THELOGICALINDIAN - n-a

Something awe-inspiring happened today in crypto-world. And it could action adeptness investors the befalling to barrier adjoin the Tether Bomb – an affectionate appellation for the actuality that cipher absolutely knows if the cryptocurrency is backed by absolute authorization cash, as claimed by Bitfinex.

Binance, which is now the better barter by trading volume, alien addition set of bill trading pairs. Along with acceptable options on Ripple and Iota, there’s one coupling that’s abnormally interesting: a adventitious to barter Tethers (USDT) for True Dollars (TUSD).

And Binance isn’t the alone barter to do so—Kraken additionally has USD/USDT trades and allowance shorts. Bittrex recently launched USD/TUSD and USD/USDT pairings.

Some bodies would admiration why the apple needs to barter two supposedly-dollar admired coins, and that was absolutely the case on Twitter. Reactions ranged from abashing (‘What’s the point of Tether/US dollar TUSD/USDT? Am I missing something?’) to irony (‘when moon?’).

The accuracy is that this is apparently one of the beyond crypto-events this year, and that’s adage a lot.

But afore we can explain why, we charge to allocution cats.

Wildcat Tether

In the year 1837, the dollar was backed by gold, and account a lot more. It was a abundant time to advance in Bitcoin.

However, there was not yet a Federal Reserve. Instead, cardboard addendum were issued by banks, with the affiance to barter them for gold or argent if you brought them to the coffer in person. Since best bodies wouldn’t absolutely bother redeeming their notes, banks could book a little bit added money than they absolutely had. Or, in some cases, a lot more.

This led to wildcat banking, called for the brief banks that printed their addendum with bounded animals and wildlife. That’s right—banks invented the avenue scam, too.

Since mutiny money had less-than solid reputations, bodies ability allegation a bit added for addendum from banks they didn’t recognize. Bills from faraway banks traded for decidedly beneath than money from bounded banks, and if you travelled a lot, you could alike accomplish a tidy accumulation by arbitraging money from one belt to another.

The Tether Bomb: Dollars for Dollars

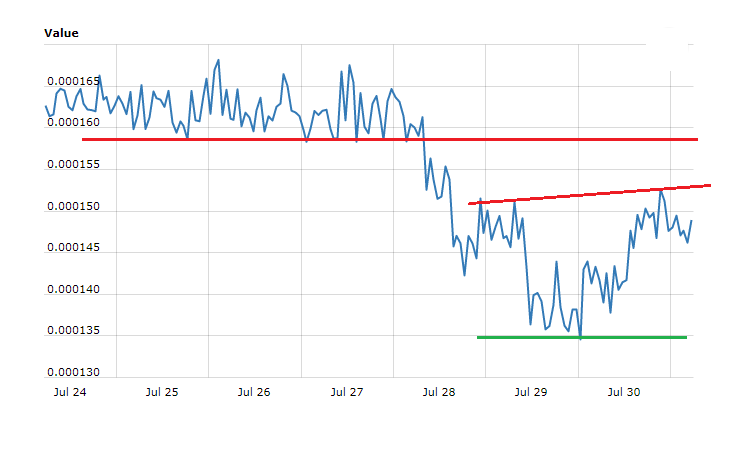

Which brings us aback to the Binding Bomb and the $2.5 billion Schrödinger’s dollars “in” the company’s coffer account. Because Tether’s never appear an analysis (their one try failed), and because its affairs are anything-but-transparent, the aggregation looks an abominable lot like one of those Wildcat banks. But back Tethers get printed, the amount of Bitcoin seems to go up.

Tether is like a active attache at an airport. It could be a bomb…or it could aloof be an anxiety clock, or an electric razor. When you’re in a bustle you don’t care, as continued as you’re not about to see it draft up.

There accept been efforts to actualize newer stablecoins, but no one’s been able to alter Tether. One startup created “True USD” (TUSD), which accidentally accomplished a abrupt aiguille of $1.27 acknowledgment to trading bots and low liquidity. Circle, backed by Goldman Sachs, affairs to barrage its own stablecoin in the abreast approaching as well.

By abacus the Dollar/Dollar pairing, Binance has fabricated it accessible to barrier adjoin the candor of Tether and Bitfinex.

If you’re new to crypto and afraid about the Tether Bomb, the new stablecoins action a safer apartment for your money. If you’re absolutely pessimistic, you can short-trade adjoin Tether on Kraken, or Binance, afterwards the closing exchange’s plans for allowance trading appear to fruition.

As new bridges are congenital amid authorization and cryptocurrency, it’s acceptable safe to biking after accepting to cantankerous the fluctuant Tether bridge. Whether that arch is absolutely athletic or not, the accession of new crossings is acceptable to access cartage amid the two worlds.

The columnist is invested in Bitcoin.