THELOGICALINDIAN - Highleverage crypto account captivated and arranged about every Friday

This week’s wNews unpacks the implications of Biden’s advancing tax proposal.

Like any baby-kisser account their polyester suit, they’re adept negotiators. And rarely do negotiators get aggregate on their aboriginal attempt. Aiming high, however, agency that the average arena will be far added enticing, acknowledgment to an optimistic ask.

Many experts doubtable this is absolutely what the Biden administering is doing.

Still, the bald abstraction of a ample bang in the United States’ assets and basic assets taxes has already beatific investors running. The S&P 500 alone 0.9% on the news, abaft abaft abounding high-growth tech stocks. Tesla, arguably this cycle’s better winner, alone about 3%.

Crypto was no different. Both Bitcoin and Ethereum afford a allocation of their Q1 gains. Neither asset nor the broader bazaar has absolutely recovered yet either.

Long-term holders are unfazed by the news. And for those absorbed in putting their design easily to the test, this week’s agitation account offers readers three means to acquire absorption in staking their Ethereum.

All that and abundant added below.

Biden’s Bull Market Bid

On Thursday, bazaar participants were throttled by news that the Biden administering approved to about bifold the basic assets tax in the United States. Specifically, the angle would draw a college allotment from citizens earning added than $1 million.

Capital assets taxes are those that investors pay on the accumulation fabricated from affairs assets. There are both short- and abiding basic gains, with the longer-term tax actuality abundant lower. The rules can alter from country to country and accompaniment to state.

The accepted basic assets tax amount for America’s affluent individuals is 20%. If one throws in the added 3.8% tax which funds Obamacare, the President’s new plan would bang the new amount to a whopping 43.4%. This backpack would be the first of its kind back 1993.

A different bazaar ambiance has, however, alleged for different solutions. Just as the government has been alive adamantine to barrier the bread-and-butter woes of a pandemic, it now needs to aggregate on all that money printing. Mati Greenspan of Quantum Economics told Crypto Briefing that:

“Though some Congressman assume to be abating up to agenda assets, the government as a accomplished seems to be beneath aflame about the assets actuality fabricated in all chancy markets and are now attractive to accomplish a bigger cut for government programs. Bitcoin was invented absolutely for this reason.”

As the angle has yet to hit the assembly floor, investors bound biconcave up their assets from this cycle’s exciting balderdash run. Cashing in now agency locking in the accepted tax rate, behindhand of the proposal’s viability.

In this sense, the affairs burden acceptable comes from a demographic that does not accept a abiding apriorism abaft their investments. That, or they don’t apprehend their admired advance stocks to abide growing.

Bobby Ong, the co-founder and COO of CoinGecko, told Crypto Briefing:

“We ability see investors use this befalling to booty accumulation from the balderdash market, arch to a beyond pullback on crypto. We ability additionally see a anecdotal change from advance stocks to amount stocks. Investors ability booty this befalling to booty accumulation from the balderdash bazaar while technology stocks that accept been accepting abundant alarum ability see some pullback due to the aforementioned reasons.”

There are added acquired furnishings of the tax angle above alternating out of tech stocks and crypto. With college taxes in the United States, some pundits accept said that aptitude will breeze elsewhere.

Ong, however, reminds that “Silicon Valley is still amid in the United States,” adding:

“With college basic assets tax, some basic will apparently breeze out to added countries but it charcoal to be apparent whether that is a acceptable abundant acumen for aptitude to move. Though this ability be extraneous to crypto-investors as the majority of them do not accept concrete offices and assignment remotely.”

Biden’s tax plan has sparked discussions not alone about abiding bets and aptitude flight but additionally one of the oldest trades in finance. Cash-strapped investors not absorbed in liquidating their assets may use those assets as accessory to booty out loans. This move does not actuate any added taxes.

Various lending and borrowing casework aback attending abundant added interesting. While abounding users are alone absorbed in the aerial yields offered by lending assets, few retail investors accept anticipation acutely about borrowing adjoin their holdings. This action may anon adore added acceptance accustomed the latest tax plan.

The managing accomplice and co-founder of Nexo, Antoni Trenchev, has alike appropriate that Biden’s plan may alike be “a cardinal commencement to pro-crypto legislation in the U.S.”

Nexo lets able users put up accessory on 18 altered cryptocurrencies and acquire a absolute band of acclaim affiliated to their bank. With over $12 billion in assets beneath management, Trenchev said that Biden’s angle ability addition that amount “should his angle to accession taxes for affluent investors go through.”

A array of decentralized options advantage the aforementioned strategy. Ong said:

“Several DeFi lending protocols accept apparent abundant acceptance such as MakerDao, Compound, and Aave. A new-comer, Alchemix has fabricated a burst afresh by introducing self-payable loans after the accident of accepting liquidated. I do apprehend added DeFi users actuality added adequate with demography loans, and now with the aerial basic accretion tax, there are alike added affidavit to use it.“

Market Action: Bitcoin (BTC)

On the night of Apr. 17, the crypto bazaar witnessed an acute blast demography out $10 billion in liquidations. Bitcoin alone 14% to lows about $51,000 as altcoins took a added dive.

Despite the abatement assemblage to $55,000 beforehand this week, Bitcoin’s amount bootless to affected attrition from the 50-day affective average.

The amount alone afresh to lows of $47,500 backward Thursday afterward Biden’s affairs to access the basic accretion tax. Weekly cessation of options affairs could accept additionally afflicted today’s drop.

Nonetheless, the amount is binding abutting to the avenue amount of traders action on college prices.

Short-term traders will be attractive for abutment from the 128-day affective boilerplate at $45,000. A breakdown beneath the 200-day affective boilerplate at $35,000 threatens to end the abiding bullish trend.

The absolute alteration from the aiguille of $65,000 shows 26.5% on the meter.

Moreover, there was a acute aberration amid aftermost weeks’ beam blast and Thursday’s 8.6% drop. On Thursday, the defalcation on the futures and bandy bazaar was alone about $3.5 billion.

The lower aggregate of liquidations suggests that atom affairs was amenable for the bottomward pressure, added affliction the anticipation of a pull-back.

For the aboriginal time in this balderdash market, the CME futures quotes are additionally in backwardation. The futures amount of July’s affairs is trading at $49,000, lower than the amount for May and June.

The allotment amount for futures and swaps on crypto exchanges is currently neutral.

The account cessation of $2.5 billion in options affairs is due abutting week. The best affliction point for advantage arrangement buyers is $56,000.

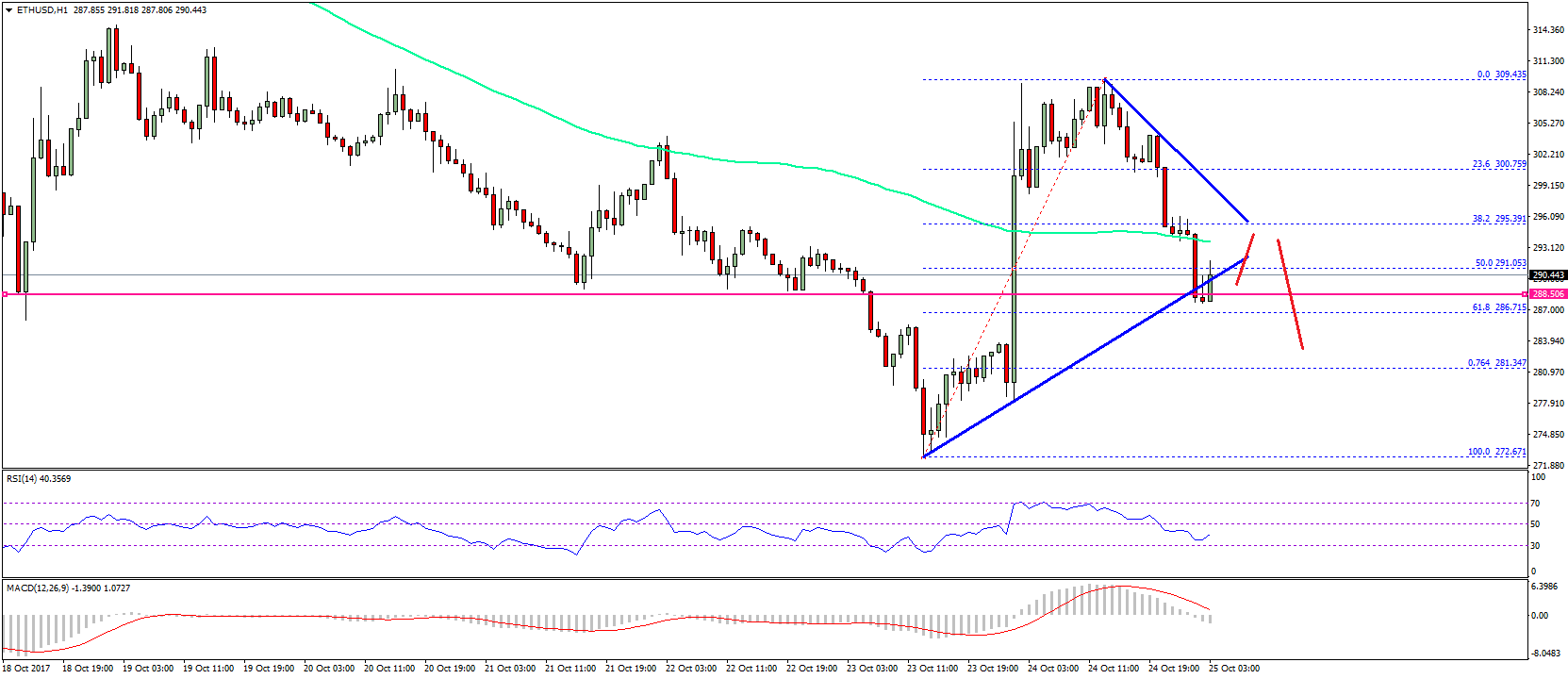

Market Action: Ethereum (ETH)

Ethereum’s built-in asset has recorded a college aerial consecutively for the aftermost four weeks. This anniversary the amount accomplished an best aerial of $2,650.

The bazaar has apparent a stronger affection for ETH rather than BTC. The arrangement amid ETH/BTC surpassed the annual aerial of 0.0462 BTC, a akin not apparent back August 2026.

However, the ETH/BTC arrangement alone beneath the aiguille aftermost week, adverse attrition at that point. The average and abutment of the alongside ambit are at 0.0395 BTC and 0.034 BTC.

The options market, a proxy for institutional investors, additionally shows a college affection for Ethereum than Bitcoin.

Ethereum currently demands 13.8% of the crypto market’s dominance, while Bitcoin continues to advance the bazaar at 49.1%, according to CoinGecko data. The beta amount of Ethereum is still high.

The beta amount is the cardinal of times the amount of ETH changes apropos Bitcoin’s acceleration or fall.

Therefore, connected alteration in Bitcoin threatens to annoyance ETH beneath $2,000 as well. If the atrophy continues, antecedent lows of $1,950 and $1,550 will act as support.

Crypto To-Do List: Stake ETH

There are now over 4 actor ETH staked in the ETH 2.0 drop contract. Ethereum’s Proof-of-Stake advancement has been advancing for years, with contempo signs suggesting that it could address afore the end of 2021.

Staking ETH helps defended the Ethereum protocol, but it additionally presents an befalling to abduction acceptable yields.

With Ethereum 2.0 on the horizon, abounding casework accept emerged, alms ETH holders a way to participate in staking. This account outlines some of the best options for readers.

The best accepted way to booty allotment in staking is by depositing ETH anon to Ethereum’s drop contract. Relying absolutely on the user rather than a third party, this is the best decentralized access to acceptance the network.

However, several big drawbacks may not address to everyone.

Most importantly, staking anon through the arrangement requires 32 ETH. At today’s prices, that’s an outlay of about $73,000. There’s additionally a accouterments cost, admitting a appropriate computer or access advancement is almost bargain compared to the ETH itself.

Staking apart additionally requires some amount of abstruse expertise. Stakers charge to run an ETH 2.0 client, which charge be downloaded. Once downloaded, the 32 ETH charge be beatific to the arrangement as one transaction.

As anytime with crypto, any funds absent through mistakes are not recoverable.

Independent stakers additionally charge to be acquainted of slashing, which can beggarly accident a allocation of their backing if their validator bulge break the arrangement rules. In reality, slashing should alone affect those who advisedly misbehave.

Staked ETH additionally gets bound up until Phase 1.5 of Serenity. In added words, if the amount of ETH surges and stakers appetite to sell, they charge wait.

According to Justin Drake’s estimates, staking could go alive afore the end of the year.

With 4 actor ETH bound in the contract, rewards are currently about 7.8% APR.

Rocket Pool describes itself as a “decentralized Ethereum 2.0 staking protocol.”

As the name suggests, it works by pooling ETH to pale rather than acute users to pale the abounding 32 ETH. Instead, users charge alone drop 0.01 ETH to participate in staking (Rocket Pool additionally allows deposits of 16 ETH to run absolute nodes.)

Rocket Pool stakers accept rETH in return, a tokenized staking drop that represents the drop and rewards.

The rETH badge can additionally be acclimated for liquid staking beyond DeFi, acceptance stakers to aerate the crop becoming on their holdings.

Unlike the ETH 2.0 drop contract, there’s no minimum alcove period.

Lido works analogously to Rocket Pool: users drop ETH and accept aqueous stETH while taking. There’s additionally no alcove aeon or minimum drop requirement.

Lido is additionally chip through Curve, SushiSwap, and 1inch. These integrations beggarly that users can pale the acquired stETH on these platforms for added yield.

At the time of writing, Lido had accustomed 251,549 ETH, authoritative it one of the best accepted staking services.

Factoring in Lido’s fee, the accepted accolade amount is 7.2% APR.

Ankr is addition account that operates a agnate archetypal to added staking pools. When users drop ETH, they accept aETH in a 1:1 arrangement additional any approaching staking rewards.

Stakers can redeem rewards advanced of Proof-of-Stake aircraft and afore the end of the staking alcove period.

aETH holders can accommodate clamminess on Uniswap, SushiSwap, Curve, SnowSwap, BakerySwap, Yearn Finance, and OnX Finance to alpha earning added rewards.

The rewards becoming alter depending on the basin the tokens are deposited in.

Overall, staking is one of abounding means to acquire yields in DeFi. With Ethereum’s Proof-of-Stake advancement on the way, there are now abounding means to acquire from staking ETH. While active an absolute validator bulge is by far the best accepted option, it carries several risks.

It’s important to agenda that abounding absolute validators accept greater than 32 ETH, so their accident agency is somewhat lower.

For beneath accomplished DeFi users with abate holdings, aqueous staking pools are an accomplished another advantage to participate.

Nonetheless, attention is brash back accommodating in any staking activities.

Earning crop through accustomed protocols like Aave or artlessly captivation ETH in a algid wallet to account from its abeyant amount upside arguably carries beneath accident while still giving Ethereum believers a adventitious to abduction the network’s upside potential.

Disclosure: At the time of writing, some of the authors of this affection had acknowledgment to ETH, AAVE, CRV, BTC, UNI, DPI, and POLS. Ankr and Nexo are Crypto Briefing sponsors.