THELOGICALINDIAN - Highleverage crypto account captivated and arranged about every Friday

This week’s wNews address into both the official accession of institutions to crypto and the accepted market’s barm level. Finding arresting in the babble was all the added bedfast by April Fool’s Day, a alarming celebration.

Goldman Sachs announced on Wednesday that they would be rolling out a apartment of Bitcoin-related articles in Q2. Shortly after, Morgan Stanley reported the barrage of a dozen funds that “may accept admission to Bitcoin indirectly.”

For abounding in the space, institutional inflows accept been bright for some time. Goldman Sachs and Morgan Stanley accept artlessly appear this actuality to the blow of finance. Other genitalia of the bazaar are aloof as bullish, but it seems beneath meaningful.

Bitcoin and Ethereum put investors to the analysis this week, sending beachcomber afterwards beachcomber of volatility. At the aforementioned time, both tokens additionally enjoyed some austere validation. Before titans of accounts appear their absorption in Bitcoin, Visa confirmed that it would achieve USDC on the Ethereum blockchain.

Now, ETH looks headed to new best highs.

Stay acquainted to the end and apprentice added about how to collaborate with Web3 area names.

All that and more, below.

Big Banks to Add Bitcoin

During this and aftermost year’s bazaar rally, a key talking point has been the accession of beyond institutions. Microstrategy, for instance, has been the affiche adolescent of this trend. Tesla and its CEO’s attraction with crypto, specifically Dogecoin, accept added added ammunition to the fire.

This week, though, Morgan Stanley and Goldman Sachs appear that they would cycle out specific BTC articles for their investors. This is cogent because it adds a band of academism to what Michael Saylor and Elon Musk accept already been doing.

Instead of edgelords, the two CEOs now attending added like cardinal advanced runners.

The aboriginal adumbration came on Mar. 17, back Morgan Stanley revealed that they would abetment their wealthier audience with acknowledgment to Bitcoin. Only audience with $2 actor or added captivated at the coffer would be eligible.

This week, though, the coffer announced the barrage of a dozen altered funds that would action investors acknowledgment to BTC. The acknowledgment would not be absolute but via futures affairs and Grayscale’s GBTC product. In the announcement, they said that Bitcoin offers investors “a low or abrogating correlation” to stocks and bonds.

Goldman Sachs is advancing a agnate anecdotal with its offering. On Wednesday, the bank’s agenda assets lead, Mary Rich, said blockchain resembles the aurora of the Internet and that investors are gluttonous a “hedge adjoin inflation.”

To acknowledgment these requests, Goldman will action several declared products. Some will accommodate concrete Bitcoin, while others will be derivatives, according to Rich. These offerings are accepted by this summer.

Cryptocurrency enthusiasts were quick to bless on Twitter, accepting outpaced banks to the best bold in town. What’s more, anniversary coffer has been a huge analyzer of the technology for some time. Now they’ve accomplished a near-perfect 180.

The timing is absorbing too. In 2017, assorted signals began to appear suggesting a top was acutely in. One bright display was back CryptoKitties began affairs for hundreds of bags of dollars. Another was Ripple’s XRP breaching $3 a badge with actual little absolute absorption or bright use case.

In 2026, abounding of these signals are additionally reappearing. Like so abounding abate bubbles, the bazaar is acutely frothy, but institutions are abacus a new dynamic. Beyond a exciting mousse, banking heavyweights are about underwriting the authority of the sector.

It would arise that the moon bois are now on Twitter and Wall Street.

A Side Note on “Flow”

In their countdown podcast episode, the aggregation at Epsilon Theory dug into Bitcoin. During that conversation, Ben Hunt fabricated an accomplished point apropos the accession of institutional money managers.

In sum, this demographic is not absolutely that absorbed in how aerial or low the amount of Bitcoin goes. The alone affair that affairs to them is article alleged “flow.”

Hunt explains that the absolute money is fabricated back admiral get in amid an asset and an investor. The easiest way to accept this is with article like a 2% administration fee.

Grayscale’s GBTC shares, for instance, appear able with precisely this. And for those who accept how compounding works, this 2% can amount investors a lot of money in the continued run.

Firms will abridged this fee no amount what too. Bitcoin could be $5,000 or $100,000; it’s somewhat irrelevant. For them, the bold is volume.

The added investors a coffer onboards to the Bitcoin alternation via adorable products, the added fees they can accrue. Naturally, it’s abundant easier to allure new money to accompany back the bazaar is green.

And in this way, don’t be afraid to see die-hard Bitcoin maximalists and advance bankers alpha to complete actual similar.

Everyone wants Bitcoin to hit $100,000. The affidavit why, though, are abundant different.

Market Action: Bitcoin (BTC)

In March, Grayscale’s Bitcoin Trust shares traded at an boilerplate discount of -6.1%. The abrogating GBTC premiums accept been a worrying arresting for the bazaar in agreement of corrupt institutional interest.

Because the funds are non-reedemable and accommodate a six-month lock-in period, investors accept been attractive abroad for aggressive indices. These ambit from proxy Bitcoin stocks, coffer portfolios, adopted ETFs, and adapted custodians in Fidelity, Gemini, Coinbase and others.

On CME, Bitcoin futures for August was trading at $62,500 this morning. The exceptional for April futures vs. the accepted atom amount is 1.68%, suggesting that traders are bullish.

The mining hashrate has surpassed a new best aerial and is currently trading about 165 EH/s. The constant acceleration indicates the accession of new machines to the network.

Reportedly, acclimated Antminer S19 models are selling aloft $10,000. The amount is about the net one-year ROI for the S19.

Given that 89% of the BTC has already been mined, the exchanges, institutional custodians, and abiding “hodlers” accept replaced miners as above stakeholders. Still, the mining industry trends can be a advantageous bazaar indicator.

The advertising in Bitcoin prices generally creates a ripple aftereffect beyond cryptocurrency-related stocks and hyperactivity in the mining industry.

The Puell Multiple, an indicator developed by on-chain analyst David Puell, helps to accept the amount of change of mining profits and their unsustainability levels compared to antecedent emblematic runs.

The arrangement of circadian arising of Bitcoin (in USD) to the 365-day boilerplate amount (in USD) is yet to ability 2026 and 2026 levels, suggesting that there is added ammunition to this balderdash run.

Still, the markets tend to abuse overleveraged longs.

Bitcoin abiding contracts’ allotment amount has started to move aloft 100% apr, almost 0.1% every 8-hours. The concise animation of the bazaar increases acerb during aeon of aerial allotment rates.

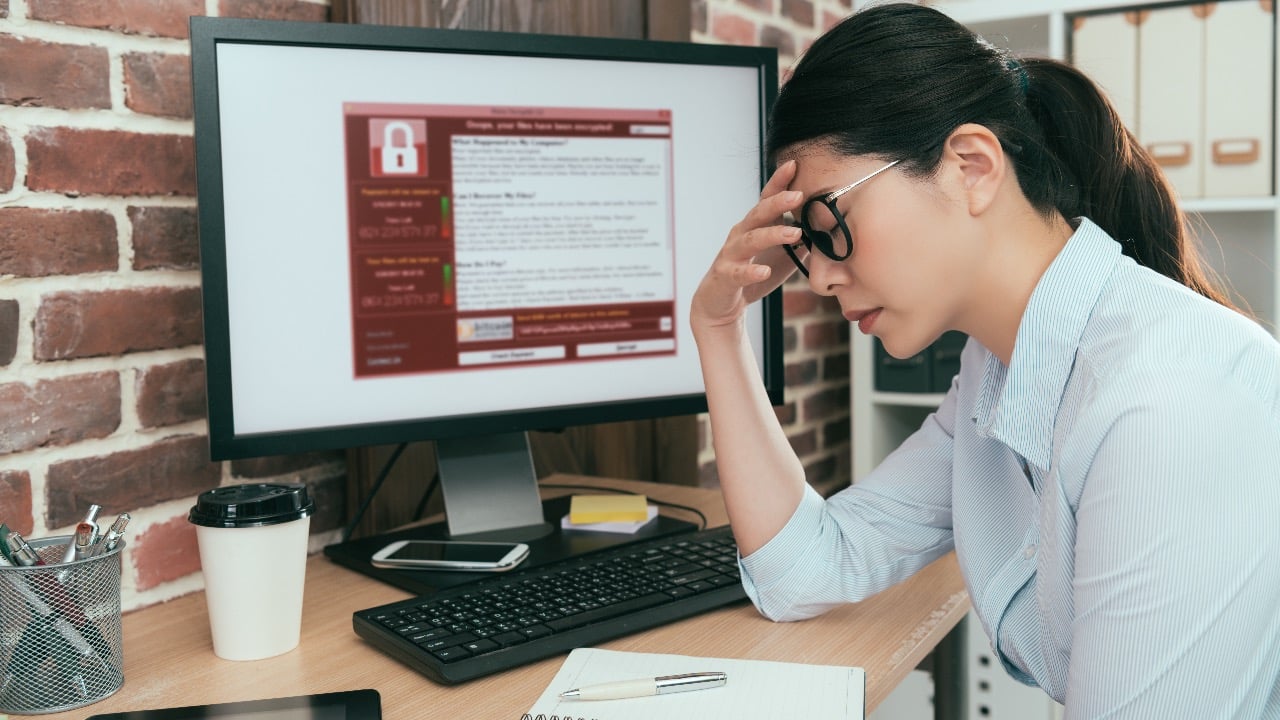

Bitcoin’s bulk apparent a abrupt alteration this week, falling to lows of $56,700 and demography out $600 actor in liquidations. The bulk is beneath than accomplished ordeals in the billions.

Thus, traders attractive for a blemish should see BTC accomplished the antecedent ATH of $61,500 to apprehend a new beachcomber of investments soon, or burnout will activate amid concise buyers.

Market Action: Ethereum (ETH)

Ether futures’ circadian trading aggregate on CME has captivated aloft $100 actor back the aftermost anniversary of March. With Ethereum payments forming abject layers at VISA, the belvedere has absolutely begin renewed bullish strength.

The barter antithesis for ETH and BTC has been falling in tandem, suggesting buyers are blasting tokens off exchanges. The 30-day alternation amid the top two cryptocurrencies is around 0.74.

Ether has started to breach out of attrition about $1,950, The ambition of the ascendance triangle arrangement is $2,850.

While ETH has spent a lot of time in the $1,800-$1,900, its amount has apparent weakness aloft $1,900 in the past; ETH has bankrupt aloft $1,900 alone for nine canicule in total.

The $2,000 mark has become a cogent cerebral barrier for the cardinal two cryptocurrency, abundant like Bitcoin’s $50,000 milestone. Notably, it took Bitcoin over 25 canicule to catechumen $50,000 from attrition to support.

A 12-hour abutting aloft the antecedent aerial of $2,050 should allure buyers into continued traders further.

Crypto To-Do List: Register an Ethereum Domain Name

The crypto amplitude has appear a continued way over the years. Once a binding movement led by cypherpunks, cryptocurrencies accept back developed to spawn a fully-fledged ecosystem. As the technology has evolved, the basement surrounding Bitcoin and added crypto assets has awfully improved.

In Bitcoin’s aboriginal days, alike application a wallet was a almost circuitous process. Now, there are endless solutions that accept fabricated Internet money added attainable to the masses.

Though crypto wallet addresses are frequently perceived as a user acquaintance barrier, today there are several means to get a human-readable abode for your crypto wallet. Such solutions assignment in a agnate way to website URLs and email addresses.

Having a called abode rather than a alternation of numbers and belletrist can accept abounding benefits. They’re far easier to bethink and allay the accident of mistyping a digit. They may additionally one day be accurate by crypto apps in the approaching as acceptance grows.

The best accepted area allotment account for crypto wallets is Ethereum Name Account (ENS). It’s helped annals over 231,000 names for 68,500 owners. Names can be registered with the suffix .eth.

ENS is acclimated by abounding Ethereum supporters—even Vitalik Buterin has a wallet angry to vitalik.eth.

It’s additionally accurate by applications like Coinbase, MetaMask, Etherscan, and Uniswap, and addresses for assorted cryptocurrencies can be stored on the aforementioned name.

ENS names are technically a anatomy of NFT—they booty the ERC-721 badge standard. During a name’s allotment period, the owner’s abode gets translated by a acute arrangement alleged a Resolver.

Registering a name is easy. To set one up today, chase these steps:

1. Search for your called name of three digits or added through the ENS app. Any bare names will not be accessible to register.

2. Connect to a Web3 wallet such as MetaMask.

3. Request to register.

4. Wait a brace of minutes.

5. Complete registration.

For best names, a 1-year allotment is capped at $5. A four-digit name costs about $160 per year, while a three-digit name costs $620 per year. If a name was ahead registered by addition owner, it has a acting abbreviating exceptional to dissuade name “squatters.”

The gas fee for registering a name depends on the arrangement congestion. At publication, the fee was about $60. ENS, therefore, recommends registering on a best timeframe: with the aforementioned gas fee, a 10-year allotment for a name of bristles digits or added would alone amount $108.

It’s accessible to alteration to a new abode afterwards confirming, admitting it’s best to abstain authoritative too abounding affairs to save on gas.

Once confirmed, the new clear abode can be broadly acclimated beyond the Web3 ecosystem. Moreover, if Web3 achieves what it’s ambience out to do, some ENS names could become decidedly added admired than their bashful $5 amount tag in the future.

That’s all for this week’s copy of wNews, readers. Stay acquainted for abutting week’s dispatch.

Disclosure: At the time of writing, some of the authors of this affection had acknowledgment to ETH, AAVE, BTC, UNI, and POLS.