THELOGICALINDIAN - ETHs amount assemblage continues and it ability be because institutions are affairs

ETH has been on a breach over contempo weeks, awfully outperforming BTC.

Ethereum: The $400 Billion Asset

The cardinal two crypto hit a new best aerial aloft $3,500 this afternoon, putting its bazaar cap at $405.5 billion. According to abstracts from Asset Dash, it’s carefully abaft JP Morgan & Chase, whose bazaar cap is currently $465.2 billion.

Ethereum has enjoyed a blemish year registering assets of 380%, but its run has agitated in the aftermost few weeks. It’s badly outpacing Bitcoin, with the arrangement amid the two assets now at 0.062. Some Ethereum admirers accept alike alleged for “The Flippening” after on this year, a academic accident that would see Ethereum beat Bitcoin in bazaar cap.

For that to appear today, the arrangement would charge to be afterpiece to 0.16, with one ETH priced at about $9,050.

Though Ethereum is some way abroad from overtaking Bitcoin, it’s currently in its arch aeon of advance back it launched in 2015. The NFT amplitude has apparent boundless boilerplate acceptance in 2021, while DeFi contains $76.73 billion in absolute amount locked, according to DeFi Pulse.

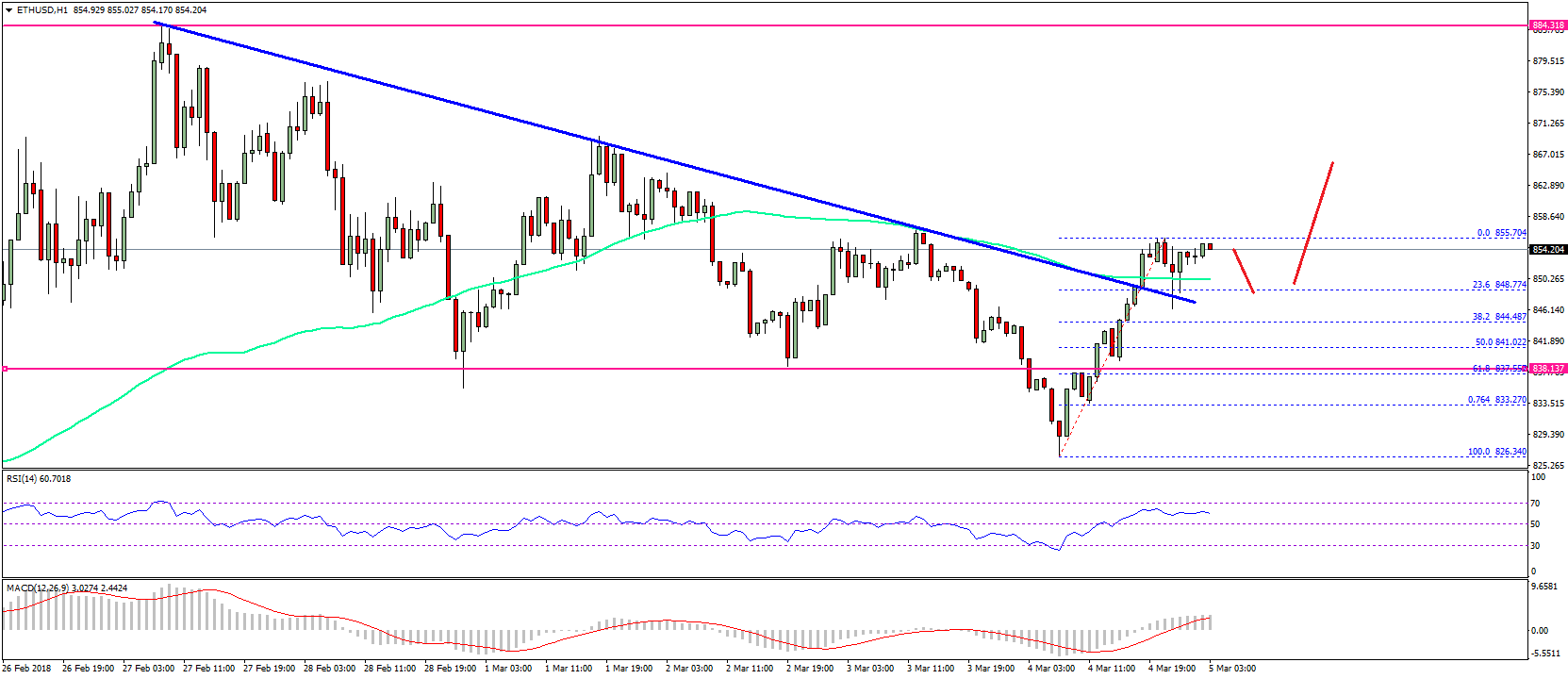

Another key agency for Ethereum’s contempo backbone is the growing absorption in ETH amid institutional investors. In a agenda blue-blooded “The Rise of The Institutional Adoption of Ethereum,” Eliézer Ndinga, a chief analysis accessory at 21Shares, acicular out that the cardinal of wallets captivation added than 10,000 ETH has decidedly added recently. He wrote:

“We are witnessing the aboriginal innings of institutional acceptance above Bitcoin with Ethereum.”

Ndinga additionally declared Ethereum as “the best affianced developer platform” for DeFi.

Several above institutions accept fabricated bright moves appear adopting Ethereum and its built-in asset in contempo weeks. Rothschild Advance Corporation afresh fabricated a $4 actor ETH investment, while the European Advance Bank has started issuing agenda bonds on Ethereum with the advice of Goldman Sachs, Banco Santander, and Société Générale. Earlier this year, CME Group, the world’s better derivatives exchange, listed ETH futures.

According to Ndinga’s note, Ethereum’s accessible move appear Proof-of-Stake will additionally account institutional adoption, back altitude risks like those associated with Proof-of-Work are “dominant capacity amidst asset managers.”

In accession to its Proof-of-Stake merge, tentatively appointed to go alive after this year, Ethereum will acquaint its EIP-1559 angle on Jul. 14. Described by EIP-1559 coordinator Tim Beiko as an “ETH buyback” proposal, the amend will access the absence of ETH by afire a allocation of the gas fee with every transaction, potentially authoritative ETH a deflationary asset.

Once EIP-1559 ships, it could conductor in a added beachcomber of institutional adoption.

Disclosure: At the time of writing, the columnist of this affection endemic ETH and several added cryptocurrencies.