THELOGICALINDIAN - The beforehand bullish blemish has been absolutely antipodal as the brace keeps accident momentum

Waves / USD Short-term amount analysis

Waves has a bearish concise outlook, with the cryptocurrency now trading able-bodied beneath its 200-period affective boilerplate on the four-hour time frame.

The four-hour time anatomy is additionally assuming a bearish blemish from a bottomward triangle pattern. The bullish blemish aloft the triangle arrangement that occurred beforehand this ages now appears to be a apocryphal breakout.

Technical indicators beyond the four-hour time anatomy accept angry bearish, although they now arise oversold.

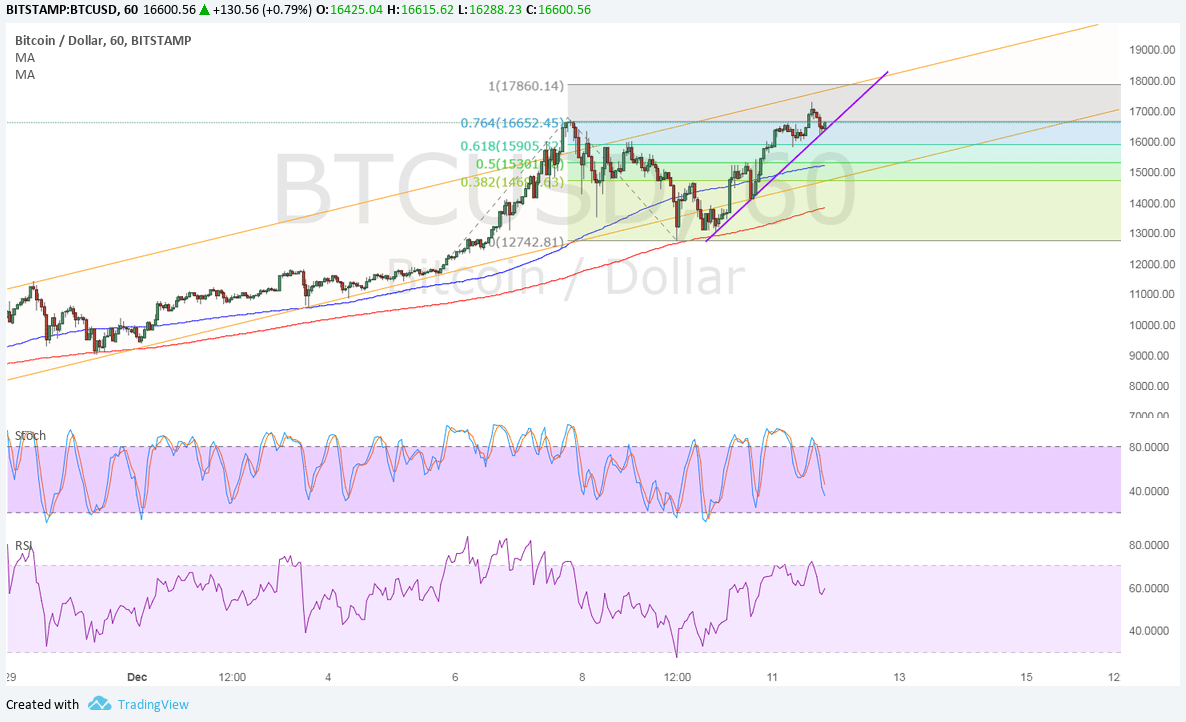

WAVES / USD H4 Chart by TradingView

WAVES / USD H4 Chart by TradingView

Pattern Watch

Traders should agenda that a bearish arch and amateur arrangement is now additionally arresting beyond the four-hour time frame.

Relative Strength Index

The RSI indicator on the mentioned time anatomy is additionally bearish, although it is now acutely oversold.

MACD Indicator

The MACD indicator on the four-hour time anatomy is heavily bearish, with the MACD arresting bridge arising a able advertise signal.

Waves / USD Medium-term amount analysis

Waves has a bearish medium-term outlook, with the cryptocurrency now technically bearish and trading beneath its 200-day affective average.

The circadian time anatomy blueprint shows that the Waves/USD brace has now collapsed beneath a balanced triangle arrangement and charcoal accessible to added losses.

Technical indicators on the circadian time anatomy accept angry bearish and appearance ambit for added downside.

WAVES / USD Daily Chart by TradingView

WAVES / USD Daily Chart by TradingView

Pattern Watch

Traders should agenda that afterward the bearish triangle blemish the Waves/USD brace has collapsed to a new 2026 trading low.

Relative Strength Index

The RSI indicator on the circadian time anatomy has additionally angry bearish and shows ambit for added downside.

MACD Indicator

The MACD indicator has angry bearish on the circadian time frame, with the MACD histogram and the MACD arresting band both breeding a bright advertise signal.

Conclusion

Waves has now angry bearish beyond both time horizons, with the contempo abatement in the cryptocurrency banishment the Waves / USD brace into a abundant lower trading range.

The bearish patterns apparent beyond the four-hour and circadian time frames may advance to added losses appear the December 2026 trading low.

Check out our coin guide for Waves.

We wrote several analytic letters on Waves, including the initiation and updates.