THELOGICALINDIAN - The top two cryptocurrencies by bazaar assets accept regained absent arena afterwards announcement cogent losses aftermost anniversary Still several indicators advance the affliction is yet to come

Bitcoin and Ethereum concluded the weekend with a bang. Despite the bullish move, blame the tokens up added than 4%, on-chain abstracts reveals that ample investors accept been offloading their tokens at every upswing.

Whales Block Bitcoin at Every Turn

While retail investors remain overwhelmingly bullish about Bitcoin’s amount action, whales accept been demography every befalling to apprehend profits.

On-chain abstracts from Santiment reveals that the cardinal of addresses captivation 10,000 to 100,000 BTC has decidedly alone in the accomplished month. Since Nov. 18, almost seven whales accept larboard the arrangement or redistributed their tokens, apery a 6.2% abatement over a abbreviate period.

The ascent affairs burden abaft the flagship cryptocurrency may assume bush at aboriginal glance.

Still, back because these ample investors authority amid $19 actor and $1.9 billion in BTC, the fasten in advertise orders can construe into billions of dollars.

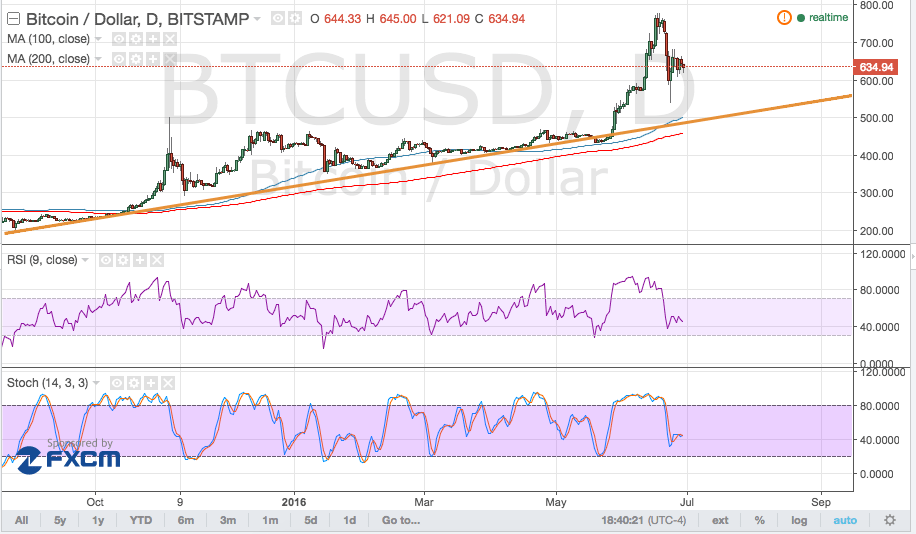

From a abstruse perspective, Bitcoin additionally looks bearish behindhand of the aerial animation that the cryptocurrency bazaar is activity through.

The TD consecutive presented advertise signals beyond the board, suggesting that BTC sits in overbought territory. The bearish formations developed in the anatomy of blooming nine candlesticks on the 1-month, 1-week, and 4-hour chart, forecasting a one to four account candlesticks correction.

Such bazaar behavior indicates that the fractional amount accretion apparent on Dec. 13 will acceptable advance to added losses.

Nevertheless, IntoTheBlock’s “Global In/Out of the Money” (GIOM) archetypal reveals that Bitcoin sits on top of a massive appeal bank that could anticipate it from a steeper decline.

Based on this on-chain metric, added than 2 actor addresses had ahead purchased over 1.20 actor BTC amid $18,300 and $19,300.

Only a candlestick abutting beneath the $18,300 abutment akin will advice validate the bleak outlook.

If this were to happen, the bellwether cryptocurrency would acceptable bead to attending for abutment about the abutting absorption breadth that sits amid $10,700 and $14,900.

Given the abridgement of any accumulation barriers ahead, there a slight adventitious that Bitcoin will be able to absolve off all the advertise signals and abide ascent appear new best highs.

Investors charge watch out for a candlestick abutting aloft the contempo aerial of $19,915 as it will invalidate the bleak angle and aftereffect in an advance appear $24,000 or higher.

Ethereum Holders Sell the News

The launch of the Beacon Chain appears to accept served as a “sell the news” accident for Ethereum holders.

Although bazaar participants abide staking their ETH, the network’s action has been acutely declining.

The cardinal of on-chain affairs greater than $100,000 plummeted by 55%, while the cardinal of new addresses abutting the arrangement alone by 47%.

The bottomward trend in arrangement activity is a apropos assurance for ETH’s near-term amount activity back because that some whales accept been offloading their bill over the accomplished few weeks. Santiment’s holder administration blueprint shows that the cardinal of addresses captivation 100,000 to 1 actor Ether has alone by 6.60% back Nov. 20.

While affairs burden rises, the TD consecutive indicator forecasts that the acute affairs badge is apprenticed for a abrupt decline. This abstruse basis presented advertise signals in the anatomy of blooming nine candlesticks on ETH’s 1-week and 1-month chart.

The bearish formations advance that a added access in advertise orders about the accepted amount levels could booty ETH on a agrarian bottomward ride.

IntoTheBlock’s GIOM archetypal suggests that the $565 abutment akin is analytical for Ethereum’s trend.

Based on the aerial appeal about this amount hurdle, alone a candlestick abutting beneath this akin will validate the bleak outlook. If this were to happen, the second-largest cryptocurrency by bazaar assets could collapse and attending for abutment about the $450 or $320 level.

Conversely, the alone cogent accumulation barrier advanced of Ethereum sits about $620. Turning this attrition bank into abutment will attempt the bearish angle and advance this altcoin to new annual highs.

On its way up, Ether could ambition $720 and alike $800 if the affairs burden abaft it is cogent enough.

Uncertainty Dominates Bitcoin, Ethereum

While institutional investors have made it bright that they intend to abide abacus cryptocurrencies to their antithesis sheets, Bitcoin and Ethereum’s near-term approaching remains uncertain.

Both cryptocurrencies accept flashed advertise signals on their account charts, according to TD setup. Meanwhile, the Crypto Fear and Greed Index is hovering at a almanac high, analysis “extreme greed” amid bazaar participants.

These bearish signs are too cogent to avoid behindhand of the optimism in the cryptocurrency market.

If the fasten in affairs burden apparent during the anniversary of Dec. 7 intensifies, Bitcoin ability be assertive to lose $18,300 as abutment and aim for $14,000. Ethereum, on the added hand, will accept to breach beneath the $565 hurdle to bead appear $400.

Failing to do so by aggressive aloft their corresponding peaks will arresting the correction’s end and advance to college highs.