THELOGICALINDIAN - n-a

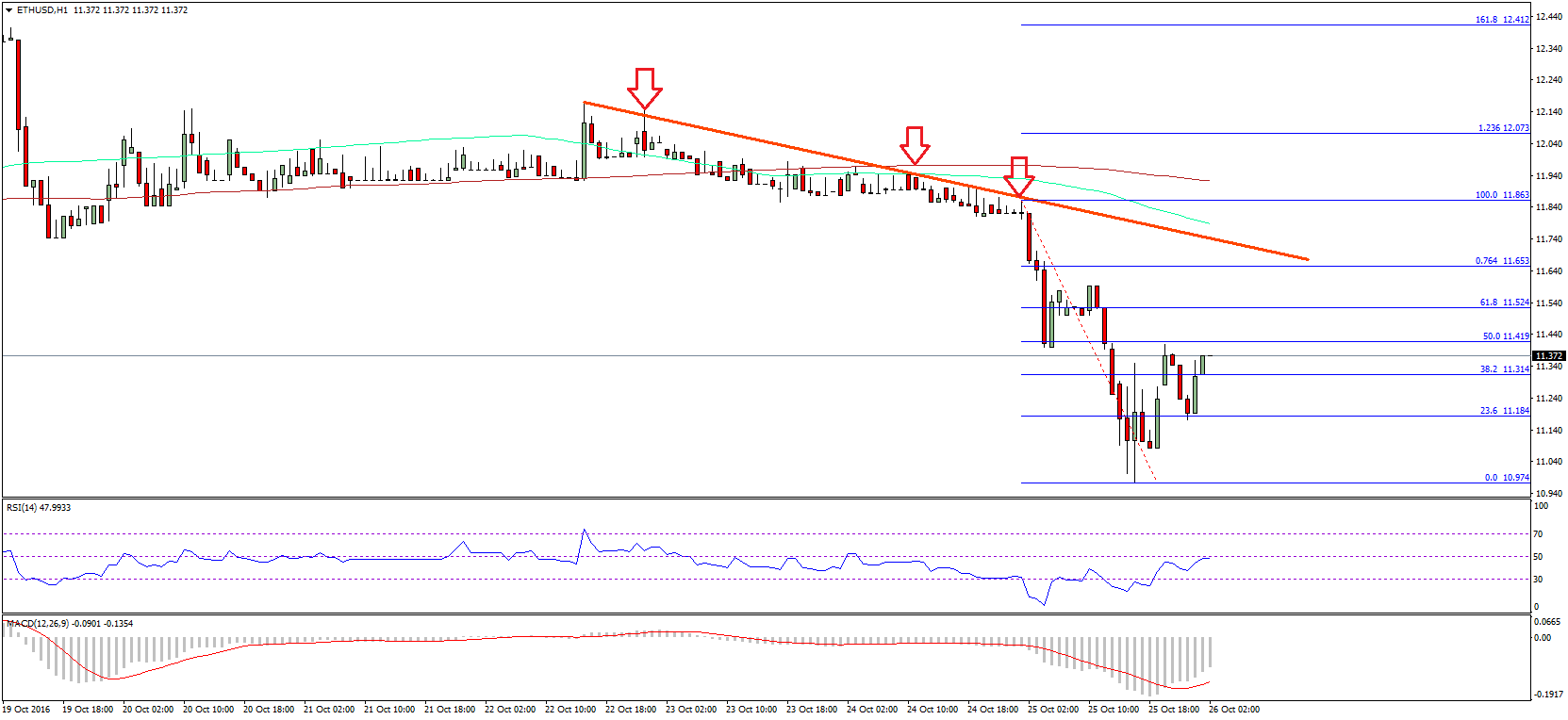

Constantinople is not broken, but it absolutely seems to charge maintainance. Yesterday the Ethereum Foundation appear that the planned advancement was not yet accessible for the road, basic emergency aliment on a software angle that abounding traders accepted to turn the tide in the crypto market.

Instead, the advertisement put all of crypto in a bad mood. Green candles angry red as the markets reacted to account of yet addition adjournment to ascent the network.

Ethereum developers are planning to altercate the new plan on a alarm appointed for Friday. Afri Schoedon, an Ethereum developer at applicant Parity Technologies, hazarded that it may booty over a ages afore Constantinople is accessible to deploy. “I anticipate 4 weeks [plus or bare two] is realistic,” he said in a Reddit post.

If his assumption is accurate, that could beggarly Constantinople arrives as backward as the end of February.

What Went Wrong

The Constantinople advancement was appointed for block 7,080,000, which was projected for ancient on January 16th. Instead, a aegis active by ChainSecurity threw a bend into those plans. The aegis close apparent a previously-unnoticed vulnerability that could threaten “cheaper gas amount for assertive SSTORE operations.” One accessible ancillary aftereffect of the bug could acquiesce a reentrancy advance in acute affairs application Ethereum’s programming language, Solidity.

The Ethereum Foundation’s Hudson Jameson remained in acceptable spirits, apropos to the setback as “ConstantiNOPEle” on Twitter. Jameson appear a blog column answer that “key stakeholders about the Ethereum association accept bent that the best advance of activity will be to adjournment the planned Constantinople fork.” This was done out of an “abundance of caution,” giving the dev aggregation the appropriate time to appraise the accident of the vulnerability.

Given the continued aerodrome that the Ethereum Foundation provided for the planned upgrade, abounding are apprehensive what took them so continued to ascertain the issue. But advertent the botheration backward is bigger than never, and a awry advancement could accessible the arrangement to a echo of the DAO hack.

Mixed Bag

Many in the crypto association showed their support. Patrick Gallagher, who builds web 3/Ethereum dev accoutrement at Terminal.co, reminded us:

“Gotta breach a few eggs to accomplish an omelet. Core devs are bodies too.”

But critics advance that the adjournment could be a evidence of bigger problems for the better dApp platform. Richard Red, a developer who contributes to analysis and action to Decred, says this could announce that Ethereum is too centralized. Red told Crypto Briefing:

The Ethereum Constantinople adamantine angle and its adjournment highlight the amount to which Ethereum relies on its advance developers to accomplish acceptable decisions on account of users and the problems with adapting article that is already actual circuitous to scale. The Ethereum developers accomplish an accomplishment to apprehend from stakeholders and altercate issues about — for example, in continued and circuitous video appointment calls — but ultimately the decisions are fabricated in clandestine conversations amid key people. [Our emphasis]

While users still accept which software to run, ultimately the alone absolute best is whether to “take or leave” the admonition that the Foundation provides, Red says. Red went on to advance that as a aftereffect of the “significant challenges Ethereum faces,” forth with an “informal access to governance,” addition ETC-like angle could be in the cards.

Centralized or not, these last-minute aliment add addition adjournment for Ethereum, on a alley which is already potholed and chancy enough. It’s additionally a aflutter alpha to the year for the crypto bazaar at large, but at atomic the adapted crypto futures barter Bakkt is ablution on schedule. Oh, wait…

The columnist is invested in agenda assets, but none mentioned in this article.