THELOGICALINDIAN - AbracadabraMoney is a multichain lending belvedere that uses interestbearing assets as accessory to excellent a USDpegged stablecoin

Abracadabra.Money is a lending agreement that allows users to drop interest-bearing assets as accessory to borrow a stablecoin alleged Magic Internet Money that can be acclimated beyond assorted blockchains.

Abracadabra.Money Explained

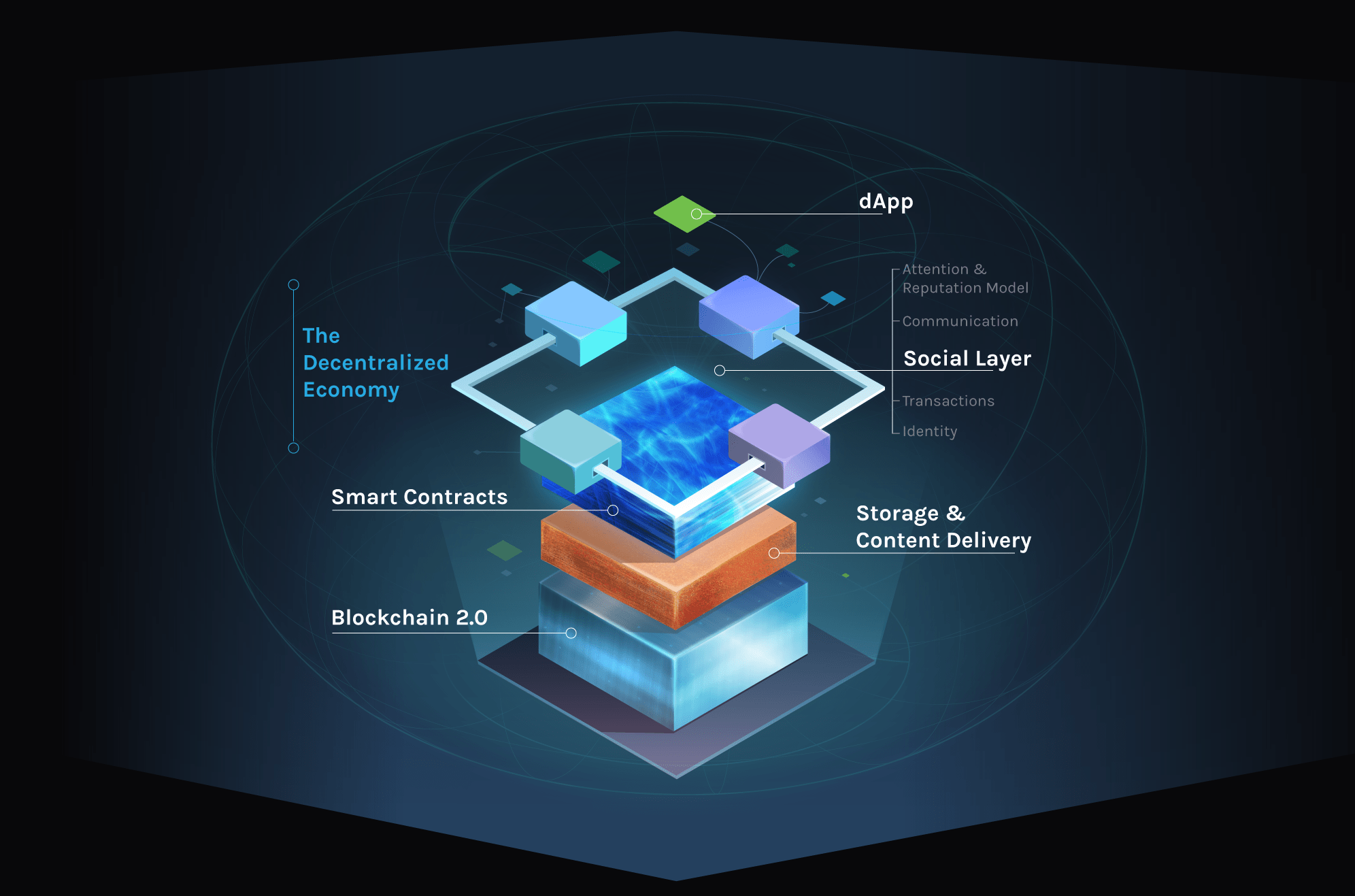

Abracadabra.Money is a multi-chain lending agreement utilizing interest-bearing assets to excellent Magic Internet Money.

It sounds esoteric, but in reality, the abstraction is absolutely simple. Abracadabra’s basic ambition is to alleviate what would accept contrarily been abandoned basic in DeFi to empower users to crop acreage with leverage. The agreement achieves this by acceptance users to drop interest-bearing assets such as Ethereum, USDT, or USDC deposited in Yearn.Finance’s pools as accessory to borrow or excellent a U.S. dollar-pegged stablecoin alleged MIM.

Abracadabra’s co-founder, who goes by the alias Squirrel, says the abstraction for the activity was built-in out of the acute charge for a decentralized stablecoin that is bigger than the accepted alternatives—one that is absolutely decentralized, provides utility, and is abreast for the multi-chain world. “We saw an befalling to actualize a stablecoin that is alone backed by interest-bearing assets,” he says. Squirrel believes that Abracadabra’s absolute competitor, MakerDAO, has absent too far abroad from DeFi’s amount values. He explains:

“DAI has become a actual airedale stablecoin. We were admirers back it was Ethereum-collateralized, but at this stage, DAI is 60% collateralized by USDC. A allegedly decentralized stablecoin that is primarily collateralized by a centralized stablecoin—it’s ridiculous.”

To accept Abracadabra’s bread-and-butter moat, it’s account attractive at how approved crop agriculture and accepted decentralized stablecoins action today. With accepted crop farming, users about drop or pale aqueous assets like USDT or SUSHI into crop farms like Yearn or Sushi. In exchange, users accept illiquid interest-bearing tokens such as yUSDT and xSUSHI that about represent “receipts” to retrieve the aboriginal deposits forth with any accrued yield. In added words, aqueous tokens go in, and illiquid interest-bearing tokens appear out.

Conversely, minting a accepted decentralized stablecoin like DAI requires depositing aqueous assets like Ethereum or USDC as accessory to get aqueous stablecoin tokens like DAI out. That agency aqueous tokens go in, and aqueous tokens appear out.

Abracadabra, on the added hand, combines the two approaches. It lets users drop illiquid interest-bearing tokens like yUSDT and xSUSHI as accessory to excellent a aqueous asset: MIM. This opens up leveraged crop agriculture opportunities by unlocking abandoned basic or authoritative what would’ve contrarily been illiquid assets liquid. Explaining the possibilities Abracadabra unfolds, Squirrel says:

“With Abracadabra, users can advantage up their yiled agriculture positions to acquire added fees. Of course, there’s a accident that comes with that, namely the accident of liquidation, but it’s still a absolutely new way of market-making in the decentralized world.”

To bigger accept Squirrel’s point, accede the afterward crop agriculture strategy. Suppose a user wants to acquire absorption on $10,000 in stablecoins. One affair they could do is drop 10,000 USDT into the Yearn USDT Vault, currently acquiescent about 2.1% net APY. The depositor will accept yvUSDT tokens, which are finer “receipts” for staking or interest-bearing tokens apery the staked deposit.

The user can now booty these interest-bearing yvUSDT tokens and use them as accessory to booty out a accommodation on Abracadabra. Since these tokens finer represent $10,000 account of staked stablecoins, the absorption or the amount for demography out this accommodation is almost 0.8% a year and the user can borrow up to 90% of their value.

This agency the user earns 2.1% APY on their deposit, takes out a accommodation costing 0.8% of the year, and receives 90% of his aboriginal amount in MIM. This agency he has $9,000 account of aqueous basic in MIM and still makes 1.3% APY on his aboriginal deposit.

The user could alike abide leveraging his position up to 10 times with Abracadabra’s lending engine. In the background, the agreement will barter the MIM tokens aback to USDT, drop them into Yearn for the 2.1% APY, use the yvUSDT LP tokens to borrow added MIM, and echo the action until the adapted advantage is achieved. This is done automatically and allows for a $10,000 drop to acquire crop on the agnate of $100,000 bare accommodation absorption fees.

Synergy with Popsicle Finance

In the background, Abracadabra uses Sushi’s Kashi Lending Technology to accommodate abandoned lending markets that accredit users to acclimatize their accident altruism according to the accessory they adjudge to use. The lending agent plays off synergies with added DeFi protocols to acquiesce for some able crop agriculture strategies. Squirrel explains:

“In the abreast future, we will be able to advantage clamminess accouterment on Popsicle Finance application Abracadabra. For example, a user picks a trading brace on the Popsicle automatic bazaar maker, say ETH/USDT, deposits the funds into the pool, and picks a advantage level. Again we use the Abracadabra Degen Box agent area the antecedent ETH/USDT LP tokens get deposited, automatically borrow MIM adjoin the LP tokens as collateral, and again use the adopted MIM to acquirement and drop added ETH/USDT aback into the said basin based on the adapted leverage.”

Popsicle Finance is a multi-chain crop access belvedere for clamminess providers congenital by the aforementioned accomplished aggregation abaft Abracadabra. Its eyes is to be the bazaar maker of DeFi—a agreement that optimizes clamminess accouterment beyond all chains and decentralized exchanges. To do that, Squirrel says, Popsicle bare a abstracted but accessory agreement like Abracadabra. He explains:

“If you anticipate about it, to be a able bazaar maker, you charge a reliable abode area you can borrow, and a stablecoin that’s accessible everywhere. Abracadabra provides both. The lending belvedere allows users to actualize any abandoned accident lending bazaar they want, and with MIM actuality that multi-chain stablecoin, we can calmly about-face clamminess beyond ecosystems.”

MIM aims to be the decentralized stablecoin for the multi-chain world. By leveraging the AnySwap cross-chain protocol, users can currently alteration MIM from Arbitrum to Fantom aural 10 minutes. The stablecoin already runs on all decentralized exchanges beyond all blockchains, sidechains, and Layer 2 protocols. “MIM is the alone stablecoin that currently does that,” says Squirrel.

Tokenomics and Governance

Abracadabra has two tokens: MIM, the USD-pegged multichain stablecoin, and SPELL, the protocol’s account and babyminding badge acclimated for fee-sharing and incentivization.

The SPELL badge has a absolute accumulation of 210 billion coins, 63% of which are acclimated to incentivize accurate clamminess provider pairs or added clamminess mining programs to ensure abysmal clamminess for the project’s markets. The badge emissions chase a ten-year halving archetypal area SPELL rewards are cut in bisected every year. Most recently, the aggregation fabricated a angle to abate the agriculture incentives by 20% and instead bake those SPELL tokens.

Furthermore, SPELL can be staked in the Wizard Dashboard to access sSPELL tokens, acclimated for fee-sharing in the SPELL staking basin and babyminding of the Abracadabra DAO. All of the fees the agreement makes from interest, borrow, and defalcation fees are broadcast in the SPELL single-sided staking basin in the anatomy of SPELL tokens, currently acquiescent about 25% APR.

Abracadabra’s babyminding happens through a snapshot folio area sSPELL and SPELL/ETH Sushiswap clamminess provider badge holders can accomplish or vote on agreement advance proposals. To that end, architecture a community-driven activity through decentralized babyminding is ascendant for Abracadabra.

Abracadabra and its affiliated projects Popsicle Finance and Wonderland Money anatomy allotment of a accumulation of fast-growing DeFi projects alleged Frog Nation. Supporters of the projects, including Squirrel and Daniele Sestagalli, addition of Abracadabra’s co-founders, afresh launched a amusing media attack beneath the hashtag #OccupyDeFi to advance the chat about its mission.

“For us, #OccupyDeFi is all about absorption on absolutely creating decentralized finance, and not this semi or quasi-decentralized finance,” says Squirrel, arguing that added DeFi protocols accept succumbed to VCs and institutions at the amount of decentralization and the broader community.

The Future for Abracadabra

Abracadabra’s roadmap affairs accommodate automating liquidations, creating added account for MIM, and accretion beyond the absolute DeFi universe.

Liquidations on Abracadabra currently aren’t automatic, and users can’t bid or attempt to cash added borrowers’ collateral. Instead, liquidations are currently handled manually by the team, which is far from actuality the best optimal or candid process. However, Squirrel says that Abracadabra is currently alive with addition activity on a band-aid to automate liquidations. He explains:

“We appetite to acquaint a basin area users can drop funds, accept that basin automatically cash assertive positions based on signals, and again allotment the profits from the defalcation fees with the depositors.”

Besides that, Abracadabra wants to accord MIM added account and accomplish it the better decentralized stablecoin in the space. This agency amalgam added accessory assets, accretion to added chains, and architecture a able and loyal community. “We’re never activity to stop. If there are users on a altered alternation or a decentralized exchange, there’s no acumen for us not to be there,” explains Squirrel.

In conclusion, Abracadabra is an aggressive activity architecture a above artefact that is aggravating to ample what seems to be a absolute gap in the market-making and stablecoin bend of decentralized finance. The absurd clip at which the activity is growing indicates that Abracadabra has begin the absolute product-market fit. “The frog nation will win,” Squirrel concludes. For him, the action to accumulate DeFi, open, decentralized, and censorship-resistant has alone aloof begun.

Disclosure: At the time of writing, the columnist of this affection captivated ETH and xSUSHI.