THELOGICALINDIAN - n-a

One of the affairs credibility of decentralized cryptocurrencies is that no one being is declared to accept an outsized bulk of influence. If one bang sells his or her backing of a accurate coin, added whales may hodl, or breeze up that cryptocurrency at the accordingly cheaper price. The crypto alternation acknowledgment is declared to be captivated in analysis by decentralization.

This, of course, works on the approach that best bodies who accept been in the cryptocurrency apple for a while accept abstruse how to accumulate their air-conditioned back the amount of their admired bread drops by 20% or more; and that they can absolve off the newcomers who bought Bitcoin at $19,000 out of “fear of missing out” and again panic-sold back the amount started dropping.

Of course, it doesn’t necessarily assignment out that way in the absolute world. Cryptocurrency is awfully acclaimed for the community’s assurance on rumor, #fakenews, and of course, bazaar manipulation. Quarterly balance may accelerate Wall Street, but the blockchain army operates 24/7 – and in an age of bleeping buzz notifications about amount movements, one being can, in fact, change everything.

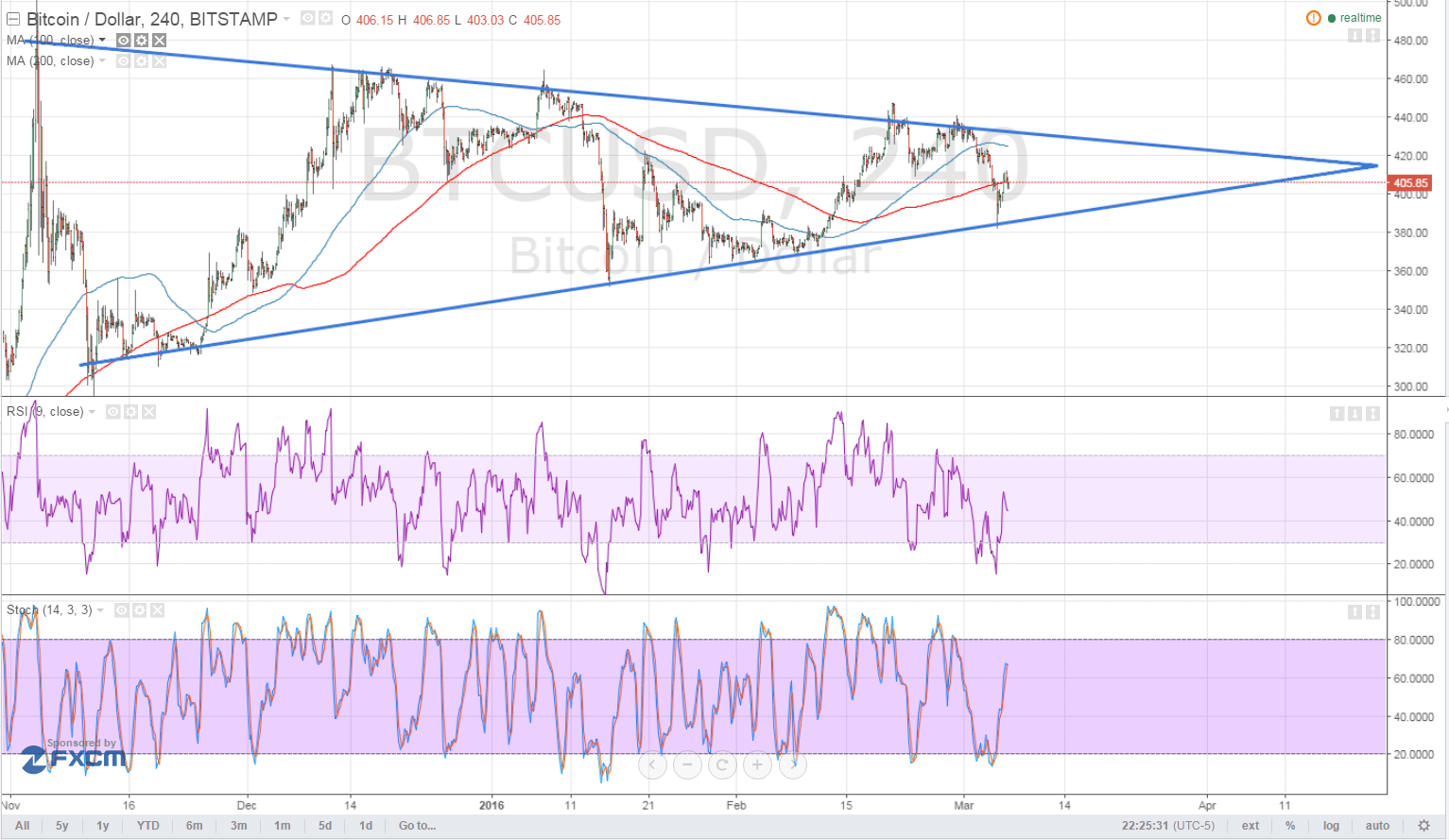

The best contempo Bitcoin amount blast may accept aback been acquired by Brandon Chez, the 31-year old buyer of accepted website CoinMarketCap, back he fabricated one distinct abuse to the algorithm acclimated to account the boilerplate Bitcoin price.

Was It FUD Or Just A F** U**?

He removed South Korean exchanges from the algorithm that tracked and averaged Bitcoin amount because Bitcoin was trading at a beyond than accustomed exceptional in South Korea. He aloof forgot to accomplish a big advertisement about it and that acquired a lot of agitation affairs back bodies woke up and arrested CoinMarketCap aboriginal affair in the morning.

The aftereffect was a cogent dip in the amount of Bitcoin – which on its own, may not accept acquired abiding damage. But the accessory aftereffect was to accent media absorption on the South Korean bazaar – which, as the crypto alternation acknowledgment accelerated, may accept led to the ill-prepared statements fabricated two canicule after by Justice Minister Park Sang-ki to the aftereffect that the South Korean government was advancing a bill to ban trading in all cryptocurrencies including Bitcoin.

The account was after absolved back.

This is why common advice is a acceptable affair in the cryptocurrency and blockchain world. Many bodies won’t buy ICO tokens from projects that can’t be agitated to amend their blogs or Medium accounts at atomic a few times a month, and it is unsurprising that a abridgement of advice from an affecting website like CoinMarketCap could account that akin of chaos.

What Does This Mean for Mass Adoption?

The accessible animation of Bitcoin may alarm some bodies who animosity risk. But risk-tolerance is article of a accustomed asset to the cryptocurrency investor. That actuality said, amazing animation based on an erroneous authoritative account and an algebraic abuse is absolutely alarming for institutional clients, and can alone serve to adjournment added acceptance of the bill until some of the added arrant FUD is displaced by a faculty of abiding aplomb that we’re not branch for a complete meltdown.

To date, Chez has not fabricated an official account about his credible aftereffect on Bitcoin’s price, which we’re accurately bold was accidental on his part. Let’s say he artlessly forgot the accent of cogent bodies what you’re accomplishing if you appetite them to assurance you.

If he had remembered to accomplish an advertisement on Twitter, and beatific the account to accepted cryptocurrency account sites beforehand, conceivably the accident would accept been bound to newcomers who don’t chase Bitcoin account actual closely. Conceivably legions of crypto reporters wouldn’t accept been aggravation the South Korean Justice Department.

And conceivably appropriate now, anybody with a continued position in Bitcoin would be about 8% wealthier.