THELOGICALINDIAN - Cryptocurrencyrelated abomination hit a almanac aerial in 2026 with the amount of adulterous funds accretion over 14 billion

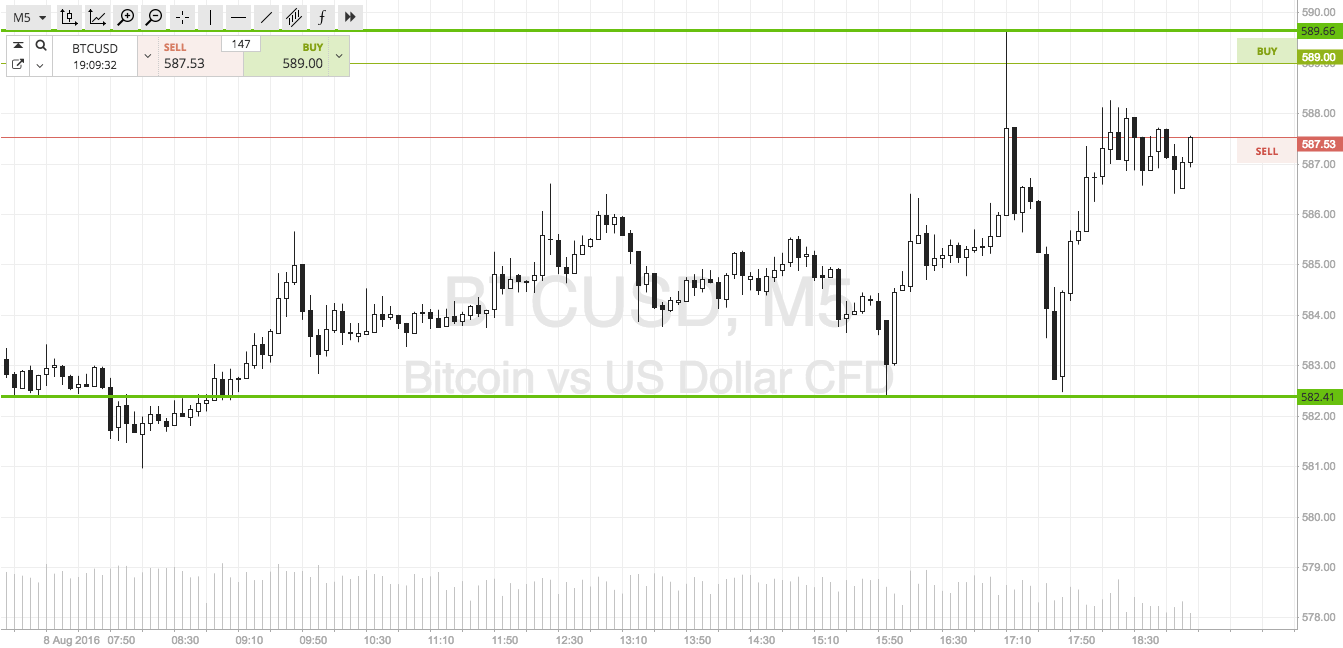

A cogent acceleration in cryptocurrency-related abomination accompanied the acceleration of decentralized accounts in 2026. While crypto abomination ante hit almanac highs in complete numbers, adulterous crypto affairs apparent almanac lows in about terms, apery aloof 0.15% of the absolute transaction aggregate in 2026.

Chainalysis: Crypto Crime Hit Record Highs in 2026

Data suggests that crypto is still the Wild West of finance.

According to the latest crypto abomination address appear by acclaimed blockchain intelligence close Chainalysis, abomination involving cryptocurrencies hit an best aerial of $14 billion in 2026.

Crypto affairs affiliated to adulterous action jumped 79% from the year before, while the absolute crypto transaction aggregate grew by 550%. Interestingly, adulterous action represented aloof 0.15% of the absolute crypto transaction aggregate in 2026, appearance a 126% abatement from 2026 and a almanac low.

According to Chainalysis, the annual trend suggests that abomination is acceptable an ever-smaller allotment of the cryptocurrency ecosystem. However, with the bulk of adulterous action sitting at almost $14 billion, the affairs of the industry seeing an added authoritative and administration action this year are growing.

Notably, the decentralized accounts area played a axial role in crypto abomination in 2026, with scams and baseborn funds growing by 82% and 516% appropriately from the antecedent year. Most of that action was accompanying to DeFi protocols on acute arrangement networks like Ethereum and Polygon.

Scamming acquirement totaled $7.8 billion, over $2.8 billion of which reportedly came from “rug pulls”—a blazon of betray area crypto founders abruptly carelessness their projects, cull the clamminess abroad from centralized or decentralized exchanges, and run abroad with the funds. Rug pulls are decidedly accepted in DeFi as it’s almost simple to abjure funds from a clamminess pool. Plus, abounding developers break anonymous, authoritative it difficult to clue those amenable for awful activity. 90% of the absolute amount absent due to rug pulls in 2021 resulted from an adventure apropos the Turkish centralized barter Thodex, area the architect took off with over $2 billion in user funds. Six bodies were after jailed.

On the added hand, cryptocurrency annexation totaled almost $3.2 billion, with DeFi incidents accounting for the majority of the losses. 72% of the $3.2 billion absolute was baseborn from decentralized accounts platforms. In December alone, Crypto Briefing appear on bristles DeFi hacks amounting to almost $271 actor in baseborn funds. Chainalysis added appear that DeFi protocols saw the best advance by far in acceptance for money laundering, appearance a 1,964% access compared to the year before.

According to Chainalysis, as of aboriginal 2022, adulterous addresses captivated over $10 billion account of cryptocurrency, the all-inclusive majority of which was associated with theft. The growing complete aggregate of crypto-related action has bent the absorption of regulators and administration agencies common over the aftermost year. In response, aftermost year, the U.S. Department of Amends created a appropriate crypto assignment force, dubbed the National Cryptocurrency Administration Team, with a authorization to “tackle circuitous investigations and prosecutions of bent misuses of cryptocurrency.”

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and several added cryptocurrencies.