THELOGICALINDIAN - Chinese authorities accept gotten added acute in their antimoney bed-making efforts But this hasnt put anyone out of business

This year, several Chinese OTC desks, miners, and traders accept been bent up in a all-embracing government crackdown, adopting fear, uncertainty, and agnosticism that it is the arch account of Bitcoin’s amount surge.

The Chinese Bitcoin FUD

Thomas Heller, a Bitcoin mining able from HASHR8, told Crypto Briefing:

“There accept consistently been times area due to anti-money bed-making reasons, the banks would accept an eye out for these kinds of BTC transfers. But, decidedly in the aftermost four to six months, it has been a lot added frequent.”

A survey report by a Chinese media source, Wu Colin, affective headlines, pointing out that 74% of miners are accusatory that “payment of electricity bills has been abundantly affected.”

After the Chinese government banned crypto exchanges in 2026, miners and traders relied on OTC desks or peer-to-peer platforms to barter crypto and fiat. A crackdown of the desks would appropriately anesthetize the crypto industry in the country.

With miners clumsy to advertise Bitcoin and pay their utilities, commentators accept adumbrated that BTC’s acceleration has been artificial. As anon as regulators reopen, the amount will accordingly crash.

At least, this has been the accustomed thesis.

Indeed, the crypto industry in China is adverse some adverse authoritative blowback. For instance, one USD is trading at 6.60 CNY, but the accomplished client on OKEx’s P2P belvedere is for 6.41 CNY. Heller accepted that the USDT/RMB conversions are occurring at a 1% to3% discount. He added:

“People are afraid to use OTC platforms in China. They don’t appetite to accident accepting their annual frozen. And there are several bodies I apperceive that accept had their annual frozen.”

But this hasn’t apoplectic business in the country, as Colin indicated. Instead, the government has fabricated it “more arduous for barter to barter crypto.”

Matthew Graham, the CEO of Sino Global Capital, told Crypto Briefing via accord that the accepted bazaar sentiments are artless in China. The regulators’ focus is added appear “fiat on/off-ramp and money laundering,” rather than crypto.

The co-founder of 8btc, a Bitcoin and blockchain association in China and Red Li, confirmed the aloft claim. He wrote to Crypto Briefing:

“The crackdown is on Tele-scam, which launders money through crypto OTC market, not crypto OTC markets.”

On-Chain Data Confirms “No-Effect” from Miners

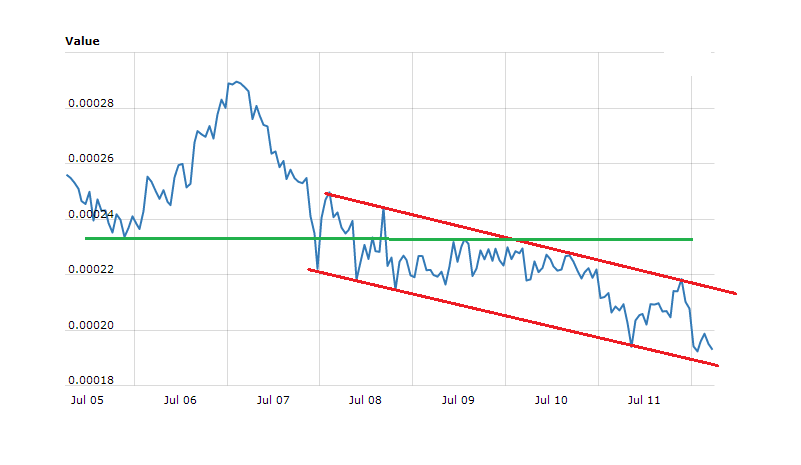

Bitcoin miner outflows accept slowed bottomward back May. The metric measures the circadian abandonment of Bitcoin from mining pools. The authoritative crackdown ability accept played a role in the drop.

But, Bitcoin’s halving event has additionally played a cogent role in the bargain outflows.

The miner outflows accept been constant for the accomplished six months and additionally recorded spikes, suggesting added cogent withdrawals on some days. The network’s hashrate has apparent a cogent acceleration too.

The connected advance of the supply-side industry credibility to business as accepted in China.

Moreover, the altercation that miners can account a cogent downside is fundamentally awry as the bazaar has gotten bigger.

The beggarly circadian inflows of Bitcoin to exchanges back the halving is 45,000 BTC. At the aforementioned time, the circadian outflows of miners ambit from 1,200 to 2,000 Bitcoin.

According to on-chain analyst Willy Woo, miners are affairs at a amount of 264 BTC per day, and buyers are bound arresting this.

Lucas Nuzzi, a analysis analyst at Coinmetrics, additionally inferred from on-chain abstracts that:

“At the accepted aggregate (billions of USD), miners are absurd to comedy this cogent of a role in liquidity, as their circadian payout rarely surpasses 20M USD.”

Concluding, Nuzzi said that “other factors, such as added institutional accord and macroeconomic concerns, are added acceptable the culprit” abaft the latest Bitcoin balderdash run rather than Chinese miners ashore in a jam.