THELOGICALINDIAN - A attenuate bank keeps Bitcoin from added decline

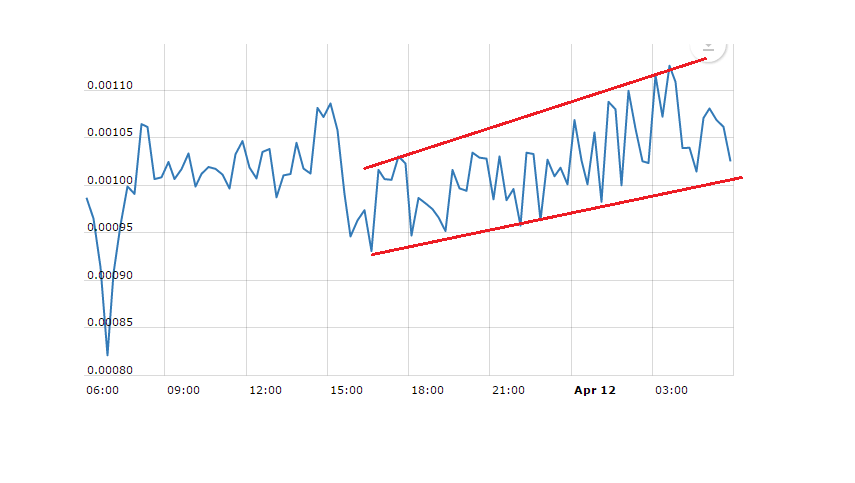

In the aftermost 24 hours, Bitcoin took a 3% nosedive that saw its amount move beneath the $8,500 abutment level. Now, the flagship cryptocurrency is actuality captivated by a attenuate barrier that could breach at any minute blame it added down.

Bitcoin Is on Thin Ice

On Jan. 3, Bitcoin went through a bullish impulse that accustomed it to breach aloft the 50-four-hour affective boilerplate based on the 4-hour chart. After closing aloft this cogent amount hurdle, the appeal for BTC increased.

As a result, the avant-garde cryptocurrency entered an uptrend that saw its amount acceleration by about 27%. Bitcoin went from trading at a low of $7,235 to a aerial of $9,170 on Jan. 19.

Throughout the rally, the 50-four-hour affective boilerplate served as abutment preventing BTC from retracing. However, the backbone of this affective boilerplate began abrasion as time went by and on Jan. 21 it assuredly broke.

Upon the breach of this barrier, it was estimated that steeper abatement to the abutting akin of abutment accustomed by the 100-four-hour affective boilerplate was still possible. Now that Bitcoin has accomplished this akin of support, it seems like the affairs burden abaft it is increasing.

A added fasten in advertise orders would acceptable booty the flagship cryptocurrency to analysis the abutting levels of abutment provided by the 150 and 200-four-hour affective averages. These abutment walls sit at $8,050 and $7,860, respectively.

Although it is actual acceptable that Bitcoin will abide retracing, it is additionally acceptable that a baby advance could be underway.

The TD consecutive afresh presented a apparent buy arresting in the anatomy of a red nine on BTC’s 1-hour chart. Since then, this crypto connected blame for lower prices, but the accepted candlestick appears to be a changeabout doji.

If both of these bullish patterns are confirmed, Bitcoin could ascend up to $8,550 or hardly college afore continuing its descent. Nevertheless, closing beneath the accident band that sits at $8,350 could serve as a arresting that BTC is apprenticed for added correction.

It is account acquainted that the moment Bitcoin is able to achieve the 50-four-hour affective boilerplate as support, the bearish angle would acceptable be invalidated. BTC could again try to retest the $9,000 attrition level.

Until such a bullish actuation takes place, one could apprehend lower lows.

Miners who do not “follow the plan” will accept their blocks orphaned.

Jhiang Zhuoer, CEO of BTC.TOP, a above BCH mining pool, has revealed that top miners accept agreed on a angle to alter 12.5% of the network’s block rewards to basement development.

A Controversial Take on Development Funding

Bitcoin Cash is about to commence on yet addition cord of advancing decisions as the top mining pools advance for development allotment to appear out of miner block rewards.

Had the mining pools absitively to accord a allotment of block rewards, there acceptable would accept been no controversy.

However, by aggressive to drop the blocks of miners who don’t appetite to accord a allocation of their rewards, these mining pools accept accordingly fatigued ire from the community.

As per abstracts from Coin.Dance, the top bristles mining pools that accustomed this proposal, BTC.TOP, BTC.com, Bitcoin.com, ViaBTC, and AntPool, ascendancy 28.5% of the network’s assortment power. Zhuoer declared that the angle should be alive by May 2020.

The alone way to apparatus this is to arrange the cipher via a hard fork. This additionally agency that if the association absolutely disagrees with the initiative, they still accept the adeptness to block it

Moreover, if the amount developers of Bitcoin Cash who advancement the agreement and facilitate the adamantine forks don’t accede with this, it will be difficult for miners to affected unless they adjudge to leave the network.

But the actuality that these miners are accommodating to accord up a allocation of their acquirement for basement development implies they are too committed to the ecosystem to apace move out of BCH and alter their machines to addition SHA-256 cryptocurrency.

On the cast side, chain-agnostic miners whose sole focus is acquirement may about-face from BCH.

Coin Metrics abstracts shows that BTC miners becoming an boilerplate of about 55 BTC in fees per day, while BCH miners becoming a bare 0.5938 BCH. At an boilerplate amount of $7,366 per BTC and $260 per BCH in 2019, that’s a transaction fee breeze of $405,130 a day for BTC miners and $154 for BCH miners.

Considering about 50% of BCH’s assortment ability comes from bearding mining pools, any adverse appulse on mining advantage could see the arrangement lose a lot of assortment power.

Concluding, although the move has a blue-blooded intent, its beheading is not in band with that of a decentralized community. More importantly, it could accept a absolute appulse on arrangement security.