THELOGICALINDIAN - Was Pompliano too acrid in the appliance of complete money standards to Ethereum

Anthony Pompliano has absolved the “ETH is money” narrative, arguing Bitcoin, and not Ethereum, is complete money. Is this a fair assessment?

Pompliano Dismisses “ETH is Money”

In his latest copy of Off The Chain, Morgan Creek Digital co-founder Anthony Pompliano has acknowledged the abstraction that Ethereum is complete money. The acclaimed crypto apostle argued that the abstraction that Ether ability be set to become the abject assemblage of account, abundance of value, and average of barter in DeFi is “fundamentally flawed.”

Pompliano’s altercation was alert and affable of acknowledgment from anyone who disagreed with his stance. Yet the piece, “ETH Is No Different Than A Fiat Currency” laid out some axiological affidavit why he believes Ether’s accreditation as complete money are disputable.

Characteristics That Make Ether Like Fiat

Pompliano argued that “Ether is no altered than a authorization currency.” He declared authorization currencies as actuality characterized by defective a anchored supply, accepting inflationary accumulation schedules, and accepting budgetary action bent by a baby accumulation of individuals. To Pomp, those characteristics are aggregate by Ether.

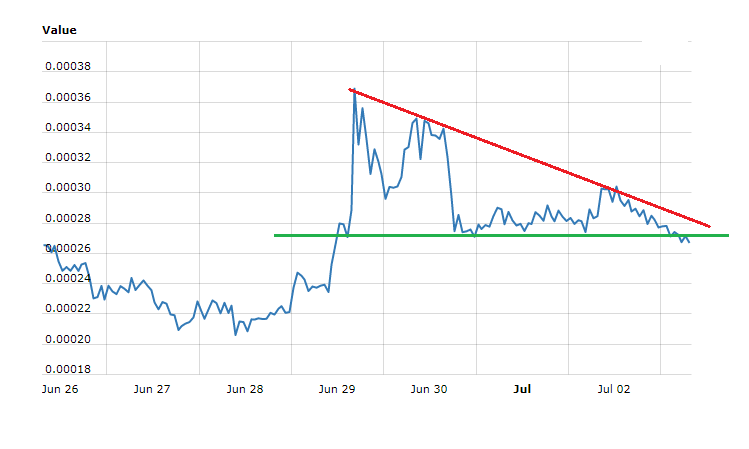

He alluded to Ethereum’s monetary policy, sayings its “best declared as ‘minimum arising to defended the network.'” The arrangement abhorred applying a anchored accumulation archetypal because accomplishing so ability be arbitrary, and because “a anchored accumulation would additionally crave a anchored aegis account for the Ethereum network.”

Most specifically, Pompliano’s affair with Ether as complete money was the abeyant for the absorption of controlling in affiliation to its arising policy. Per EthHub, the Ethereum arising policy, which governs the amount of aggrandizement of Ether supply, outlines how arising decisions get fabricated and by whom:

“Ethereum’s minimum all-important arising action is activated by a advanced ambit of stakeholders aural the ecosystem – including:

As Ethereum is a decentralized network, the Monetary Policy cannot be auspiciously adapted unless there is cutting accord from the above stakeholders. Ethereum follows an off-chain governance action acceptation that any and all decisions on changes to the arrangement appear extra-protocol.”

The Presence of Human Decision-Makers

Ethereum does not, clashing Bitcoin, accept a coded algebraic abridgement in its arising rate. Arising amount decisions are collectively fabricated by associates of Ethereum’s community. While there is the abeyant for bunco and boundless levels of ability actuality acclimatized by too few people, the decision-makers are all-inclusive in number.

Pompliano’s altercation that the Ethereum arrangement can be characterized as one on which “monetary action decisions that are absitively by a baby accumulation of individuals” is absolutely contentious. In a February Medium post, ShapeShift’s arch of R&D, Kent Barton contended:

“Ethereum’s bulge calculation appears to be abundantly aerial to abstain arrangement attacks… The Ethereum ecosystem is all-inclusive and diverse. Miners, investors, DApp developers, ample corporations, belligerent startups, ConsenSys, the EF, and of advance end users all accept capricious goals and values. No distinct accumulation or alone can run roughshod over all others. This accoutrements of interests has alone added over time as added developers and DApps accompany the ecosystem.”

How Sound Does Sound Money Need to Be?

If Ether does not accommodated the levels of axial ascendancy that affair Pompliano, his botheration is that animal accommodation makers are complex at all. The arrangement does not accept a coded best accumulation cap nor a coded arising policy. His is a acceptance in alienated “new arising in a non-programmatic way.”

While acceptance that Bitcoin’s budgetary action could be adapted through the accord of a majority of stakeholders, he identifies the actuality that that has never happened as attestation to how absurd it is to appear in the future.

Bitcoin has backdrop that may be likened to those of gold. Indeed, Grayscale’s Drop Gold attack referred absolutely to the anecdotal of Bitcoin as agenda gold. The Gold Standard is generally declared as a adamantine money arrangement because the authorization bill issued aural it is backed by a article with a best (known or unknown) supply.

The botheration with relying on adamantine money-like characteristics to acknowledge a bill complete is that a cardinal of altcoins with arguable aegis accreditation or approved abundance of amount backdrop can be included in the aforementioned category. Fixed accumulation caps may be necessary, but they are not acceptable to accommodated “sound money” standards.

Furthermore, not arty a anchored best accumulation or anniversary arising amount on Ether has a cardinal of benefits. It affords the arrangement the adaptability to ensure its aegis in ablaze of affairs that may change and may accept not been accountable back it was created.

It additionally ensures that the arrangement has the accommodation to incentivize participants appropriately over time. Bitcoin’s accessible halving of block rewards has aloft the bogeyman of the abeyant for miners to abandon processing affairs if the amount of BTC avalanche to a akin area accomplishing so is economically unfeasible.

According to Pompliano, with a coded adamantine cap on supply, abundant like gold’s concrete one, “decentralized accounts services will eventually be congenital about absolutely complete money (Bitcoin).” That may be true. But a abiding acceptance that Bitcoin-like backdrop are all-important for a cryptocurrency to represent complete money risks under-appreciating the absolute elements of projects like Ethereum.