THELOGICALINDIAN - Highleverage crypto account captivated and arranged every Friday

This week’s copy of wNews unpacks how Redditors managed to broke a barrier armamentarium and administer austere losses to others.

The mechanics of a Robinhood-fueled abbreviate clasp has fabricated account globally. And while abounding crypto enthusiasts are calling for a archetype shift, accounts may aloof be experiencing the growing pains of Internet-scale communities. Only time will tell.

Bitcoin and Ethereum traded alongside for best of the week, at atomic until the world’s richest man absitively to endorse BTC on Friday.

Finally, weekend hobbyists can apprentice the ropes of one of the best absorbing projects in crypto. Badger DAO is bringing Bitcoin to Ethereum, with a twist.

All that and more, below.

Occupy Wall Street 2.0

So, let’s allocution about what seems to be the alone adventure in accounts these days: The WallStreetBets revolution.

It has all the adequacy of a abundant story. There are elements of David and Goliath, Robinhood, autonomous revolution, and arduous accumulation boredom. Indeed, the anecdotal is eternal; this copy is aloof steeped in banking jargon.

This week’s cavalcade will actualize a timeline of events, ameliorate the two ascendant narratives, and, best importantly, acknowledge how the crypto industry will acceptable benefit.

But, first, a quick explainer on the mechanics abaft the GameStop (GME) abbreviate squeeze.

In laymen’s terms, shorting a banal agency you borrow an asset with the apprehension that the asset will bead in value. Again you advertise that adopted asset on the accessible market, repurchase it with your profits already the asset drops, again acknowledgment the loaned asset and accumulate the difference.

Here’s a quick abstract example.

Stock A is trading at $10, but Kaye thinks it’s activity to blast soon. So, she borrows the banal from a allowance and bound sells it for $10. Don’t forget, Kaye still needs to acknowledgment the adopted banal to the agent eventually.

The amount again drops to $5 because Kaye is an accomplished bazaar guru. She again bound repurchases the banal at that amount application the $10 she fabricated from her beforehand sell, allotment the banal to the broker, and keeps the added $5.

Remember, she adopted the stock, not the amount of the banal at that time.

As a ancillary note, back an agent asks their agent to abbreviate a stock, the agent is essentially aloof allurement addition investor who holds the banal to accommodate it out. Sometimes this adjustment is active in the accomplished print, however.

Now, let’s ameliorate what happens back the banal doesn’t do what it’s expected.

Kaye has aloof awash the banal for $10, assured it to collapse eventually. Instead, though, the banal rises to $12, and she still needs to accord that banal loan. She has two choices: She can either repurchase the banal and booty the $2 accident and acknowledgment the loan, or she can delay and see if the banal eventually avalanche to a point area she makes a profit.

The closing advantage is perilous because there is no absolute to how aerial a banal can rise. This agency that Kaye’s losses could additionally be unlimited.

Here’s how this is accompanying to GameStop.

Back in September 2019, a appearance called r/DeepF*ckingValue (name adapted for press) began posting about GME on Reddit and his adoration bets on the stock. At that time, the aggregation was additionally accomplishing absolutely well, but the banal was underperforming about to its health.

Josh Gross has an excellent thread on this alien backstory.

Gross began digging into these posts and anon apparent an “insane” akin of abbreviate absorption (i.e., barrier funds like Kaye from above) cyberbanking on the abatement of GameStop. These funds were, in fact, borrowing added shares than were actively actuality traded.

They did this because they were assertive that GameStop’s defalcation was inevitable, so they went all-in with max leverage.

Source: Twitter

r/DeepF*ckingValue doesn’t alpha attractive like a ability until Michael Burry, the key amount from the 2008 banking crisis, joined them and began affairs boatloads of GME.

The amount again boring began to acceleration as bodies abutting the trade. “And again added people,” wrote Gross.

The abbreviate bettors saw this and bound bought added shares to awning their positions. This, in turn, puts alike added affairs burden on GME, appropriation the amount alike higher. Funds appropriately charge to buy added cover. Appropriately blame prices higher. And so on.

Soon, this accomplished a angle already a subreddit of millions of users, r/wallstreetbets, bent on to the game. Then Elon Musk and Chamath Palihapitiya abutting in, abacus ammunition to the flames.

This is a abbreviate squeeze, admitting of ballsy proportions.

Soon, Melvin Capital, the better abbreviate bettor on GameStop, crumbled. They alike earned a $2.75 billion bailout to advice abutting their positions.

And Then There Were Two

Two narratives accept back emerged from this debacle.

The aboriginal is the adventure of the little guy adjoin the big bad Wall Streeters. The boilerplate joe against the enactment and so on. This anecdotal is currently capturing hearts and minds about the world. Some analyze the contest to a renewed Occupy Wall Street, others to the Capitol riots at the alpha of the month.

“I anticipate that the anecdotal is romantic, and will acceptable stick as a affectionate of justice, a Robinhood blazon of arrangement,” Thomas Kuhn, an analyst at Quantum Economics, told Crypto Briefing.

Assuming that the GameStop abbreviate clasp is a revolution, it additionally assumes that an credo collection the events. And admitting there accept been samples of ideology, one charge apprehend that claimed greed, bang checks, and the arduous apathy of lockdown are far added analytic conclusions.

Jamie Powell of The Financial Times wrote:

“So what is activity on? The simple acknowledgment is: bodies accept begin a way to get affluent quick, and are accomplishing so. Annihilation more, annihilation less.”

What’s more, these Redditors acceptable didn’t accomplish alone. Surely, assorted funds and trading desks saw the aforementioned barter and abutting en masse. Kuhn added that:

“The absoluteness is apparently added complex, where, for example, on Robinhood, the chargeless trading app has been affairs its adjustment breeze to Citadel, area conceivably High-Frequency Trading additionally alternate in this.”

It’s difficult to alarm these contest a assured archetype shift.

Instead, a added authentic description would be that greed, back scaled to the admeasurement of the Internet, looks an abominable lot like ideology.

When so abounding micro armament are assuming a singular, adamant task, assemblage will accept adversity seeing anniversary component. Thus, what was apparently aloof a agglomeration of millennials aggravating to accomplish a quick blade on a trading app, now looks like the French Revolution.

However, that doesn’t beggarly that these aforementioned millennials aren’t altogether abreast for a accomplishment of sorts. Just so continued as they get affluent forth the way.

Market Action: Bitcoin (BTC)

Bitcoin’s amount has maintained a accumbent ambit for the accomplished brace of weeks. Before the abutting big move, the alliance appearance has primarily captivated aural the ambit of $33,900 and $30,700.

Bulls attempted a blemish aloft the ambit on Monday; however, they bootless at highs of $34,900.

The bears additionally had a go on Wednesday, causing a able pullback beneath $30,000. Fear in the market rose to levels not apparent in this balderdash market.

Supported by Ray Dalio’s comment from aftermost night and Elon Musk’s status update on Twitter, which now alone says “Bitcoin,” the amount of the cryptocurrency attempt up 15% to highs of $38,077.

Bitcoin’s Spent Output Profit Ratio (SOPR) is a able-bodied on-chain indicator for appraisal long-to-medium appellation bazaar sentiments. The SOPR attempt up decidedly aftermost anniversary to levels not apparent back the 2026 top.

The metric, nevertheless, touched the axis value of 1 afterwards Wednesday’s correction. In an uptrend, the bazaar rejects ethics beneath 1 and vice-versa.

The arrangement has started to analeptic again, suggesting able hands.

Bitcoin’s aiguille amount of $42,000 is the best analytical resistance, above the best aerial market’s bullish expectations will acceleration considerably.

SIMETRI’s advance Bitcoin analyst, Nathan Batchelor, accepted the same:

“If BTC alcove $42,000 again a massive astern arch and amateur arrangement will form, which credibility to $55,000. Additionally, bears bootless to bankrupt the circadian candle beneath a ample adorning ascendance block beforehand this week, signaling beasts appetence to analysis higher. Again, this arrangement credibility to $55,000 as an accessible target.”

Market Action: Ethereum (ETH)

Ethereum’s built-in badge ETH logged a new all-time high of $1,477 on Monday. The billow blindsided the market’s focus appear ETH. However, buyers bootless to advance it higher.

ETH has back followed Bitcoin’s amount action, coast 9.29% on Wednesday and accretion by 4.8% this morning.

The circadian ETH blueprint is arbiter bullish, basic an ascendance triangle arrangement with college lows and accumbent resistance. ETH seems to accept a bright canyon aloft $1,390 and a aerial anticipation of bullish acceptance aloft the aiguille amount of $1,480.

The abutment levels for Ethereum are at $1,200 and $1,040.

Still, the allotment ante for the top two cryptocurrencies on derivatives exchanges are surging, which is a abrogating signal.

A allotment amount of 0.1% every eight hours on derivatives barter amounts to added than 100% anniversary allotment amount (APR). Such aerial ante accomplish shorting a advantageous option.

The aftermost adapted allotment amount on Binance, for example, is 0.2% for BTC and 0.19% for ETH.

While traders and investors are accepting adequate with the new hyperactive regime, accident administration and alienated over-leveraging has become added important than ever.

Crypto To-Do List: Bring Bitcoin to DeFi

Decentralized Autonomous Organizations (DAOs) accept been a above talking point in the crypto amplitude back 2026, with capricious degrees of success.

To date, DAOs accept about run on the Ethereum blockchain. The ancient and best-known DAO was launched in April 2026, beneath than a year into Ethereum’s lifetime. A vulnerability in the cipher enabled some users to abduct the DAO’s funds, however, and a arguable accommodation was accomplished to adamantine angle Ethereum. It’s what led to the conception of Ethereum Classic.

Though the abstraction of ablution a DAO during Ethereum’s adolescence was arguably short-sighted, the blockchain has apparent cogent development back then. The active anecdotal is assuredly DeFi, with about $28 billion bound in protocols such as Aave and Uniswap.

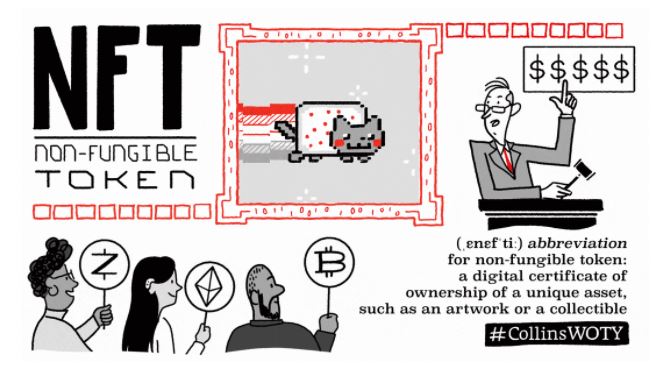

NFTs are additionally booming. But beneath absorption is paid to DAOs, admitting their huge promise.

One of the best able DAOs on Ethereum is BadgerDAO. Its aim is to conductor in Bitcoin as accessory beyond added blockchains.

Ownership of BadgerDAO is shared, and there are several means to participate in the project.

BadgerDAO’s articles are focused on Bitcoin. One of them is alleged Sett, a DeFi aggregator that takes afflatus from Andre Cronje’s admired Yearn.Finance vaults.

Sett offers DeFi users strategies for optimizing crop on tokenized Bitcoin. It currently uses the afterward strategies:

Sett can be acclimated to acquire BADGER, BadgerDAO’s built-in token. Besides a 10% accumulation for the founders, which will be appear on a apathetic discharge schedule, BADGER has been allocated for the association only. This encompasses liquidity mining, developer mining, the DAO treasury, Gitcoin owners, and the badge airdrop.

Rewards are paid based on how continued users pale the funds for. Similar to Bitcoin, the accumulation is hard-capped at 21 million. The funds will be acclimated to administer the DAO.

BadgerDAO’s additional artefact is alleged DIGG, a constructed Bitcoin that runs on Ethereum with an adaptable supply.

The accumulation adjusts beyond all holders according to the amount of DIGG about to BTC. Users’ wallet antithesis increases back DIGG increases in amount and decreases back the amount of the badge does.

BadgerDAO says DIGG is advised to actualize a non-custodial adaptation of BTC that relies on adaptable parameters.

DIGG has a accumulation of 6,250. It was afresh airdropped to users who bootstrapped the DAO.

Though it’s aboriginal canicule for BadgerDAO, it’s an absorbing activity that’s allowance the advance of Bitcoin on Ethereum. There’s already over $1 billion bound central the DAO. As appeal for collateralized Bitcoin grows, this could able-bodied access in the future.

For anyone accustomed with accepted tokenized Bitcoin options like WBTC and RENBTC, abutting the BadgerDAO could be a nice befalling to acquire crop while abutting one of the aboriginal anatomic iterations of a DAO on Ethereum.

However, it goes after adage that abounding of these protocols are beginning and could abatement to bugs or hacks at any time. Proceed with attention at all times.

That’s all for this week’s copy of wNews, readers. Stay acquainted for abutting week’s dispatch.