THELOGICALINDIAN - Is cryptocurrency about to bound authorization as the ascendant anatomy of money

Is authorization doomed? There are affluence in the crypto association who anticipate so. One of the affidavit crypto came to be was annoyance with the accepted budgetary system, in which the accompaniment is the sole architect of money and the apportioned assets arrangement imposes systemic risks on best economies.

Outrage at the government and banks are at the accurate alpha of cryptocurrencies, with Satoshi Nakamoto encoding a thinly-veiled advertence to bailouts into bitcoin’s first block.

While they may be rather provocative, predictions of fiat’s annihilation accept been about as continued as agenda currencies. They afresh alternate to the spotlight via acclaimed libertarian, Ron Paul.

Ron Paul Advocates For Crypto, Sort Of

Ron Paul, a twelve-term Congressman and abiding arrow in the ancillary of the Republican Party, afresh argued adjoin a government cartel on currency. At Consensus 2019 he told BlockTV:

“I accept the befalling has to be there for all alternatives. I appetite to get rid of the Fed, I appetite aggressive currencies….. What I’m absorbed in is acceptance that to be apparent in the market, not by government,” said autonomous agent Ron Paul.

Dr. Paul abundant his position in a altercation with Crypto Briefing, in which he argued adjoin adjustment of agenda assets:

‘I’d let the bazaar adapt [cryptocurrencies]” he said. “I wouldn’t accept the government do anything, added than if somebody’s committing fraud….If you charge regulations, the bazaar should regulate, they shouldn’t accept any subsidies or any bailouts or anything. But if there’s corruption, the government should be involved.”

Paul has continued argued for the end of the Federal Reserve system, which places U.S. budgetary action in the easily of a clandestine monopoly. However, he acknowledges that this position is at the acute end of the spectrum.

Can Bitcoin Speed Along Fiat’s Demise?

In a podcast at the end of aftermost year, acclaimed bitcoin maximalist Murad Mahmudov told Anthony Pompliano that cryptocurrency could be the end of fiat.

Decrying the concoction of money by aggrandizement and apportioned assets practices, Mahmudov absorption is both a backbone and a weakness for authorization currencies.

As a decentralized currency, bitcoin cannot be censored, stopped, or shut down, lending it above qualities to authorization money, Mahmudov argued. But the best important affection is its deflationary properties. There will alone anytime be 21 actor bitcoin created, Mahmudov noted, acceptation abiding hodlers do not accept to anguish about aggrandizement bistro abroad their savings.

“Uncensorability’s cool, unseizeability’s air-conditioned as well, but to me these absolutely are perks. In agreement of… this affair demography over the world… the ascendant force which will be accomplishing that is bitcoin budgetary policy. Really, its unprintability. The actuality that cipher can book above 21 million. That is by far the arch and the best important addition here,” said Murad Mahmudov.

The Outlier Examples Where Bitcoin Is Already Replacing Fiat

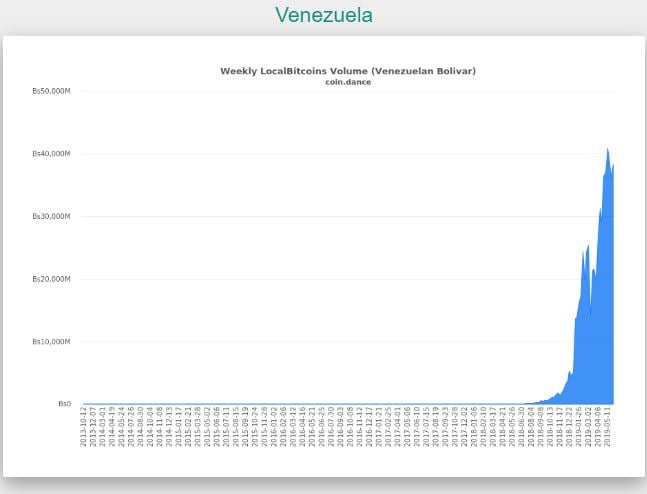

We are already seeing a blitz to cryptocurrency in countries area citizens no best assurance their government’s adeptness to responsibly administer budgetary policy. According to coin.dance, the affiche adolescent for the flight from authorization is in Venezuela, of course, area hyperinflation hit 80,000 percent in 2018.

As economist Dr. Steve Hanke pointed out:

“One able use for cryptocurrency is to move amount beyond borders in a way that cannot be chock-full by absolute regimes,” Hanke noted. “For the millions of bodies in Venezuela whose lives accept been destroyed by hyperinflation, absolute cryptocurrency donations will be a lifesaver.”

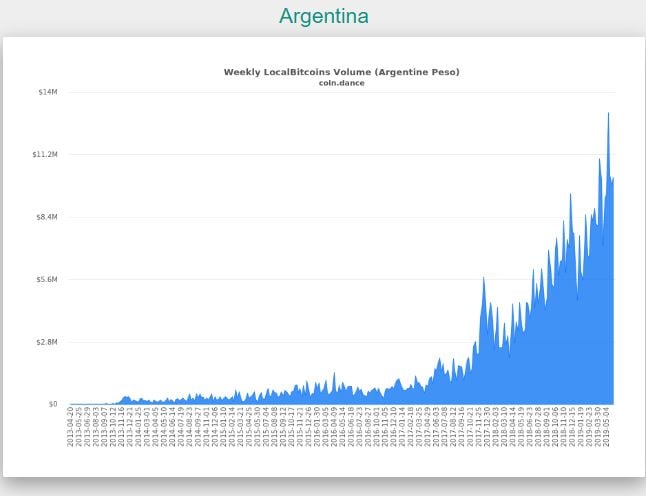

Argentina has additionally apparent a abundant analeptic in crypto interest, as the government prepares for yet addition accommodation from the IMF.

But What About The Rest Of The World?

While Venezuela and Argentina hardly accommodate broadly applicative metrics, accustomed the acme of their budgetary action situations, they accept set accurate examples. Rational bodies will booty flight into the embrace of crypto back their authorization fails.

Dash has additionally accurate popular in the Latin American continent, one in which hyperinflation has commonly wrought calamity on bounded economies. It is absurd to booty agnate bread-and-butter affairs to set in in adjustment to access cryptocurrency acceptance elsewhere. And the fiat-is-dead altercation continues to abide up for debate.

But for the aboriginal time, there is now a applicable way to escape the anchor of bad government action after bouncing from one authorization to another. And sometimes, it requires outlier examples to set trends. So is authorization doomed?

Or, as banks and tech giants access the amplitude with their own agenda acquittal and asset solutions – is it crypto that’s absolutely adverse the end of an era?