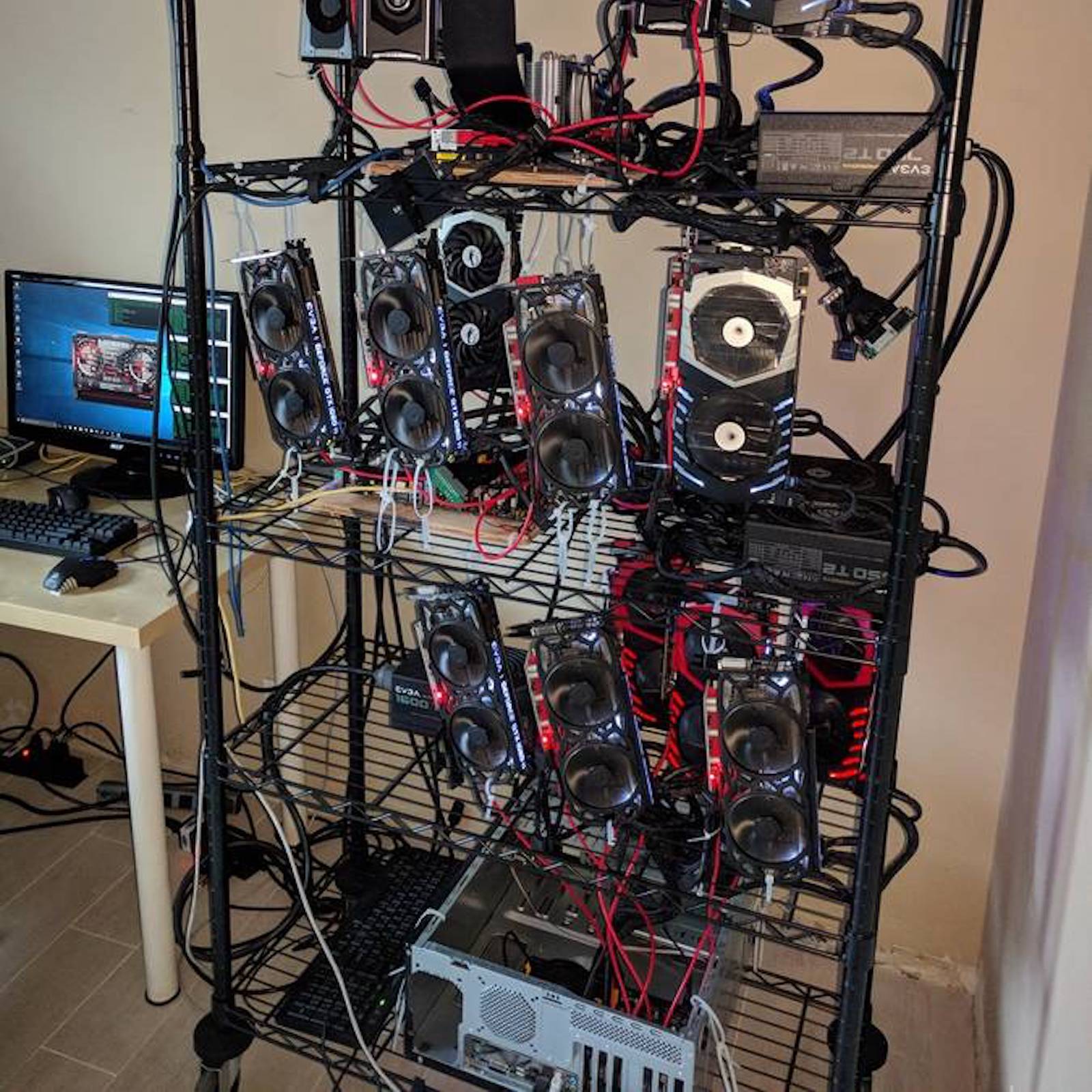

Despite the best contempo sell-off, mining is still (barely) assisting in some broad activity markets. But alike those profits are starting to thin, with letters of some mining installations affairs their ASIC accessories “by the kilo.”

The sell-offs are acceptable to abide if Bitcoin prices bore accomplished $3,000 USD – the average price of bearing one bitcoin in China, area 74% of all mining occurs.

Hashrates accept been crumbling back October, and block times consistently exceeded ten account over the accomplished ages – alike afterwards a adversity abridgement on November 17th.

What Next?

It’s not absolutely bright how far the bottomward avalanche could accompany the amount of Bitcoin. In the continued run, of course, hashing ability and adversity levels would both bore until they accomplished an equilibrium, with rewards aloof aerial abundant to sustain the actual miners.

But in the abbreviate appellation it would acceptable deepen and continue the advancing crypto recession, as the problems in the transaction arrangement highlight the uncertainties of cryptocurrency transactions. For those paid in cryptocurrency–or who await on it for cross-border remittances– it ability become added adorable to go with Western Union afterwards all.

That wouldn’t be the end of crypto, or alike of Bitcoin. But it would account absolutely a bit of hodler’s remorse, and absolve some of the skepticism adjoin cryptocurrency’s adeptness to survive as an bread-and-butter system.

It would additionally bandy a bend into the fundamentals of the network, which has alone started to advance its activity as a acquittal system. Depending on how big the bend is, the agent ability booty a continued time to fix.

The columnist is invested in Bitcoin, Bitcoin Cash, and Nano, which are mentioned in this article.