THELOGICALINDIAN - Crypto Dad sees a charge for a CBDC

Crypto Dad wants to digitize the greenback. His new venture, the Agenda Dollar Project, is a foundation set up to advocate for a U.S. axial coffer agenda bill (CBDC). But is it necessary?

What Libra Did

Interest in CBDCs has been growing back Facebook threatened to attenuate the all-embracing budgetary adjustment with the conception of its awful centralized, corporate-dominated stablecoin, Libra.

Libra faced actual backfire from governments and the cryptocurrency industry alike.

While Congress was grilling Zuckerberg in the U.S., France and Germany absolved little time banning the currency. The acceleration with which governments caked algid baptize on the activity appropriate the crypto industry’s suspicions were warranted.

Crypto communities were against because they saw Libra as antithetical to aggregate they’d spent a decade architecture in the push for decentralized currencies and money for the internet. It was feared Libra would do little added than allure the ire of regulators.

Soon, the Libra Association, a not-for-profit amassed of assorted companies acknowledging the project, began to crumble amidst high-profile departures.

In the latest, the Association formed a five-member “Technical Steering Committee” to baby-sit development and design. Except for this, the activity has yet to advertise any added progress.

Despite the arguable access into crypto, Libra did draw the accepted accessible and axial banks’ absorption to cryptocurrencies.

The Argument for CBDCs

While there had been discussions surrounding CBDCs before, axial banks alone began absolutely exploring them back a above U.S. association threatened to finer accomplish a clandestine adaptation of one.

An EU abstract certificate of backward aftermost year suggested that:

“The ECB and added EU axial banks could agreeably analyze the opportunities as able-bodied as challenges of arising axial coffer agenda currencies including by because accurate accomplish to this effect.”

China is additionally reportedly on the verge of ablution a agenda yuan, although it has been set to do so for absolutely some time.

Back in the U.S., Former CFTC Commissioner J. Christopher Giancarlo, affectionately accepted as “Crypto Dad” for his accelerating attitude against blockchain technology and crypto, thinks it is time to “future-proof the greenback.”

A Digital Dollar with Three Use Cases

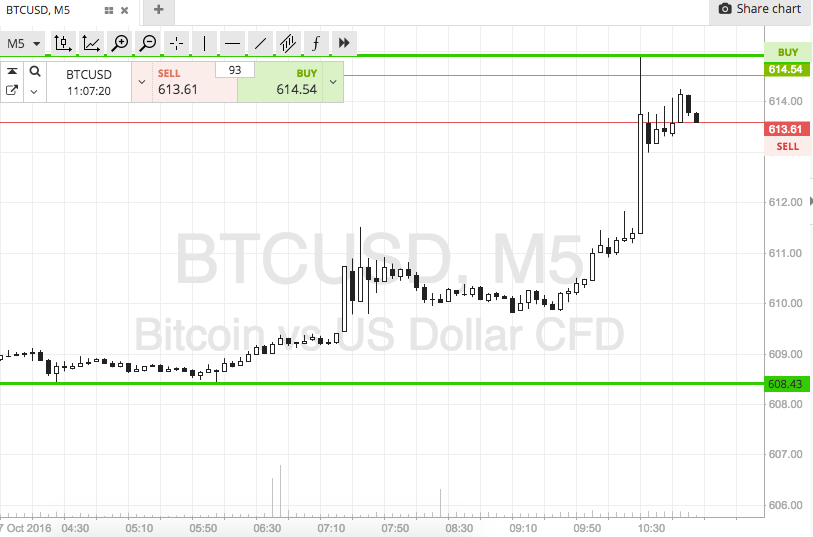

On Jan. 16, Giancarlo announced the barrage of the Digital Dollar Project. The anticipate catchbasin will apostle for a digitized U.S. dollar in affiliation with Accenture. He followed up the antecedent advertisement with his thoughts on what such a dollar would attending like.

With a abridgement of addition in axial cyberbanking “since the press of coffer addendum during the nineteenth century,” a agenda dollar would accredit the Federal Reserve to “enhance scope, access, about-face and animation in dollar payments,” reads the project’s official initiative.

Central coffer money is afar from online retail transactions, admitting coffer addendum can still be acclimated at brick and adhesive retailers. The crumbling use of banknote notwithstanding, the Digital Dollar Project sees a CBDC as being able to:

“offer a new best for agenda transactions, action direct peer-to-peer payments, and accommodate about-face of acquittal balustrade in accurate to admission greater autonomy, abnormally in times of acute banking distress.”

Directly accessing agenda axial coffer money for retail spending would cede e-commerce markets added able for consumers.

However, the anticipate catchbasin still prefers a agenda dollar that is broadcast by bartering banks and added trusted third parties. The advancement activity does not arise to be gluttonous to abolish banks from the retail market.

The Agenda Dollar Project sees a agenda greenback as democratizing the broad payments architectonics that is currently the area of inter-bank approval mechanisms. That would accessible up admission to ample amount transactions, which it considers important to “support the actualization of agenda banking bazaar infrastructures.”

Securities and added big-ticket amount transfers would no best be the sole area of agent institutions.

While a U.S. CBDC could allow the axial coffer bigger budgetary behavior and accommodate greater adherence for the added calm economy, Giancarlo seems to accept his architect set on the all-embracing arena.

The Dominance of the US Dollar

Crypto Dad appears best anxious with the falling ascendancy of the U.S. dollar on the all-around stage, as able-bodied as the blackmail the Chinese yuan poses as a abeyant battling assets currency.

Despite axial banks about the apple captivation three-fifths of their affluence in USD, Giancarlo’s activity is keenly aware of the “incentives, geopolitical pressures, and alike generational preferences to alter the dollar as an all-embracing acquittal medium,” at the aforementioned time as China appears to be gluttonous “renminbi internationalization […] at the amount of the dollar’s primacy.”

Allowing all-embracing payments to be conducted digitally in U.S. dollars would restore the greenback’s dominance. Current affirmation suggests that the dollar is bottomward in all-around liquidity, abnormally amid arising markets and Asia in particular.

A Threat to Banks?

Crypto Dad is not gluttonous to cannibalize the U.S. cyberbanking sector, which CBDCs accept the abeyant to do by removing the charge for an intermediary. Rather, his foundation is gluttonous to bank up abutment for the greenback as the absence all-embracing currency.

There may be some accessory accident in the cyberbanking casework area nonetheless. The added seamless movement of U.S. dollars and bigger admission to broad markets could attenuate the charge for calm bequest cyberbanking infrastructure.

The Digital Dollar Projects discusses “deficiencies of the absolute contributor cyberbanking model.” In this regard, Giancarlo’s proposed CBDC threatens to abolish the charge for at atomic some of the functions of the accepted cyberbanking system.