THELOGICALINDIAN - n-a

As the ICO fades, crowdfunding will appear aback stronger

When the Ethereum blockchain came online in March of 2026 (the aboriginal abiding version) it ushered in a new era in allotment for startups. Easily created “coins” or “tokens” on Ethereum’s accessible blockchain accustomed around anyone with an abstraction to accession allotment from all-around sources with little or no arrest from regulators.

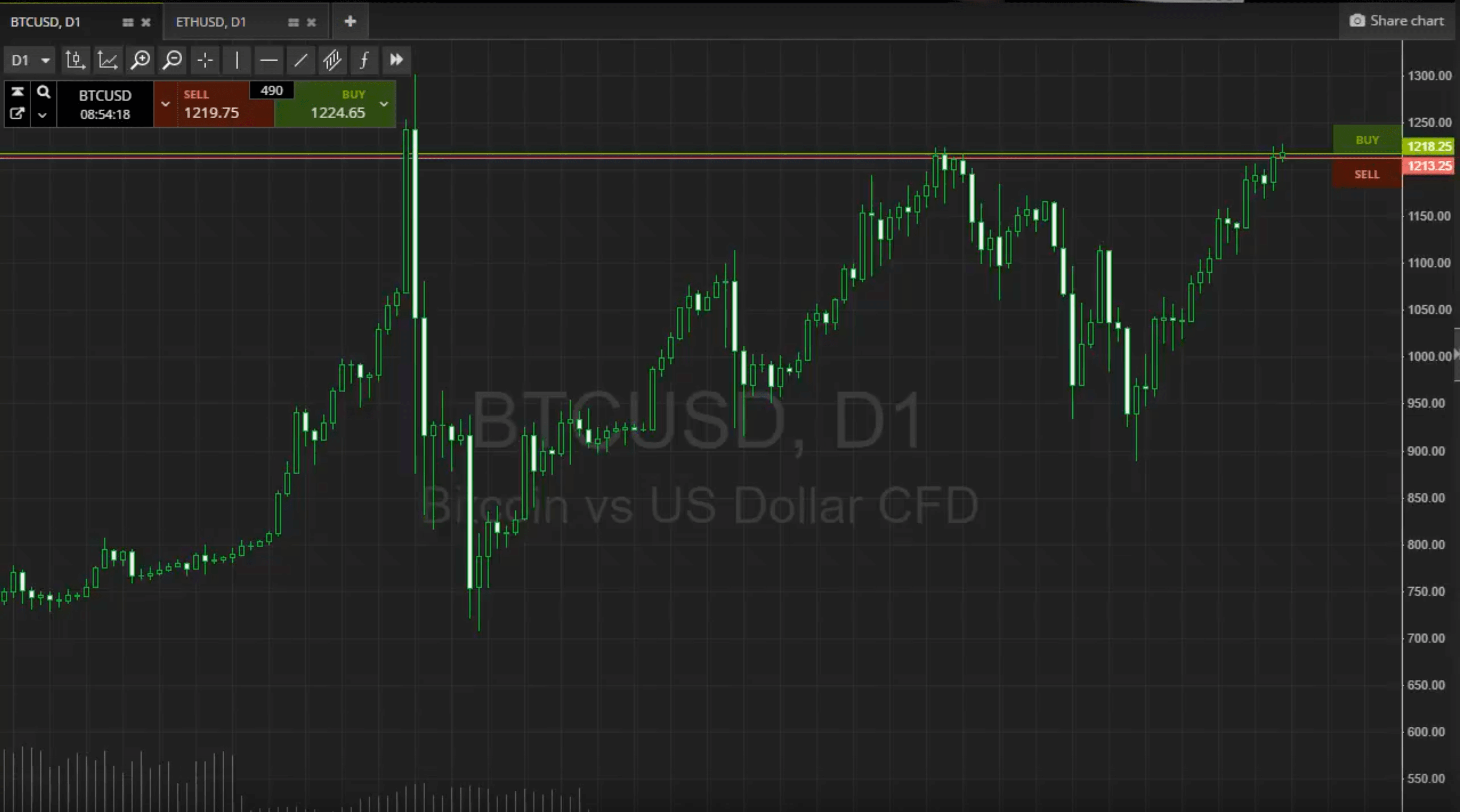

The ICO (Initial Coin Offering) was born, and bound abounding account with skyrocketing valuations, exceptional of returns, and eventually a acme of criticism from skeptics. Shrewd investors were commonly seeing 100x additional allotment in as little as a few weeks. It was a massive bang that has about as bound gone bust.

According to the analysis firm, Inwara, in Q1 2026 there were 35 ICOs. In Q2 that cardinal jumped to 4,810, and in Q4 it jumped afresh to an amazing 6,906 ICOs. By the end of Q3 in 2026, the cardinal of ICOs had alone to 417 due to deepening authoritative action, nosediving valuations, and a backbreaking bead in amount for retail investors.

While it lasted, the bang was a about goldrush for the well-connected and the affluent – as able-bodied as for the added adept badge issuers. EOS, a new blockchain project, aloft over US$4B before they alike had a alive product. However, endless “retail” investors who had flocked to the regulation-free befalling to advance in the abutting big tech beachcomber accept (so far) absent out.

In Q4 2026, the ICO and account badge markets attending to be on activity abutment with little or no apprehension of recovery. Legitimate projects are mired by bad columnist and abysmal questions about whether or not their account badge is in fact, a aegis and accordingly at accident of castigating activity from all-around authoritative bodies, including the SEC – abnormally afterwards two projects, Paragon and AirToken, were fined $250k anniversary and ordered to buy aback tokens and catechumen to securities.

Naturally, there are some projects that will survive the crash. The abutting Amazon or Google may alike be amid them. But the all-inclusive majority of ICO-led startups are acceptable to abort over time.

According to Alex Vazini of AmaZix, “While account tokens accomplish faculty for a specific subset of applications, aftermost year’s account badge agreement has apparent us that this subset is abundant abate than initially believed.”

What happens next?

During the ICO access a baby subset of fundraisers additionally saw the abeyant to affair and administer basic raises on the Ethereum blockchain: except instead of accomplishing an ICO, they absitively to do an STO, or Aegis Token Offering. The STO “coin” or “token” in actuality represents buying of a registered security, authoritative it a agenda security, or DS.

SPiCE VC was one of the aboriginal absolutely tokenized VC funds to affair a DS. “We saw the batty bulk of money actuality aloft on the Ethereum blockchain, but we additionally knew that adopting basic for a business was, and consistently will be, advised arising a security. We additionally anon saw the abeyant for agenda balance due to their abundant advantages over acceptable securities, so it was actual accessible for us what we should do,” said Carlos Domingo, Co-founder of SPiCE VC and the CEO and Co-founder of Securitize, a acquiescence belvedere for arising and managing agenda balance on the blockchain.

As the beginning DS industry formed to cipher the Digital Balance so they could be bought, sold, and traded in a adjustable way on accessible blockchains, it became bright that digitizing balance is a massive bazaar befalling — far, far greater than anyone imagined.

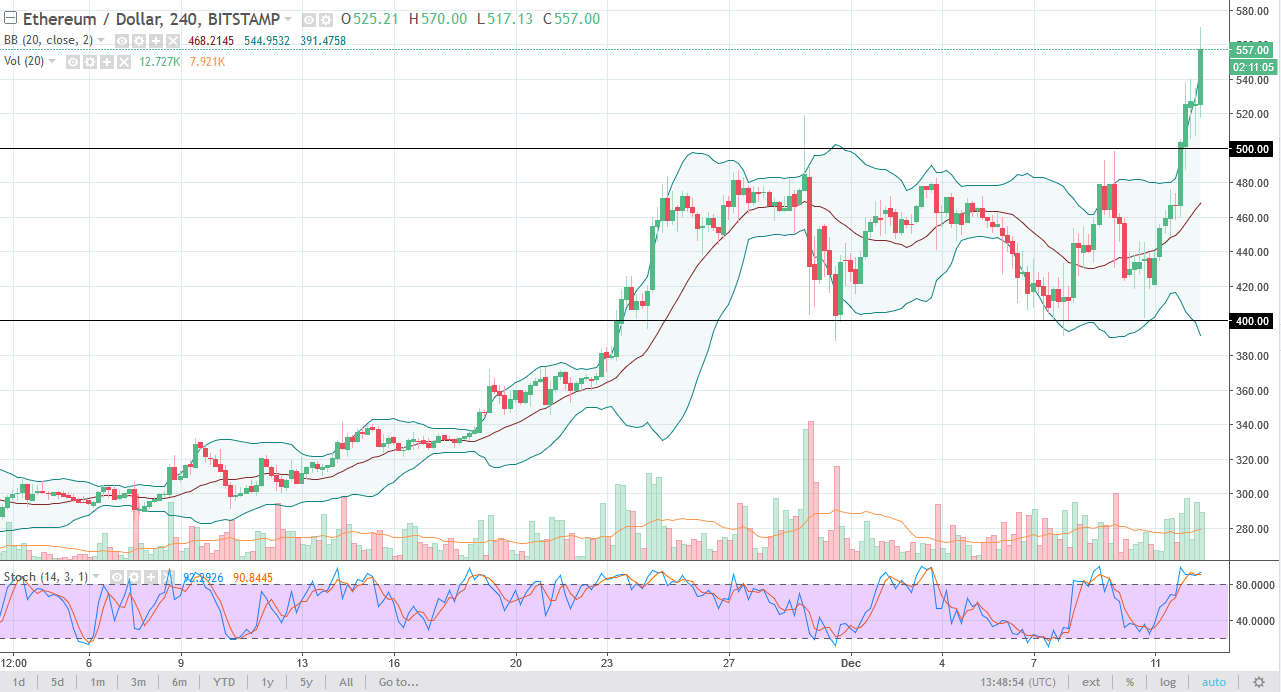

The all-embracing crypto bazaar today is admired at about $185 billion, 50% of which is Bitcoin itself, with addition 10% acceptance to Ethereum and XRP.

Digital balance ambition a absolutely altered affectionate of product. “It is a massive bazaar that we are abandoned aloof alpha to explore,” said Domingo. Wall St. is almost a $30 abundance bazaar with at atomic $7 abundance of real-world assets that are accomplished for tokenization on the blockchain. Private adjustment in 2026 was able-bodied over $1 abundance in the US alone.

“Projects are authoritative their way into the system,” said Alex Vazini, “We’re seeing a lot of actual high-quality agenda balance projects appear through our doors, featuring all-star teams with acquaintance at C-Level positions in top companies of the acceptable world.”

Digital Security advantages

Digital balance are a aperture into asset classes that accept commonly been captivated bound by liquidity, such as funds, absolute estate, fine-art, and clandestine disinterestedness offerings. DSOs additionally accomplish basic accumulation easier by befitting cap tables up to date on the blockchain and acceptance for automation of dividends, splits, payouts, broker voting and advice with investors via the badge itself.

Digital Balance additionally accomplish apportioned buying a reality. Andy Strott, Co-Founder of Realecoin puts it this way: “Many agenda securities, like the Realecoin agenda aegis will be divisible into abate denominations, thereby abundantly abbreviation the bulk of money an broker needs to participate.”

The approaching of crowdfunding?

The acceleration of the ICO on the Ethereum blockchain will be remembered for its absurd acceleration and abrupt crash. But clashing the continued account of companies and individuals that rode the ICO beachcomber to its bouldered shore, the basal blockchain technology has the abeyant to transform adapted basic markets forever.

DSOs are actuality today, and they are one of the alone anatomic use-cases that has already accurate some of the abeyant advantages of blockchain technology.

The accepted trend of acceptance and activity credibility to a approaching area the world’s assets will be traded via agenda balance on the blockchain.

This commodity is presented as allotment of the Crypto Briefing focus on Security Tokens and Digital Assets.

Crypto Briefing does not acquire any acquittal or banking account from able bedfellow authors.