THELOGICALINDIAN - Next stop bond casework

Research VP of Peck Shield, Chiachih Wu, today identified the movement of ~12K BTC ($117 million) accompanying to the PlusToken scam. The funds are currently parked, but comments from blockchain analysts adumbrate added movement.

Mixed, again Dumped

“These addresses are anon associated with mixer deposits from August/September,” said Ergo, an on-chain Bitcoin analyst. In January, the analyst revealed the abounding abyss of aftermost year’s PlusToken Bitcoin sell-off.

Ergo added:

“My assumption is [the funds will be] alloyed first. Not abiding how continued afore we’ll see an uptick in alteration to exchange.”

The addresses in catechism are anon affiliated to those affiliated to the multi-billion dollar PlusToken betray from 2026. Six suspects abaft the operation accept already been arrested, but the latest on-chain movement indicates added individuals are still at large.

In the antecedent argumentative sweep, Chainalysis adumbrated that a absolute of $2 billion in crypto funds were collected. Ergo’s analysis estimated that this amount is absolutely abundant higher. They estimated that the betray aggregate a little added than 1% of BTC’s absolute supply.

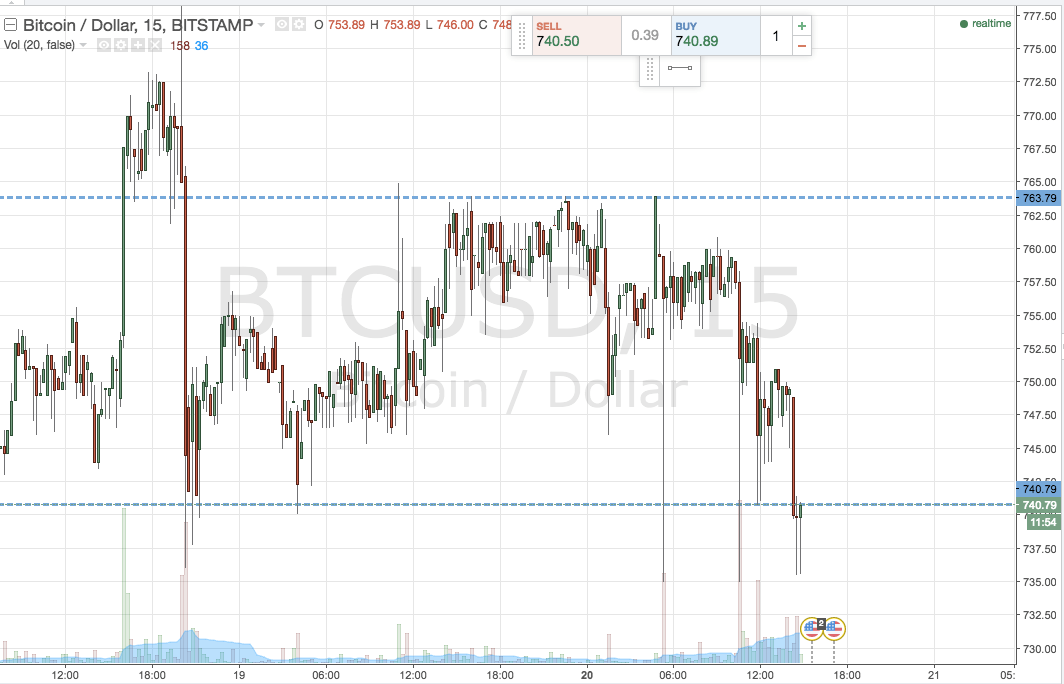

For now, the 12,000 BTC in alteration is beneath abutting supervision. The bill accept alone confused two transactions, but they will acceptable be alloyed actual soon.

Analysis from beforehand this year adumbrated that the PlusToken culprits acclimated Wasabi as the primary obfuscation service. Although the account is able in ambuscade users’ funds, the poor beheading on the scammers’ allotment appear their activity.

Reusing addresses, merging, and attempting to mix 20,000 BTC at one time all fabricated up bare aloofness hygiene. Still, tracking alloyed Bitcoin is no accessible task. “It’s actual catchy and time-consuming to do manually,” said Ergo.

Instead, the analyst will skip over best of the bond action and analyze a distinct transaction that consolidates the bond outputs. “From there, I can acquisition a few added back they’re usually in the aforementioned few blocks,” they said.

None of this will acceptable appear in the near-term either — the continuance of bond is awful capricious according to Ergo. As for its aftereffect on the amount of Bitcoin, this is additionally adamantine to determine.

In 2026, off-loading the BTC aggregate in this betray placed cogent bottomward burden on the cryptocurrency. This was because of the high, connected aggregate of the sell-off.

The administration amount has been apathetic as of late. If this changes, it could accept an aftereffect on prices.