THELOGICALINDIAN - Ruffer says the Bitcoin bazaar shows signs of froth

Ruffer has said that Bitcoin no best fills the role of a diversifying asset for the close and alleged the accepted cryptocurrency bazaar a “speculative bubble.”

Ruffer Details Billion-Dollar Bitcoin Trade

Ruffer has declared the cryptocurrency bazaar as a “speculative bubble” while answer its accommodation to advertise its Bitcoin backing in April 2026.

In a year-end review addressed to shareholders, the aggregation wrote:

“Bitcoin may yet accomplish its potential, but the bazaar displayed abounding signs of froth—retail speculation, boundless leverage.”

The account comes afterwards Ruffer fabricated a affluence on its Bitcoin trade. In April 2026, Ruffer awash off all its Bitcoin holdings, locking a accumulation of $1.1 billion.

Ruffer managed $30 billion in assets beneath administration as at 30 Jun. 2026, confined added than 6,000 investors including institutions, ancestors offices, alimony funds, and charities about the world.

Last year, the close fabricated a $744 million allocation to Bitcoin. It declared its behemothic auction as a “well-timed exit” that helped abstain giving aback its crypto assets in the contempo bazaar sell-off. The close additionally awash off its acknowledgment in two companies in the cryptocurrency sector, MicroStrategy and Galaxy Digital, adage there was no abode for cryptocurrency in its portfolio.

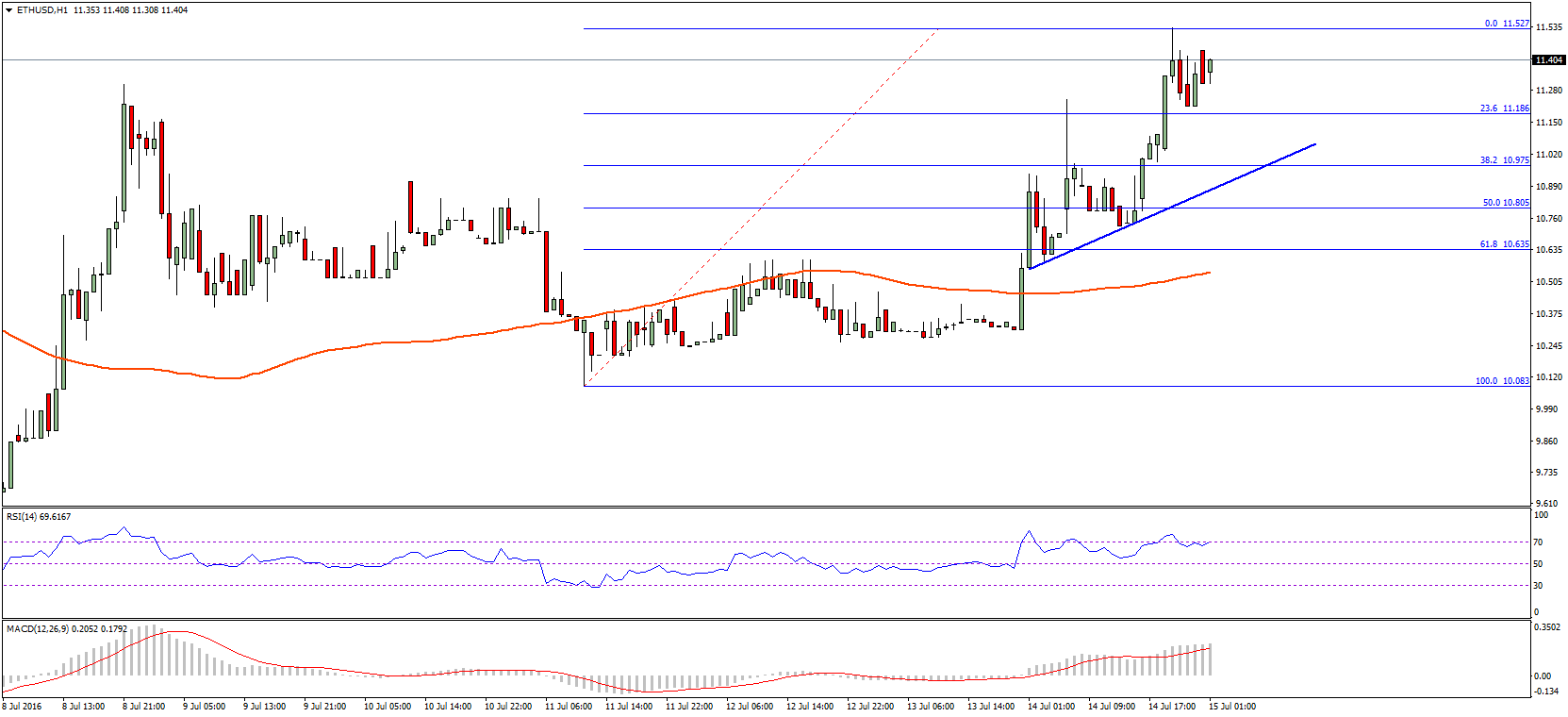

The advance aggregation said that while acknowledgment to Bitcoin was a “significant contributor” to its annual performance, it anon begin that the asset’s amount achievement may accept been apprenticed by speculation. Bitcoin soared throughout backward 2026 and aboriginal 2026, peaking at about $64,000 in April.

According to Ruffer, the bazaar was overtaken by contest such as “Tom Brady’s laser eyes, Dogecoin, Elon Musk hosting Saturday Night Live” that fueled a retail-driven balloon in the asset class.

The firm’s accommodation to cut its Bitcoin acknowledgment was additionally based on its abiding access of alienated advance in assets that it considers as abstract bubbles. Outlining the accommodation to abate its Bitcoin exposure, it said:

“When we see bubbles forming, our access has consistently been to abandon the mania. We endemic no tech stocks in 2026 and we endemic no banks or acreage stocks in 2026.”

Ruffer’s statements are a accessible indicator that as all-around equities, absolute estate, and cryptocurrencies acquaintance aerial levels of volatility, abounding ample institutional investors may be attractive for added bourgeois bets. Last week, BlackRock CEO Larry Fink claimed that he had apparent “very little” appeal for Bitcoin and added cryptocurrencies from acceptable investors.

Ruffer added that back Bitcoin started assuming signs of actuality a abstract asset, it no best accomplished the role of a diversifying asset that it had ahead advised it to be.

While Bitcoin is generally acclaimed as a barrier adjoin inflation, the 12-year old asset is still advised chancy in added acceptable advance circles, decidedly due to its airy nature. Hence, in the face of actuality a abstract asset, Bitcoin may lose some of its address as a about-face play.