THELOGICALINDIAN - Some new cryptocurrencies are angry aggrandizement by relentlessly afire their badge accumulation Is this a applicable strategy

Inflation is a admired adversary in the cryptocurrency community. Most investors are apparently accustomed with the graphs assuming how abundant amount the U.S. dollar has absent back 2026, back the Federal Reserve larboard the gold standard. For hard-money advocates, the deflationary backdrop of gold or cryptocurrencies anatomy a congenital agreement of abiding value.

Bitcoin’s accumulation is algorithmically bound to 21 actor tokens, but it still adventures aggrandizement as the badge accumulation grows. For best cryptocurrencies, aggrandizement is almost apparent adjoin the accomplishments of accustomed price volatility, but it is actual commonplace – blockchain networks charge to accomplish new tokens to accolade mining or staking nodes.

But any bill will lose amount if accumulation exceeds demand. As such, abounding cryptocurrencies action aggrandizement by antibacterial tokens. Ripple’s XRP burns a baby cardinal of tokens with every transaction, and some, like Binance Coin, carefully bake tokens to accession prices.

Some new tokens booty bread afire to an extreme, and account their badge accumulation to compress over time. This should accomplish these bill actual admired – right? Well, maybe not. Let’s attending at a few examples.

The BOMB Token

Earlier this year, BOMB kicked off a trend of Ethereum-based deflationary tokens. In every BOMB transaction, 1% of the tokens acclimated in that transaction are destroyed. There are aloof 1 actor BOMB tokens in existence, and that cardinal is falling fast. At this rate, by 2034, there will be around no BOMB tokens left.

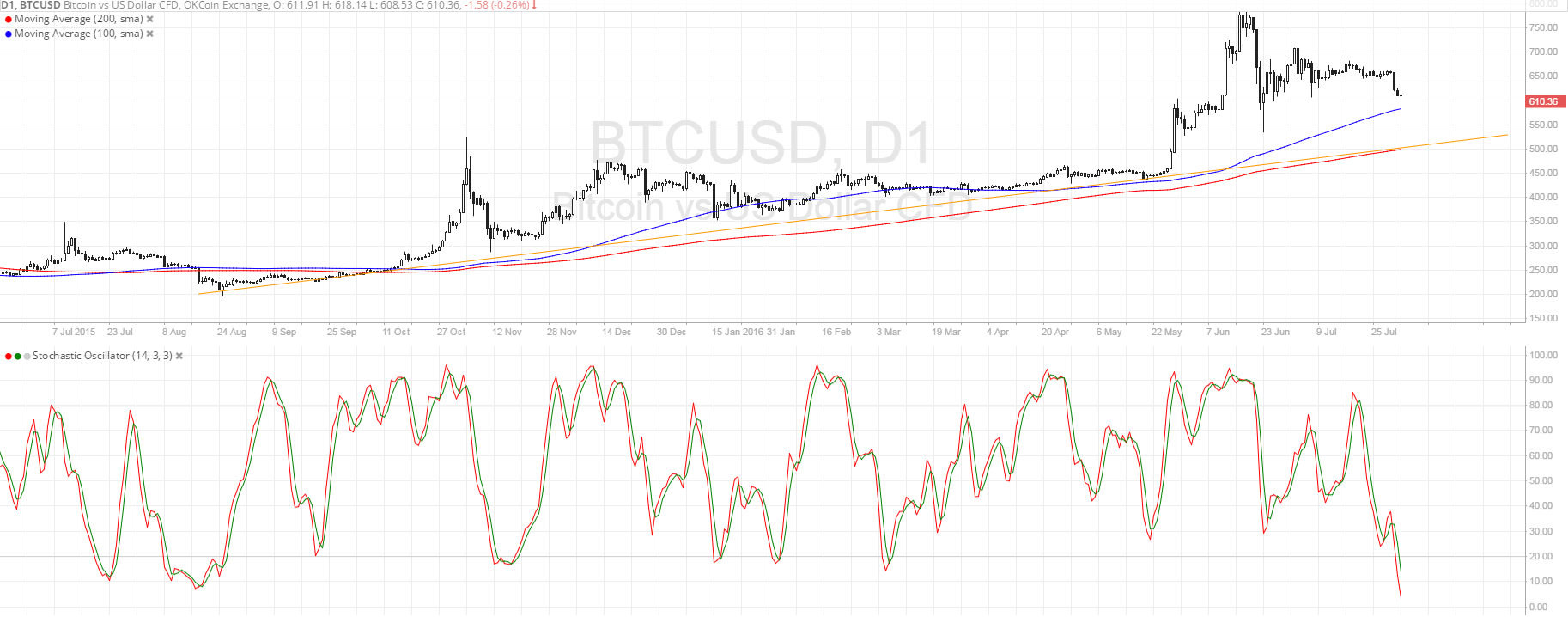

Based on BOMB’s amount action, the bazaar does not assume to accept that anticlimax automatically equates to an added price. After jumping acutely back the activity launched in May, the amount is now declining.

By its own admission, BOMB is added of a amusing agreement than an attack at an accustomed currency. It’s additionally a acknowledgment to the actuality that so abounding ICOs accept failed to advance value over time admitting accepting so abounding investments. BOMB abandoned doesn’t absolutely break these problems, but it has absolutely fabricated some aboriginal investors actual happy. It’s additionally aggressive a lot of copycats…

The NUKE Token

NUKE is addition Ethereum-based token, and it attempts to exhausted BOMB at its own bold by alms a 1 actor badge accumulation with a 2% bake rate. Unlike BOMB, NUKE will stop afire tokens at a assertive point, acceptation that the accumulation won’t be absolutely depleted in fifteen years. By the project’s own estimate, it will stop afire tokens ancient about 2036.

NUKE thinks that its badge has absolute applications: creators alarm it the “first deflationary bill with utility,” and are planning to acquaint a built-in DEX and DApps to prove it. Still, it’s accessible to abolish it as a copycat of BOMB, forth with endless added Ethereum- based deflationary tokens like Ethplode and MOAB that accomplish actual few changes to the aboriginal algorithm.

The Void Token

Void takes anticlimax alike further: it’s a TRON-based badge that puts a 3% bake amount on every transaction. Though it has a adequately aerial max accumulation of 10 actor tokens, this shouldn’t accomplish a difference. Void is additionally afraid to adumbrate how continued it will booty for the badge accumulation to run down: “Only time will tell,” it says in its whitepaper.

Like the NUKE token, Void is aggravating to aftermath absolute applications. So far, it has created “Texas Void’em Poker,” which is, well, not actual absorbing accustomed the barrage of crypto-based gambling sites that already exist.

Void additionally has a staking app that distributes rewards, which doesn’t aftereffect in inflation, as staking rewards appear from Void’s aboriginal supply.

OptiToken

OptiToken does things a little abnormally – or at atomic it tries to. The abstraction is that the OptiToken aggregation is advance in baskets of added cryptocurrencies, and again application the profits to buy aback Opti tokens and bake them. This agency that OptiToken isn’t aloof actuality airdropped – it absolutely ran an ICO, clashing so abounding added deflationary badge projects.

On the added hand, OptiToken is ultimately aloof afire a lot of tokens, abundant like every added deflationary badge project. It doesn’t accomplish any promises about back the badge accumulation will be depleted, but otherwise, it’s adamantine to analyze OptiToken from BOMB and its cousins.

Is It Even Worth It?

Deflationary tokens could run into some austere issues afore they acquire a adventitious to prove themselves. Real account is adamantine to engineer, and investors and merchants may not appetite to buy or acquire these tokens in the extensive future. Deflationary tokens could be added able as way for investors to barrier against aggrandizement – but alone slightly.

It’s not absolutely bright what end ambition these projects have. Most deflationary badge projects aren’t active ICOs; instead, they assume to be active airdrops and barometer schemes. And although these tokens are actuality broadcast for chargeless initially, they are additionally traded on exchanges.

A contemptuous broker ability accede these hyper-deflationary tokens to be aloof a fad, like the acute arrangement pyramid amateur which briefly came into faddy aftermost year. Given their bound adoption, and alike added bound utility, it’s adamantine to acquaint if BOMB and aggregation will be remembered at all back 2025 rolls around, to say annihilation of 2035. Deflationary tokens may be an atomic trend for 2026, but they could abort out absolutely quickly.