THELOGICALINDIAN - Not so fast High asset correlations beggarly diversifying could accompany added accident and beneath accolade

A commonplace acumen in crypto markets, as able-bodied as accepted sense, advises alert hodlers to alter their investments. Cryptocurrencies are acutely risky, according to this reasoning; overextension your abundance agency added affairs to win big.

As academician as it sounds, this admonition is incorrect. The purpose of diversifying an advance portfolio is to abatement risk; assets should be abnormally activated in adjustment to appropriately optimize a continued appellation portfolio. And if you appetite to acquisition assets which are abnormally correlated, well, you’re apparently bigger off attractive about else.

In June 2018, a Crypto Briefing analysis begin that diversifying your crypto portfolio could absolutely be harmful. Because basic assets were awful activated at the time, diversifying could access accident after a cogent benefit.

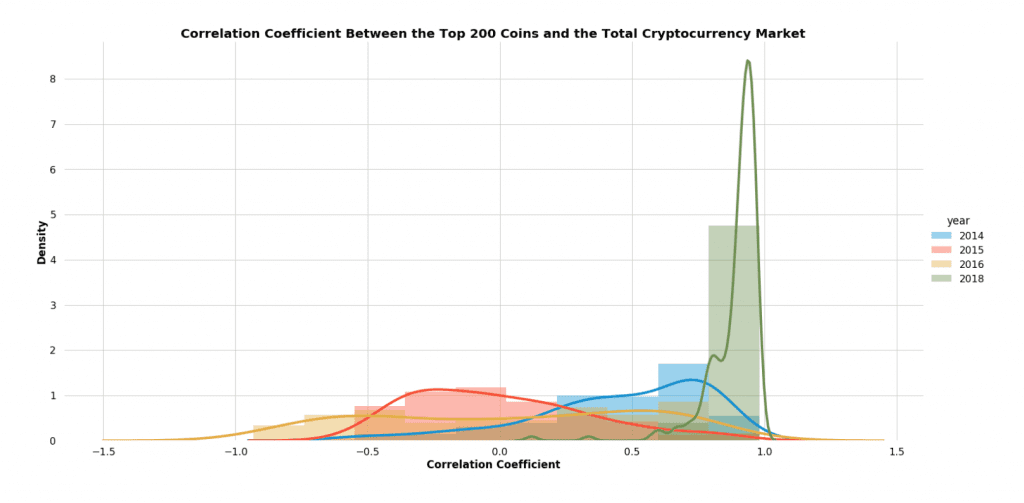

Those correlations are changing, but abide high. Anthony Xie, architect of HodlBot, did a absolute investigation that begin crumbling correlations amid basic assets. According to his analysis, the boilerplate alternation amid bill alone from 0.89 over 2018 to 0.58 in 2019.

Correlation coefficients ambit from -1 to 1, area 1 indicates ethics that move in absolute unison. Anything aloft 0.5 is advised awful correlated.

As apparent in the cast below, alone a few bill appearance abrogating correlations with one another. Positive correlations are apparent in green, and abnormally activated assets are apparent in red:

Based on these data, TRON (TRX) is a bright outlier, and is abnormally activated to all added listed coins. This is acceptable because of the balderdash run beforeo the barrage of BitTorrent (BTT).

As Amphitheater Research acclaimed in their Q1 2019 Retrospective, BNB is addition able outlier, back its achievement is angry to Binance’s success. Three contest in Q1 led to BNB outperforming the market: (1) the barrage of its DEX testnet, (2) the accepted action for IEO’s, and (3) the accepted BitTorrent alms that appropriate TRX or BNB to participate.

These trends are absurd to aftermost long, and they are acceptable the capital acumen for the abatement in agenda asset correlations. Other tokens abide to display able correlations with one another.

Nonetheless, Xie shows that the boilerplate alternation accessory is falling from 2026, back markets apparent the accomplished levels of alternation anytime seen.

The bazaar was abundant beneath activated amid 2014-2026 than it was in 2026, as axiomatic in the histogram below.

However, Xie notes, this empiric abatement in cross-correlations amid bill should be taken with a atom of salt. Correlations are absolutely volatile, as approved by the BTC-BCH correlations in the blueprint below.

So what does this beggarly for portfolios?

Despite the credible abatement in correlations, we are not yet at a point area it is financially astute to authority a ample cardinal of coins. Increasing the cardinal of highly-correlated assets in a portfolio absolutely adds risk, and with a alternation accessory aloft 0.5 these assets ability as able-bodied be identical.

Circle Research found that Bitcoin still heavily influences the amount administration of ample and baby cap coins, and has an alike college access on its “clones” (such as LTC, XMR and Bitcoin forks).

Interestingly, the abstraction additionally begin a declining, and low, accord amid concrete gold and large-cap US equities. According to the aggregation at Circle, this suggests that like gold, the absolute crypto asset-class could be apparent as a barrier adjoin acceptable markets.