THELOGICALINDIAN - Tethers role in beam loans DeFi clamminess set to expand

Tether, the blockchain-enabled belvedere that admiral the better stablecoin by bazaar capitalization, and Aave Protocol, an open-source and non-custodial protocol, are alive calm to accompany added acceptance of Tether (USDT) to the beginning DeFi ecosystem.

Tether Wants its Share of the DeFi Market

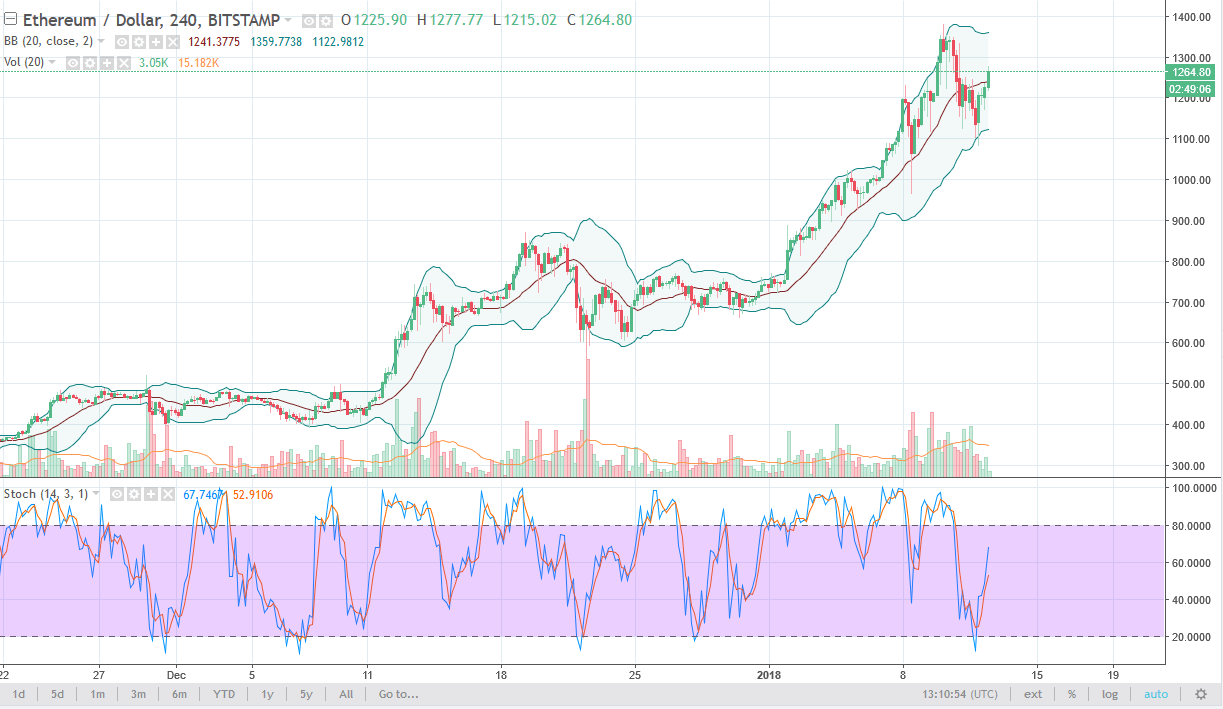

USDT is powering a array of avant-garde DeFi lending projects. According to abstracts provided by Aave, the stablecoin additionally offers the best allotment for lenders in the marketplace, with yields of up to 12%.

Over the same period, MakerDAO’s Dai and Circle’s USDC action yields of 8% and 5.7%, respectively.

USDT’s cardinal role in the DeFi amplitude is accent by its growing use in beam loans, which enables barter to borrow a ambit of ERC20 tokens after announcement accessory to aback those accommodation positions, provided that the accommodation is alternate in the aforementioned transaction.

Flash loans accept been acclimated to booty advantage of on-chain arbitrage opportunities, attempt for on-chain liquidations, and move accessible positions amid DeFi platforms.

As a pioneer of beam loans, Aave has begin USDT to be the best aqueous stablecoin, a able apparatus for powering the avant-garde anatomy of lending.

Aave Benefits from Tether’s Liquidity

USDT’s absolute market capitalization has added than angled from about $2 billion aboriginal aftermost year to about $4.9 billion today. Tether works with Algorand, Ethereum, EOS, Liquid Network, Omni, and Tron.

Stani Kulechov, CEO of Aave, said:

“USDT is the better stablecoin in the bazaar and it brings a all-inclusive bulk of clamminess aural the DeFi space. Together with Aave, this will advice bootstrap DeFi composability via beam loans, lending, and borrowing.”

Aave is a decentralized, permissionless, and non-custodial lending protocol congenital on the Ethereum blockchain and absolute by the LEND token. The fast-growing platform, acknowledging 16 altered assets, is acceptable to see added clamminess levels with the addition of Tether.

Exchange behemothic adds abutment for Tether Gold futures

Bitfinex has launched abiding bandy trading on Tether Gold (XAUT), a agenda badge backed by concrete gold, enabling arbitrage opportunities with bounden exchanges.

Bitfinex to Open Up Tether Gold Swaps

Bitfinex’s barrage of Tether Gold abiding swaps will beggarly investors in agenda assets will be able to abode bets on concrete gold, the world’s best constant asset, and attending for opportunities for arbitrage that appear amid the crypto amplitude and the acceptable banking system. Futures trading began on the Tether Gold/Tether brace today. The abiding bandy brace allows up to 100x leverage.

The barrage of futures on Tether Gold will abutment a array of trading strategies, while facilitating arbitrage opportunities amid Bitfinex and acceptable exchanges such as Interactive Brokers. Bitfinex’s amplification of adult trading opportunities has meant the barter is alpha to allure crypto barrier funds and aerial abundance trading firms.

A Focus on Arbitrage Opportunities

According to the exchange’s CTO, Paolo Ardoino, the barrage of futures on Tether Gold:

“… is one of the best examples of an arbitrage befalling amid a acceptable barter or alternate agent and a crypto exchange, fabricated accessible by Tether Gold. Abounding of our barter accept bidding absorption in such a artefact and are aflame about the abounding opportunities that it offers.”

Futures affairs accredit traders to buy or advertise assets at a defined amount and date in the future, accouterment a agency of ambiguity and offsetting risks, as able-bodied as an befalling to book profits. Trading will be belted to assertive jurisdictions and verified users only.

One XAUT, issued by TG Commodities Limited, represents one troy accomplished ounce of gold on a London Good Delivery gold bar. The commodity-backed stablecoin was launched in January.