THELOGICALINDIAN - Bitcoin is starting to aching the all-around amount hypothesis of gold alike the US dollar

According to one analyst, the U.S. government will “regulate the hell out of Bitcoin” if it starts to see the $BTC as a blackmail to the dollar.

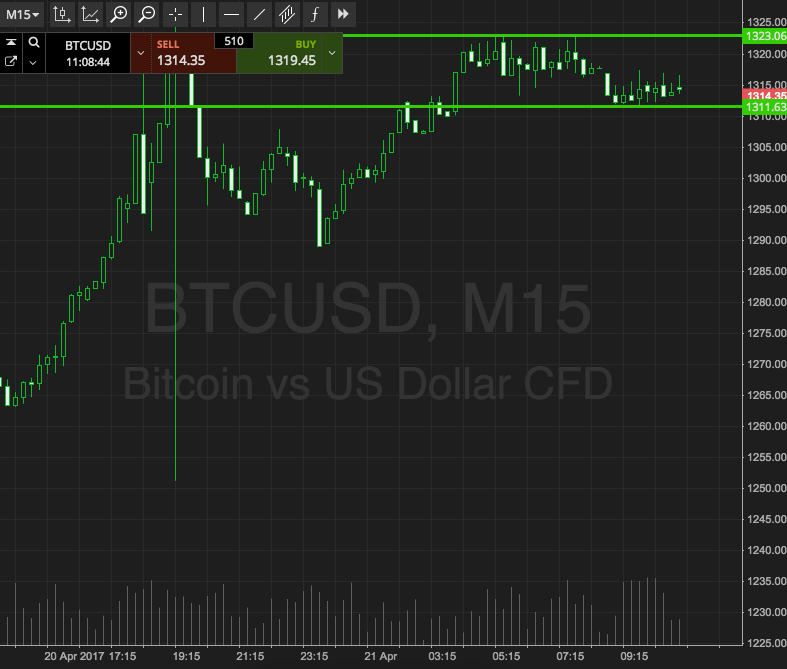

However, the faster companies and abundance managers adopt, the added difficult it will become for the government to intervene.

Bitcoin Eats Into Gold ETF Market Share

In hindsight, Elon Musk’s constant tweets about Dogecoin may accept been a adumbration about Tesla’s BTC purchase. Now, while Bitcoin enthusiasts anticipate the abutting cogent accumulated investment, the about-face of banknote balances to BTC may accept added cogent implications than its hypothesis as an inflationary hedge.

Bitcoin and gold accept followed a abrogating alternation with the dollar basis back the COVID-19 crash.

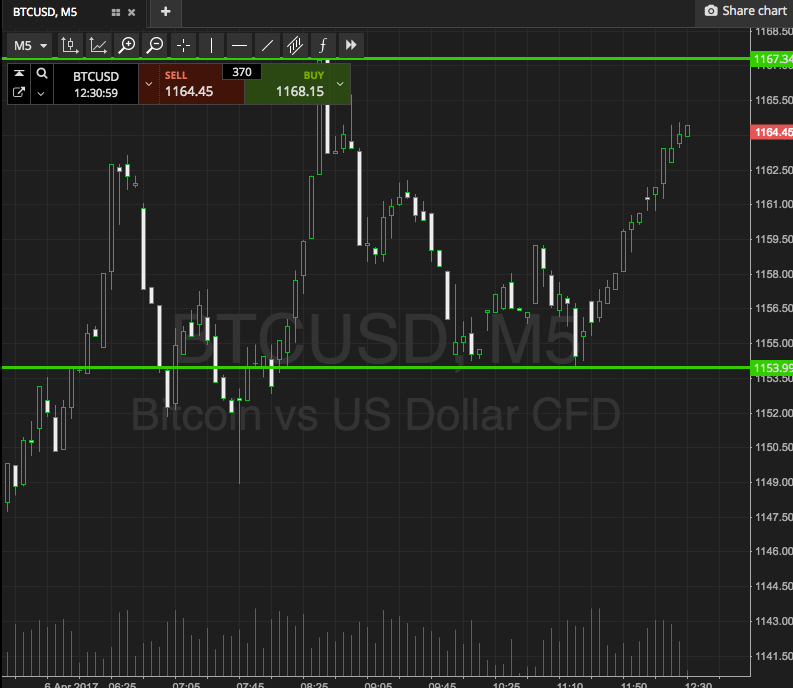

The 90-day Spearman alternation for BTC with the dollar alone to abrogating 0.36 alongside gold. Although, the downside in the greenback has advantaged Bitcoin’s acceleration added than gold.

Gold topped out at $2,075 per ounce on Aug. 7 aftermost year. Since then, BTC has acquired 320% to the aiguille of $48,200 yesterday, while gold has been in a downtrend.

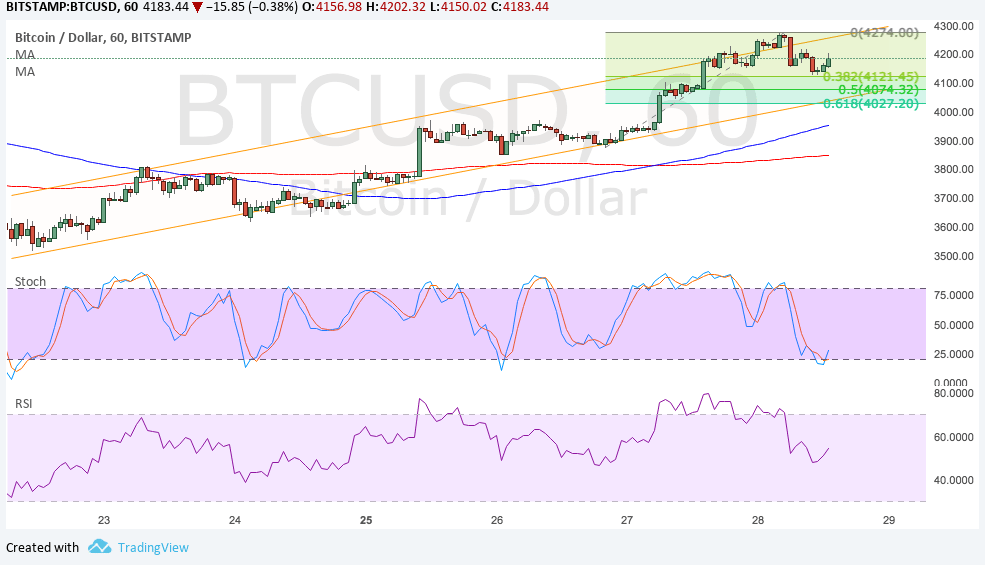

In October aftermost year, JP Morgan’s analyst begin Grayscale GBTC advance has baffled gold ETF allocation back 2019. They additionally predicted that Bitcoin’s amount could appreciate ten times back compared with gold.

Cash assets allocation to BTC, like Tesla and MicroStrategy, act as allowance for these companies.

Still, this trend is starting to aching the dollar’s value. While Bitcoin has set its sights on $50,000, the dollar basis (DXY) is aptitude appear a abrogating breakdown beneath $90.5. The bill basis adjoin aggressive assets currencies has begin abutment at $89.2 next.

If companies alpha to afford their banknote balances for BTC, the crumbling acceptance could aching USD’s amount added than inflation.

Disclosure: The columnist captivated Bitcoin at the time of press.