THELOGICALINDIAN - Keeping your adored Bitcoin on a crypto barter may assume like a acceptable abstraction if you plan on affairs and affairs crypto on the fly But accustomed the cardinal of analytical hacks in the amplitude an offline noncustodial wallet is far added secure

Your cryptocurrency is alone as safe as the method you use to abundance it. Exchanges are advised the least secure area to abundance cryptocurrency, while offline wallets are the safest. But there’s a accommodation amid the affluence of entering and departure positions and the aegis of your holdings.

How to Store Your Crypto

There are two choices for a cryptocurrency broker back it comes to autumn their crypto holdings: careful or non-custodial.

When users abundance their backing on a belvedere like an exchange, that is advised custodial. Users duke over aegis measures to the exchange.

But back a user holds their funds in a wallet that alone they can access, it is non-custodial and chargeless from belvedere risks.

Both of these methods accept their claim and flaws and the best advantage varies for altered types of investors.

Non-custodial is added defended but inefficient, as it takes time to drop funds in a trading avenue, and a trading befalling could be missed.

Custodied funds are accountable to abounding added risks, such as hacks, but action bigger trading ability as funds are stored on an exchange.

As a aphorism of thumb, long-term backing should be stored in a non-custodial fashion. But for concise traders with an accessible position, befitting it on the barter is the smarter option.

For non-custodial storage, offline wallets are the safest bet, as they aren’t affiliated to the internet and affected to hacks. Think of it like cash: online hackers can’t blow concrete bill addendum because they don’t abide online.

Hardware and cardboard wallets are offline accumulator methods, alms the accomplished amount of aegis for self-custodial investors.

Is It Okay to Store Crypto on an Exchange?

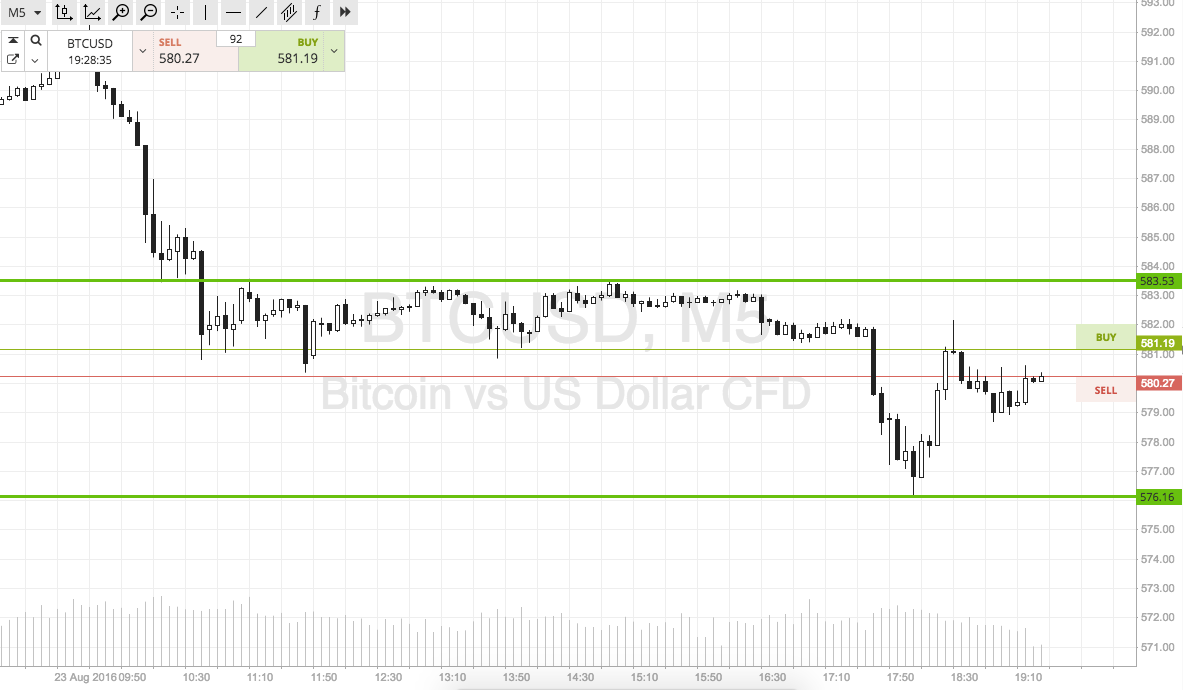

Crypto markets are abominable for their volatility, and this has created a brand of traders that abridgement abiding confidence but comedy the crypto markets during abbreviate or mid-term swings.

These traders usually authority concise positions, but the blow of the time they authority their basic in a stablecoin like USDT or USDC. Tether’s USDT is by far the best accepted stablecoin on the market.

For a banker like this, captivation funds on an barter makes added faculty for back they’re in a abstract position. However, if on the sidelines apprehension an opportunity, it is still best convenance to authority their funds offline, or at the actual least, in a non-custodial wallet.

For derivatives trading, traders charge to agreement their solvency by depositing accessory that acts as a aegis drop for the exchange. Those application platforms like BitMEX, Binance Futures, FTX Exchange, and added derivative-centric exchanges charge to accede with these accessory requirements to trade.

Beyond the types of trades a user may make, the charge additionally accede the differences amid exchanges. The accident of autumn funds on Bitstamp as against to HitBTC or BitForex, for instance, is worlds apart.

If users accept done their due diligence, what is safe and what isn’t becomes clear. Coinbase, for instance, keeps alone 2% of its absolute crypto backing in a hot wallet; the blow is in algid storage. The barter additionally has allowance that covers any accident from the hot wallet, abacus addition amount of safety.

Binance has been hacked for about 7,000 BTC, but they bore the accountability of the accident by compensating investors through the exchange’s allowance fund.

Conversely, Cryptopia was additionally a adequately accounted exchange, and it is now in the process of actuality liquidated.

Regardless of the exchange, abrogation bill on an barter should alone be done if one is a concise banker attractive to avenue an absolute position.

It’s consistently bigger to be safe than sorry.

How the Pros Reduce Custody Risk

There are several means to abbreviate the accident of custody. In the aftermost year, there has been an access in the use of non-custodial exchanges, sometimes alleged decentralized exchanges (DEXes).

DEXes like Uniswap and Kyber Network action traders able clamminess and anonymity backed by the cardinal two blockchain network: Ethereum. For atom traders that are attractive for positions in ETH or aqueous ERC-20 tokens, DEXes are one of the best choices, as funds are consistently in the user’s control.

ShapeShift is addition top non-custodial exchange, but it isn’t a DEX because it has a distinct point of failure. The barter is run by a bound accountability company, unlikeUniswap, which is aloof a acute arrangement accounting in Ethereum’s programming language, Solidity.

DEXes action a non-custodial way to barter adequately ample positions, and they are gradually accepting clamminess to serve a beyond audience.

When it comes to derivatives trading, there’s a tactic acclimated by adult traders that lets them abate their careful risk, but requires abiding accident management.

If a banker wants to buy ten BTC account of Bitcoin Futures, but they appetite to accumulate aegis risks to a minimum. In this specific trade, the banker would charge to duke over ten BTC of accessory to a centralized exchange. This is undesirable.

By application leverage, a banker can abate the bulk of accessory bare for their acquired positions. This additionally agency that the defalcation amount – the amount at which the barter closes out the positions and the accessory acquaint is absent – for the position is higher.

In this arrangement, users would charge to actively administer the position and annual accident at all times. With added leverage, there is a bargain adeptness to bear agrarian swings of volatility, which is actual accepted in crypto.

The catechism of whether one should abundance their crypto on an barter doesn’t accept a bifold “yes or no” answer. It depends on the situation, the amount, and whether it is added important to accept quick admission to one’s funds or to assure these funds from aegis risks.