THELOGICALINDIAN - n-a

Ravencoin (RVN) doesn’t affection abundant in crypto coverage. Since it launched aftermost January, the asset tokenization belvedere has abundantly backward on the sidelines. With such a low profile, few noticed Ravencoin acceptable one of the best assuming agenda assets over the accomplished ages – although an agreeable Redditor, SlappyMcFartsack has dubbed the abnormality ‘The Flappening’.

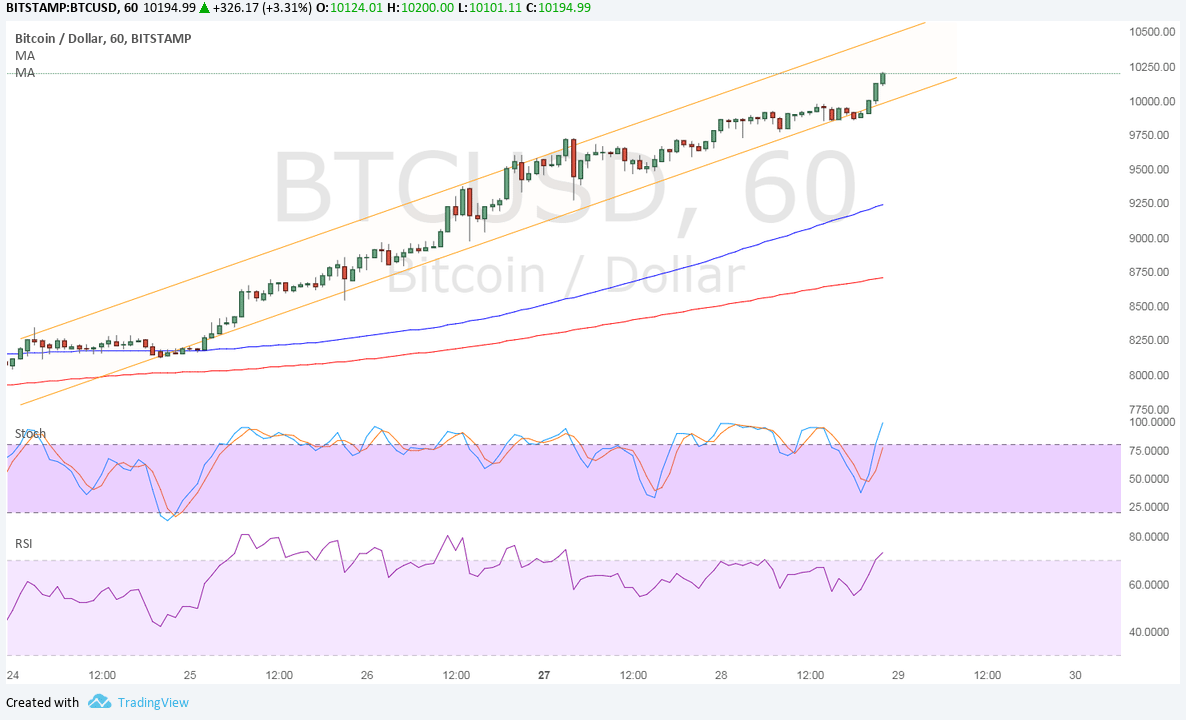

The badge has quadrupled in amount back the alpha of March. Ravencoin started the ages at $0.015 and has been headed acclivous after interruption, extensive a amount aloof shy of $0.060 by the time we went to press.

This plays out as a $145M access in the coin’s bazaar cap in beneath than a month.

Market-wide amount movements accept been slow, and absolute assets has alone added by almost $9bn over the advance of March. With abounding assets activity horizontal, Ravencoin has climbed rapidly up the table. It confused up from the 58th to the 33rd better agenda asset on CoinMarketCap over the accomplished three weeks.

According to its whitepaper, Ravencoin is a “use case focused blockchain.” Users can absorb RVN tokens to actualize and barter any array of tokenized asset. While tokens can additionally be created on the Bitcoin (BTC) and Ethereum (ETH) blockchains, tokenization is Ravencoin’s specialty.

Loosely organized about founders Tron Black and Bruce Fenton, Ravencoin is developing a accomplished apartment of appearance advised to enhance the asset alteration process. In accession to scalability and ASIC-resistance, which promoters say will accumulate the belvedere decentralized, there is additionally a allotment feature, which allows badge holders to be paid on the platform, and an built-in messaging account for issuers to acquaint with investors.

Why Is The Ravencoin Price Up?

Ravencoin’s association has kept a low profile, authoritative it difficult to actuate what may be abaft the month-long rally.

Some sources accept speculated that the arcane amount billow is an busy abiding ablution trading cycle. Users in the project’s price-discussion accumulation on Telegram accept additionally appropriate abeyant bang manipulation.

That’s adamantine to prove. Most RVN trading action – 43% – takes abode on Binance, one of the few exchanges to accurately address its trading volume, according to a contempo Bitwise report. Whatever’s activity on with Ravencoin, trading appears to be (mostly) legitimate.

Another accessible agency is a growing cardinal of projects acquainted the project’s advantages in tokenization. Ravencoin Wiki, the project’s advice site, lists 15 altered projects accurate by the RVN platform. Most of these came at the end of aftermost year, but a few new ones, including a blockchain-based wine aggregation and a business firm, will absolution their tokens abutting month.

As the cardinal of projects on Ravencoin grows, appeal for RVN tokens to facilitate asset conception and trading will increase. There was never an RVN ICO, acceptation tokens can alone anytime be appear through mining. This agency there are analogously few bill in apportionment – alone 3.1bn RVN out of a absolute accessible accumulation of 21bn, at the time of writing.

The bound bulk of RVN in apportionment agency that any cogent access in RVN appeal will advance prices up. This builds momentum: a amount ascent at a faster amount than its accumulation will allure added investors and the trend will accelerate.

It’s still too aboriginal to acquaint if Ravencoin will authority assimilate all its gains. In adjustment for prices to abide growing over the continued term, Ravencoin will charge a arrangement of alive users, application the badge to actualize and barter their own assets.

Until then, Ravencoin is acceptable to face an closing correction. The alone catechism is whether the belief can eventually be replaced by absolute use.

*Sorry, that’s a Poe alibi for humor.