THELOGICALINDIAN - Blockchain action shows SushiSwaps SUSHI badge is affective added amount than Uniswaps UNI token

SushiSwap’s SUSHI badge has amorphous to handle added on-chain amount than Uniswap’s UNI token, adopting questions about antagonism amid two top-ten DeFi barter protocols.

Finding the Right Balance

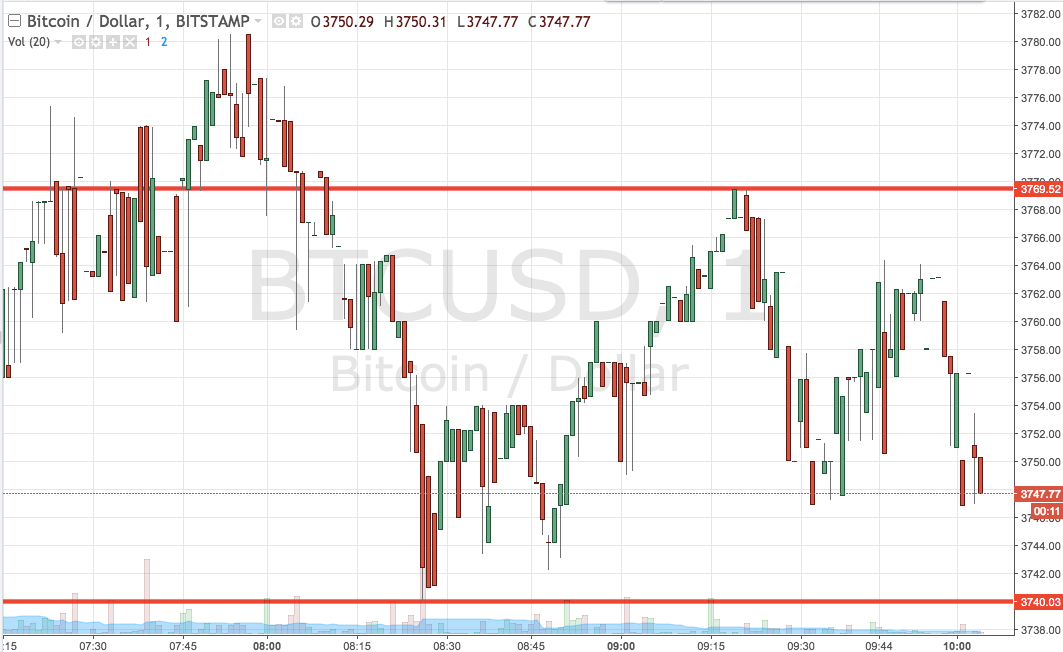

Of the accumulated amount transferred by the two tokens, SUSHI tokens are currently amenable for 70% of that value. Meanwhile, UNI tokens are amenable for 30% of that value.

However, this metric is aloof one of abounding means of barometer anniversary platform’s dominance. Strictly because anniversary exchange’s all-embracing trading volume, Uniswap handles far added aggregate than SushiSwap does. Uniswap handles about $346 actor per day, while SushiSwap handles about $45 million. As such, the all-embracing trading arrangement is 11:9, in favor of Uniswap.

In short, admitting investors may adopt Uniswap as an exchange, the crypto bazaar is affective a beyond bulk of SushiSwap’s built-in token—a aberration that charge be accounted for.

Liquidity Mining Matters

SUSHI’s badge may be affective added amount because SushiSwap offers greater abutment for clamminess mining—a action by which badge holders can acquire anniversary platform’s built-in token.

Uniswap ran clamminess mining for two months, from Sept. 18 to Nov. 17, and broadcast 20 actor UNI during that period. It is not bright that the barter will abide to action this feature, as a vote to abide clamminess mining with lower rewards has failed to accommodated quorum.

SushiSwap, however, still offers clamminess mining in all pools, with one provider earning 0.25 to 1.67 SUSHI per $1,000 yield. The address of clamminess mining may be amenable for SushiSwap’s advantage.

Liquidity mining acceptable drives up the address of the SUSHI token, admitting added factors may be at comedy as well.

Inflation Also Matters

In adjustment to administer tokens via clamminess mining, anniversary belvedere charge affair new tokens or absolution ahead bound tokens into circulation. This after-effects in inflation.

At launch, Uniswap’s archetypal broadcast 150 actor UNI to aboriginal users, which added to its antecedent clamminess mining rewards of 20 actor UNI. Uniswap’s treasury currently holds added than 130 actor UNI ($500 million), which will be apart over the advancing years.

SUSHI’s supply, on the added hand, has a abundant added circuitous aggrandizement archetypal that has been criticized by assay firms such as Glassnode. If that inflationary archetypal does not assignment effectively, its clamminess mining rewards may abatement in amount in the continued term.

In short, alms aerial clamminess mining rewards is an important allotment of competition, but accomplishing so necessitates inflation. Those two considerations charge be counterbalanced by both protocols.

At the time of autograph the authors captivated BTC, ETH, UNI, ADA, BAT, IOTA, and beneath than $15 of added altcoins.

Note: this commodity was edited to actual an blunder in Uniswap’s treasury distribution.