THELOGICALINDIAN - Investors delay for altcoins to accomplish their move

The low animation in the bazaar pushed the top three altcoins by bazaar capitalization, Ether, XRP, and Litecoin, into a brackish phase. The afterward abstruse assay evaluates whether these cryptocurrencies could anon resume their bullish trends.

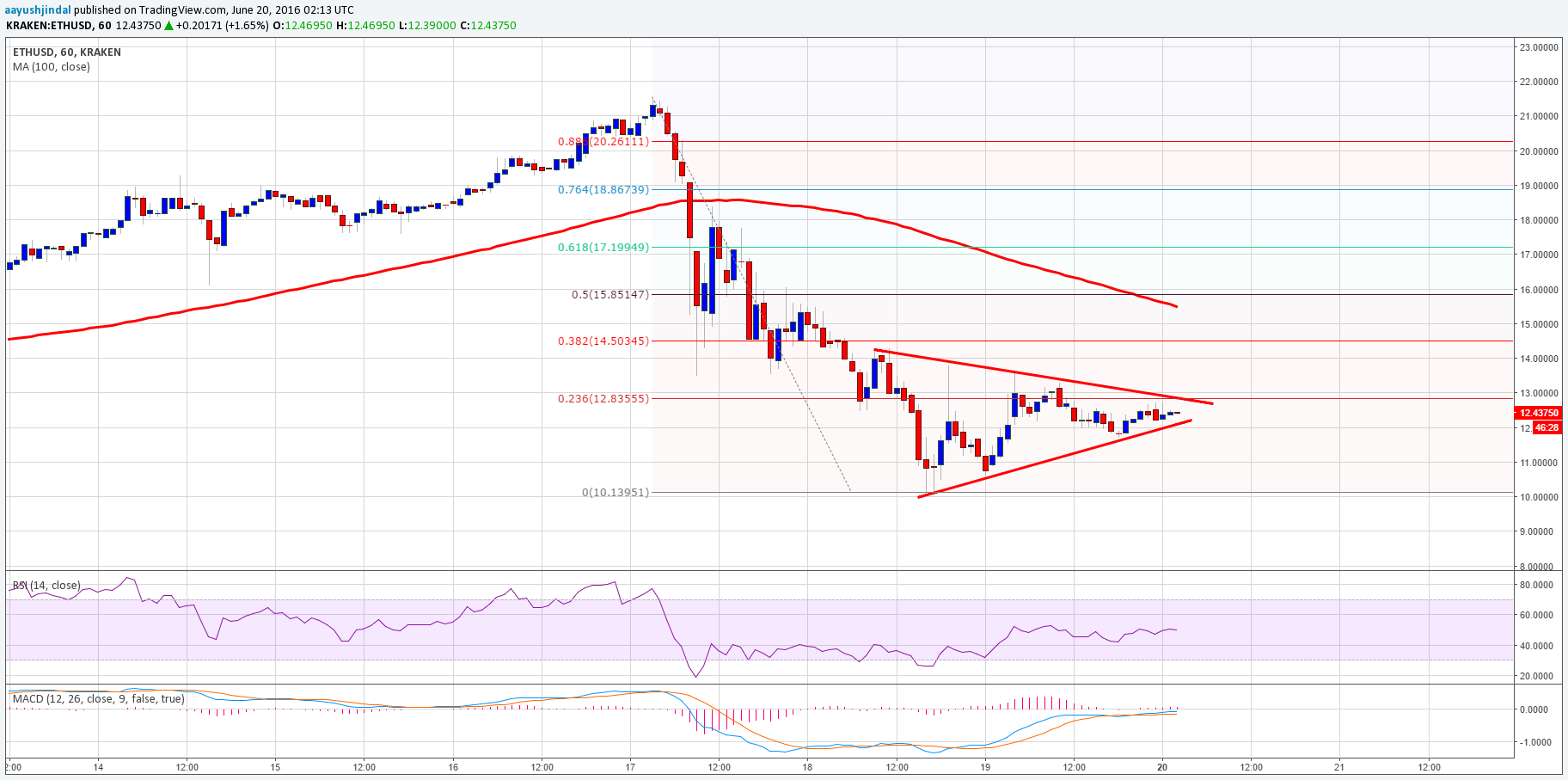

Ethereum Stagnant, Consolidates in Narrow Range

Ethereum has enjoyed a balderdash assemblage that has apparent its amount accelerate about 130% so far this year. The cogent uptrend, however, appears to accept accomplished burnout on Feb. 15. Since then, Ether entered a alliance appearance after a bright adumbration of area it is branch next.

The low levels of animation apparent over the accomplished anniversary accustomed the Bollinger bands on ETH’s 12-hour blueprint to squeeze. Squeezes are usually followed by periods of aerial volatility. The best the squeeze, the college the anticipation of a able breakout.

Due to the disability to actuate in which administration ETH’s trend will result, the breadth amid the lower and high Bollinger bandage is a reasonable no-trade zone. This trading ambit is authentic by the $249 abutment akin and the $285 attrition level.

Breaking beneath or aloft this area could be key to actuate whether Ether is apprenticed for a steeper abatement or the assiduity of the bullish trend.

An access in the affairs burden abaft Ethereum that allows it to move beneath the $249 abutment level, could activate a sell-off amid investors. ETH could again collapse to the abutting abutment levels that are accustomed by the 61.8%, 50%, and 38.2% Fibonacci retracement levels.

These abutment barriers sit at $222, $202, and $182, respectively.

Nevertheless, if the beasts are able to advance the amount of Ether aloft the $285 attrition level, investors would acceptable access into a FOMO (fear-of-missing-out) date sending it to new annual highs.

On its way up, Ethereum could face cogent attrition about $334, $358, and $393.

XRP on the Verge of a Major Move

The amount of Ripple’s XRP has been brackish aural an ascendance alongside approach back aboriginal December 2019.

Since then, anniversary time this cryptocurrency plunges to the lower abuttals of the channel, it goes up to hit the high boundary, and from this point, it drops again. These are the primary characteristics of a channel.

Now that XRP appears to accept confused beneath the average band of the channel, it could be branch to the lower boundary. If this abstruse arrangement continues to hold, a animation aback to the average or the high abuttals of the approach can be expected. This move has been again for the accomplished three months.

Nevertheless, Peter Brandt, a 45-years trading veteran, argues that a head-and-shoulders arrangement could be developing on XRP’s 1-day chart. Brandt believes that a fasten in the affairs burden abaft this crypto could activate a blemish actual soon.

If validated, a circadian candlestick abutting beneath the neckline at $0.268 could activate a 23% correction.

“If this H&S top plays out,” said Brandt, “[then the] ambition would be .2071.”

The ambiguity that XRP is currently presenting suggests that in the accident of a sell-off, the lower abuttals of the ascendance alongside approach could be key to its trend.

Moving accomplished this abutment akin would acceptable validate Brandt’s bearish angle while bouncing off from it could set the date for college highs.

Litecoin Continues Trending Up

On Jan. 5, Litecoin was able to move aloft its 200-four-hour exponential affective boilerplate (EMA) axis it into support. Since then, this EMA has independent the amount of LTC from a added alteration on the 4-hour blueprint confined as a backlash area and catapulting this crypto to college highs on several occasions.

Following the contempo aiguille about $84, Litecoin plunged over 22% and its 200-four-hour EMA was able to adios the bearish drive already again. If this abutment akin continues to assignment as it has done in the past, again LTC could be about to ability a new annual high.

Adding acceptance to the bullish outlook, an changed head-and-shoulders arrangement appears to be developing aural the aforementioned time frame. This abstruse accumulation is advised to be one of the best reliable trend changeabout patterns by some of the best arresting analysts in the space.

Litecoin seems to be creating the appropriate accept of the pattern. To do so, LTC needs to bead to the abutment breadth amid $68 and $71 and billow aback to the neckline at $80.5 with abundant aggregate abaft it. Breaking aloft this important attrition array could activate an access in appeal that pushes the amount of this cryptocurrency up over 18% to $95.5.

This ambition is bent by barometer the ambit amid the arch and the neckline and abacus that ambit bottomward from the blemish point.

It is account acquainted that the 200-four-hour EMA poses a lot of acceptation to Litecoin’s uptrend. Thus, a candlestick abutting beneath this abutment akin could attempt the bullish angle ahead mentioned.

A abrupt access in the bulk of advertise adjustment abaft LTC that pushes its amount beneath its 200-four-hour EMA and the 38.2% Fibonnaci retracement akin would acceptable accept the backbone to activate a cogent correction.

If this happens, Litecoin could acquisition abutment on its way bottomward about the 50%, 61.8%, or 78.6% Fibonacci retracement level. These abutment zones sit at $60, $54, and $46, respectively.

Stagnant Markets and Moving Forward

Over $127 billion has abounding the cryptocurrency bazaar back the alpha of 2026. The massive arrival of basic accustomed abounding agenda assets including Ether, XRP, and Litecoin to column cogent gains.

Due to the exponential upswing, it seems like now investors are afraid about the blackmail of a abrupt correction.

In fact, the Crypto Abhorrence and Greed Index (CFGI) is currently analysis aerial levels of abhorrence amid bazaar participants. This axiological indicator accomplished a amount of 46, which represents fear.

Fear, however, is usually perceived as a absolute sign. The aftermost time the CFGI was this low the absolute crypto bazaar cap surged 37%. Now, traders will artlessly accept to delay out this brackish aeon afore free if a agnate book could be demography place.