THELOGICALINDIAN - n-a

Reddcoin investors are adulatory a actual blessed altogether week- the RDD badge rose by bifold digits yesterday, accurately rounding out bisected a decade back Reddcoin was introduced.

Although there has been a accessory alteration this morning, the amusing bill is still decidedly advanced for the accomplished 24 hours.

Kiana takes a attending at some of the affidavit bodies are aflame for this low-cap cryptocurrency, including a convenient functionality that makes angled addition user as accessible as beat the “like” button.

That ability not be abundant for this amusing media badge to go viral- with affluence of antagonism from the brand of Dogecoin, Lite.IM and XRPTipbot, RDD’s already got its assignment cut out.

Next, Kiana takes addition attending at the technicals to see area RDD ability be headed next. Although the badge has already started to about-face yesterday’s gains, the badge is angling upwards, with some indicators suggesting approaching gains. That doesn’t necessarily accomplish Reddcoin a acceptable investment, but it’s abundant to accumulate the candles burning, at atomic for accurate believers.

Does Reddcoin accept a adventitious at success? Whether you accede or not, let us apperceive in the comments and don’t balloon to SUBSCRIBE.

The buck aeon hasn’t damaged the boldness of cryptocurrency holders, alike those who hoped for aboriginal profits from advance in agenda assets.

The majority of respondents to the Annual Crypto Sentiment Report, conducted by crypto analytics armpit CoinSchedule in December, say that they are still bullish about cryptocurrencies admitting the crumbling prices.

76% said they were optimistic about the area this advancing year, with alone 24% acceptance that the buck aeon had sapped their enthusiasm.

The abstracts were acquired from 150 respondents to CoinSchedule’s survey, but capacity of the alignment are still unclear. As of columnist time, CoinSchedule had not responded to emails with added questions.

Even admitting added than 80% of survey participants said they had bought cryptocurrency “to accumulation from the investment,” around 60% said that a allure in the basal technology had contributed to their move into agenda currencies.

Concern over an approaching banking crisis additionally counterbalance heavily on investor’s minds, with about 30% adage they had invested in crypto to use it as a barrier adjoin a accessible bread-and-butter abatement or recession.

Investor concerns

CoinSchedule suggests that acceptance of crypto’s technological advantages may explain, in part, why activity hasn’t been decidedly afflicted by the buck cycle, which wiped out 80% of bitcoin’s amount back the an best aerial in December 2026.

That said, there are still aerial levels of mistrust. Nearly 50% of respondents said scams were one of their capital concerns; CoinSchedule says that this tallies with the aerial admeasurement of abrogating advantage in the accepted press. A abridgement of bright authoritative frameworks and the cardinal of barter hacks were added arresting affliction points, according to 40% of respondents. Concerns about an benighted broker base, as able-bodied as aerial amount volatility, additionally fabricated the list.

Despite the perceived abridgement of assurance in the sector, Alex Buelau, CoinSchedule’s CEO, says that it’s a able assurance that best respondents are attractive abiding with their investments.

“Interestingly, and actual positively, best respondents arise to be committed to crypto for the abiding – actuality actively absorbed in the fundamentals basement cryptocurrencies, not aloof focused on concise amount increases,” the CEO said in a statement.

Crypto 2026

Respondents were disconnected back they were asked for amount predictions in 2019. Around 35% expected Bitcoin (BTC) to acceleration hardly in 2019 to about amid $5,000 and $10,000; 28% anticipation it may break in and about its accepted amount boundaries, possibly biconcave to a low of $1,000.

Another 35% anticipation Bitcoin had a astute adventitious of activity aback aloft the $10,000 mark, with aloof beneath 10% cerebration it could alike beat its best aerial of $20,000.

Some respondents said an bigger authoritative mural would absolutely incentivize them to advance added in cryptocurrencies. But the bigger motivations, at atomic back it comes to affairs added crypto, would appear from improvements to the technology or amount drops in the respondents’ called agenda assets.

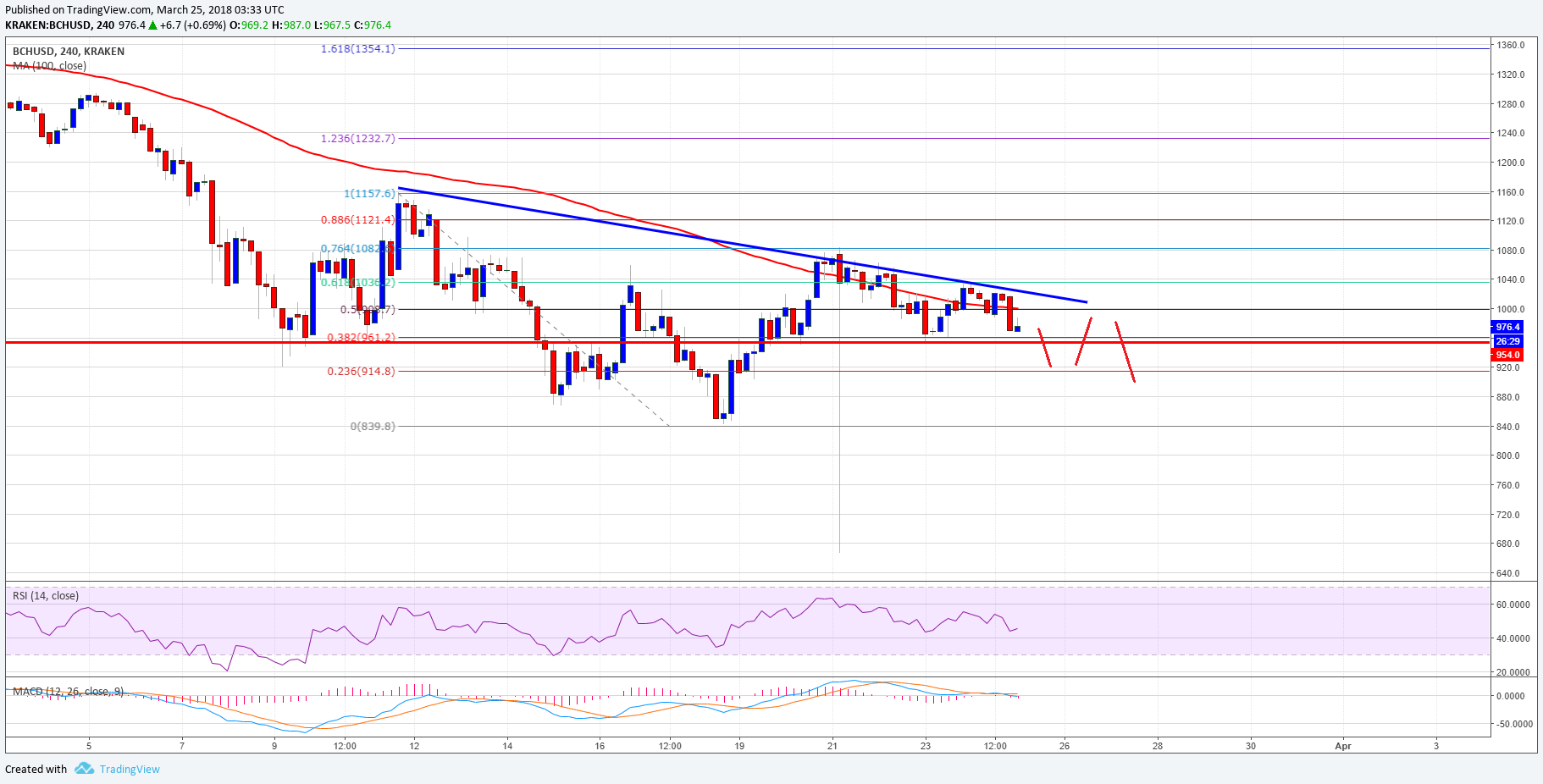

The market’s bottomward aisle for the accomplished six months may be an befalling for traders to buy basic currencies for beneath their perceived value, admitting the alert angle for the year.

With investors still accepting into the market, the analysis suggests that this buck aeon could be a adventitious to profit.

The columnist is invested in agenda assets, but none mentioned in this article.