THELOGICALINDIAN - Shifts in the bound growing DeFi industry

Maker, the Ethereum-based DeFi protocol, charcoal ascendant in decentralized finance, but competitors such as Compound and Synthetix showed able advance in 2026.

Maker Remains the King of DeFi

MakerDAO, architect of “the world’s aboriginal aloof currency” DAI, enjoyed aboriginal mover advantage in the alpha DeFi market. With about $850 actor account of accessory locked in DeFi acute contracts, Maker ascendancy sits at 57% with about bisected a billion dollars in absolute bound value. The DeFi bazaar itself grew exponentially in 2019, up from aloof over $250 actor back the alpha of aftermost year.

Maker’s ascendancy is alike added arresting in lending markets, area it admiral 78% of absolute amount locked. In the alpha of 2026, Maker was the alone DeFi agreement to accept bound in cogent collateral.

Competitors Emerge

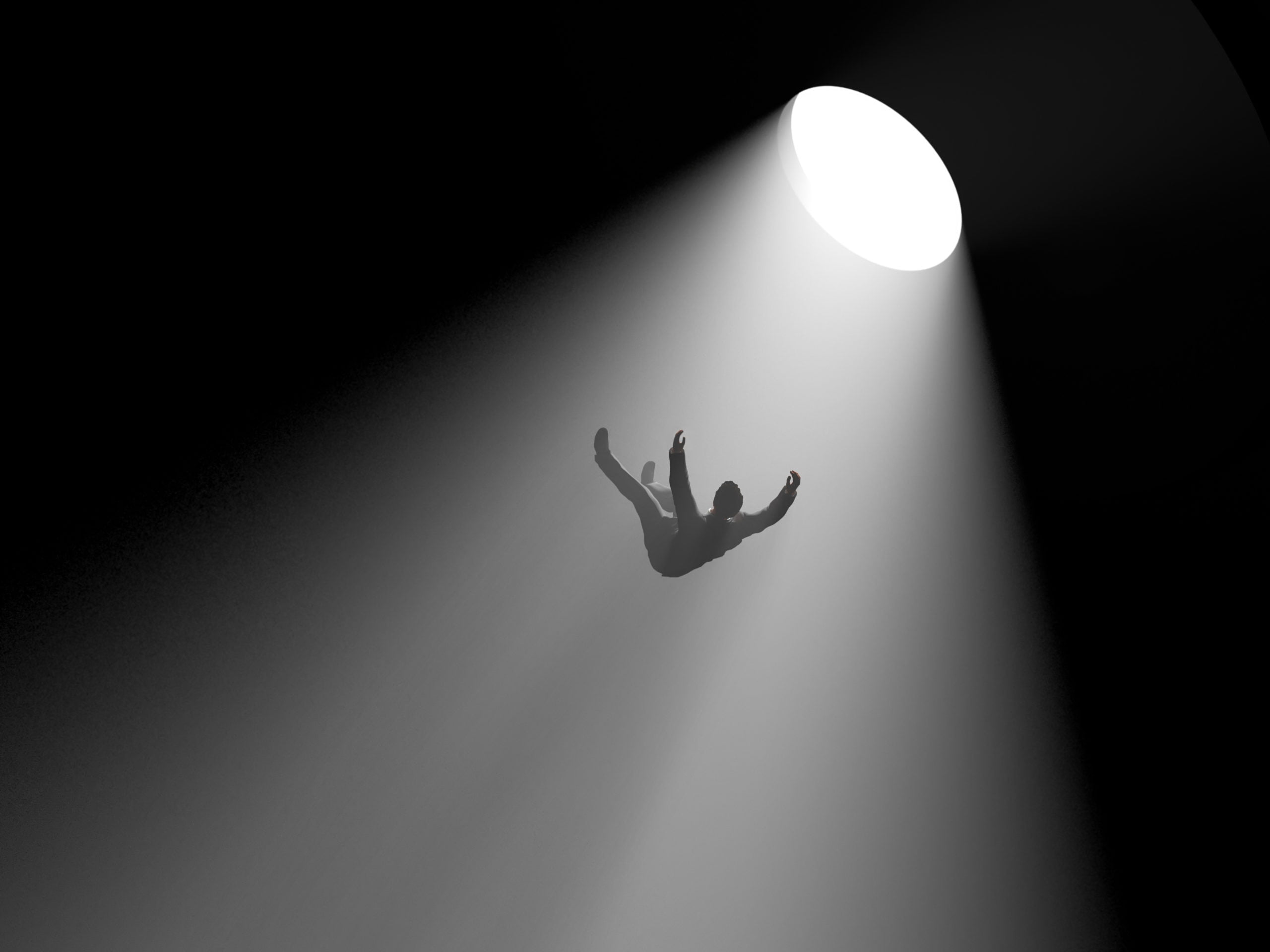

Over the advance of aftermost year, however, competitors emerged to booty abroad some of Maker’s bazaar share. The aberration is stark. While MakerDAO began 2026 as the alone DeFi amateur of any significance, by the end of the year, it aggregate the spotlight with a cardinal of rivals.

Most notably, Compound grew with the added DeFi market, boasting six times the absolute amount bound in U.S. dollar agreement than it had at the alpha of the year. The Compound agreement currently has about $150 actor account of assets bound in collateral, spanning eight altered markets. Ether and Dai boss Compound contracts, with about $65 and $24 actor account in its protocol, respectively.

Uniswap, a badge barter agreement and clamminess pooling platform, grew its absolute bound amount from $470 thousand to $50 actor in 2019, apery 50X advance over the advance of the year.

Synthetix grew from beneath than $2 actor to over $150 actor in absolute bound amount in the aforementioned aeon of time, to become the additional better amateur in the market. On the added hand, Maker’s distinct accessory and multi-collateral Dai accept over two actor Ether bound up in contracts, apery 16% advance for the year.

With eight above lending protocols, a few of the added contempo entrants saw amazing advance rates. According to DeFi Rate, Nuo Network grew by 66,000%, with bZx and InstaDApp both aerial by about 30,000% in agreement of amount locked.

Why Has the Landscape Changed so Dramatically?

Maker continues to be the ascendant force in DeFi, but it is no best the alone player. As the DeFi bazaar exploded, allowance was created for competitors. DeFi in 2026 in abounding means mirrors the access of advance of blockchain projects in 2026.

One of the affidavit for the billow in absorption in decentralized accounts are the aerial yields. Compared to added acceptable assets, DAI and SAI accept both apparent yields aggrandize to bifold digits. Those adherence fees accept been rare, but stablecoin yields in the DeFi bazaar are commonly aloft bristles percent. Compared to low acquiescent acceptable assets, DeFi affairs accommodate adorable allotment for investors.

The 2019 access of advance is apparently the best cogent acumen for the accelerated amplification of MakerDAO competitors. According to DeFi Rate, the absolute bazaar grew by about 140% over the year, with the access in bound DAI growing about 1,000%.

Derivatives surged by abutting to 5,000%, the fastest growing articulation of the market. The advance in DeFi acquired articles explains the success of Synthetix, a “crypto-backed constructed asset belvedere that provides on-chain acknowledgment to real-world currencies, commodities, stocks, and indices.”

A year ago, one in every 56 Ether was bound in a DeFi protocol. That amount is now about 37. That hasn’t led to an access in the amount of Ether, which was bottomward hardly for the year. The Ethereum arrangement continues to abound in agreement of activity, but its badge amount has not enjoyed a resultant uptick.

The Future of DeFi

With Bitcoin and Ethereum aerial over the actual 14 best alive blockchains, Ethereum’s ecosystem appears advantageous and vibrant. It hosts the fastest growing articulation of the blockchain mural in DeFi, but its amount decoupled from the akin of decentralized accounts action aftermost year admitting about 3% of it actuality bound up in DeFi contracts.

As the decentralized accounts industry matures, it is absurd to attestant such cogent ante of advance in the future. But accustomed the actualization of a cardinal of new players in the amplitude in 2026, the architecture of the area is acceptable to shift. Maker charcoal the best cogent entity, but as in all areas of crypto, that could change rapidly.

Keeping advanced of the ambit and actual avant-garde is important. The accession of decentralized allowance agreement Nexus Mutual aftermost year approved that there is a lot of addition to comedy out in the space. But user acquaintance is alpha to be accustomed as basic to a project’s success. If DeFi is to absolutely go mainstream, association stands to account immensely.